- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- IRA to HSA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA to HSA

I heard I can move an IRA into a HSA fund. Is this true?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA to HSA

Yes, you can...but only once in a lifetime.

Note the limitation: the rollover is counted as part of the annual contribution to your HSA and is subject to the annual HSA contribution limit. Since this can't be larger than $7,750 in the best of cases, this limits the benefit that you can derive. However, it does mean that for one year, at least, you can stop sending money to your HSA and rollover some money from an IRA instead.

Also note that the rollover must be from an IRA in your name to an HSA in your name. No rolling over amounts to/from your spouse's or someone else's account.

To enter the rollover into TurboTax, please do the following:

1. Navigate to the screens to enter your 1099-R (Federal->Wages & Income->Retirement Plans & Social Security->IRA, 401(k), Pension Plan Withdrawals (1099-R)).

2. Enter your 1099-R information. Be sure to check the box that it is an IRA.

3. The distribution code in box 7 is probably '7' (normal distribution).

4. When asked if this money was rolled into a Roth IRA, be sure to answer "No".

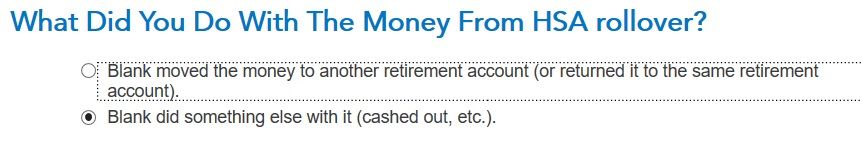

5. After a screen or two, you should see this screen: "Did [name] Put This Money from ira to hsa in a Health Savings Account (HSA)?". Answer "Yes" and Continue.

6. This will carry automatically to the HSA interview.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

o-robles

New Member

chanflorence2

New Member

wanderlust

New Member

Compuski1

Level 3

eevee-joltz34

New Member