- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Okay, thanks @JeffreyR77 . Let me give you some more information and that will make my doubt clear. For around 10 months I was a student in 2020. Started full time job in last two months of the 2020. So I have 2 W2 forms. One from school (call it S-W2), this is for first ~10 months of the year. The other one for the remaining part of the year is from the full time job (call it J-W2). I am describing below the SS and Medi withholding for both of them:

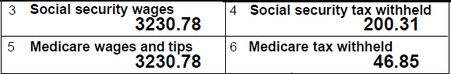

- On S-W2, SS and Medicare taxes have been held only for the partial wage. The SS and the medicare

wage on S-W2 is only $3,230 and the tax withheld is $200 (SS) and $47 (medi) only. This W2 is for the first part of the salary so, shouldn't this be holding SS and medicare on larger amount of salary? - On J-W2, there is on holding for SS and medicare at all.

J-W2

I think there has been a confusion on my tax-residency (I was being treated as non resident alien for 2020) and that is why there is a mistake in tax-withholding.

Now my question is that how should I calculate the SS and Medi taxes for me? Will the TurboTax do it automatically and subtract the already held amount and calculate how much more to pay and then subtract that from my final return?

I am concerned as the S/W is not asking for any information corresponding to it and is not showing my already held amount for SS and Medi anywhere in the summary.

Please advice.