- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- International Citizen - Resident Alien - F1 OPT - Social Security and Medicare Tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

International Citizen - Resident Alien - F1 OPT - Social Security and Medicare Tax

I am an international citizen whose status is resident alien. I am on F1 OPT. My understanding is that I should not be paying social security and the medicare taxes. However one of my employer has withheld some taxes for that. So, my understanding is that it will be refunded after filling the proper tax return. However, turbotax premier has not asked any such question in the profile and personal information section by which it can verify my tax residency and immigration status. Also, after taking all the entries for deduction the s/w shows the credits. There it show the total amount withheld. That amount is not reflecting the social security and medicare taxes withheld.

Please advice on how will this work?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

International Citizen - Resident Alien - F1 OPT - Social Security and Medicare Tax

If you are a resident alien then you are no longer exempt from paying social security and medicare taxes. Your employer was correct in withholding taxes.

If your F1 status were nonresident then you would be exempt from paying social security and medicare taxes during OPT.

Resident Alien Social Security and Medicare Tax Responsibiltiy

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

International Citizen - Resident Alien - F1 OPT - Social Security and Medicare Tax

Thanks for the response @JeffreyR77. This helps. However, I think there is still something wrong in my return. In the credits section TurboTax Premier shows only my "Federal income tax withheld" from my W2. It doesn't show the other two taxes (SS and Medicare) in the tax withheld. Why so?

Other details:

- I have two W2s. One of them has withheld SS and Medicare for a fraction of wages. The other one holds nothing.

- The Tax withholding in the turbotax is just the sum of "Federal income tax withheld" in both of my W2s

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

International Citizen - Resident Alien - F1 OPT - Social Security and Medicare Tax

Social Security and Medicare taxes are not income taxes and are not ordinarily refundable taxes.

Wages in 2020 were taxed on Social Security on the first $137,700 of wages earned.

Wages were taxed on Medicare on all wages regardless of amount.

Social security and Medicare are trust fund taxes not income taxes.

That is why you only see reference to Federal income taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

International Citizen - Resident Alien - F1 OPT - Social Security and Medicare Tax

Okay, thanks @JeffreyR77 . Let me give you some more information and that will make my doubt clear. For around 10 months I was a student in 2020. Started full time job in last two months of the 2020. So I have 2 W2 forms. One from school (call it S-W2), this is for first ~10 months of the year. The other one for the remaining part of the year is from the full time job (call it J-W2). I am describing below the SS and Medi withholding for both of them:

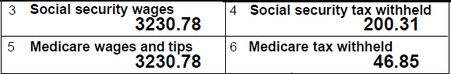

- On S-W2, SS and Medicare taxes have been held only for the partial wage. The SS and the medicare

wage on S-W2 is only $3,230 and the tax withheld is $200 (SS) and $47 (medi) only. This W2 is for the first part of the salary so, shouldn't this be holding SS and medicare on larger amount of salary? - On J-W2, there is on holding for SS and medicare at all.

J-W2

I think there has been a confusion on my tax-residency (I was being treated as non resident alien for 2020) and that is why there is a mistake in tax-withholding.

Now my question is that how should I calculate the SS and Medi taxes for me? Will the TurboTax do it automatically and subtract the already held amount and calculate how much more to pay and then subtract that from my final return?

I am concerned as the S/W is not asking for any information corresponding to it and is not showing my already held amount for SS and Medi anywhere in the summary.

Please advice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

International Citizen - Resident Alien - F1 OPT - Social Security and Medicare Tax

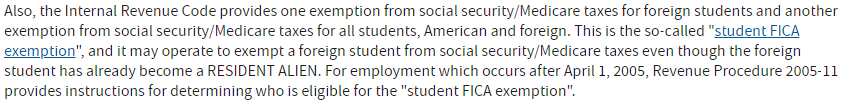

@JeffreyR77 Please read the screenshot I am pasting below. It is from the link you sent.

I don't think Resident aliens who are on F-1 have to pay Social Security and Medicare taxes. It is because of the FICA. https://www.irs.gov/individuals/international-taxpayers/foreign-student-liability-for-social-securit...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

International Citizen - Resident Alien - F1 OPT - Social Security and Medicare Tax

If your employer withheld too much Social Security tax because of your visa status, you should discuss it with your employer. You won't be able to take a credit for the excess on your tax return with your current W-2.

Contact them and ask for:

- A refund for the excess amount, and

- A corrected W-2 (also called a W-2c) which shows the correct Box 3 and Box 4 amounts.

Please see the following TurboTax article for more information

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hijyoon

New Member

JeffAndMartina

Level 2

fatimatiwana

New Member

westmom2384

New Member

KSFall2018

New Member