- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Inconsistent amount on beneficiaries K-1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inconsistent amount on beneficiaries K-1

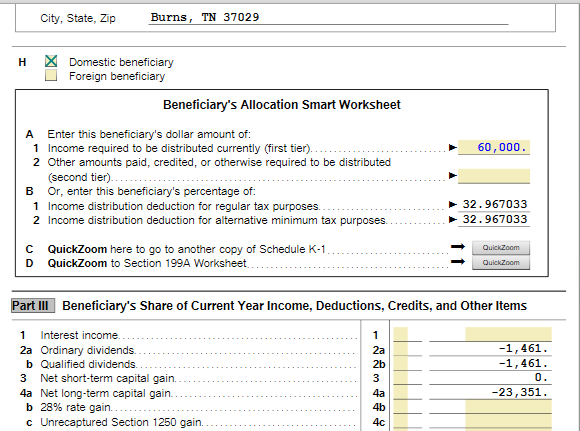

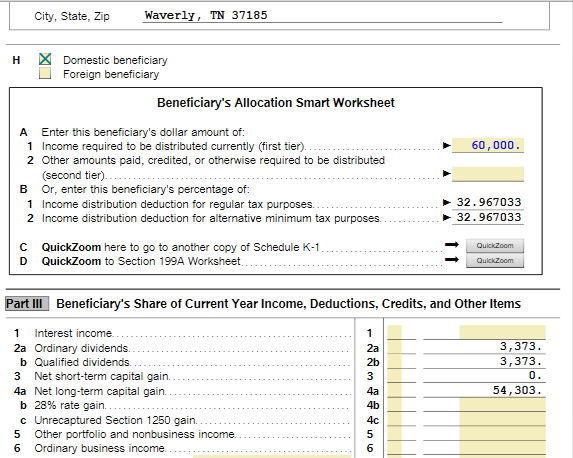

I am in the process of completing my trust return that is a form 1041. I have two beneficiaries each receiving exactly the same amount of a distribution. On the K-1 item 4a for one beneficiary the number is a positive number of 54,303 For the other beneficiary the number is a negative number -23,351. See below

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inconsistent amount on beneficiaries K-1

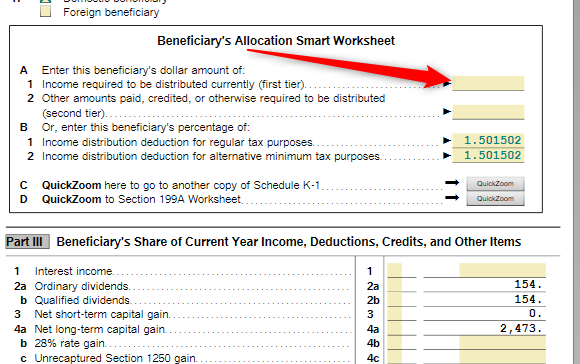

There is a BUG (?) in the software. One of 2020 beneficiaries did not receive a distribution in 2021 so I left the distribution amount blank. The software did not know how to treat a blank i.e. null amount and posted last year (?) or some unknown (?) percentage for the 2021 distribution for this beneficiary this caused more than 100% for the total distribution and cause the error. When I entered $0.0 the program work OK.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inconsistent amount on beneficiaries K-1

I think you need to check both the information you entered for each beneficiary and also the Distributions section of the Interview (Step-by-Step).

There is an input error somewhere.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inconsistent amount on beneficiaries K-1

There is a BUG (?) in the software. One of 2020 beneficiaries did not receive a distribution in 2021 so I left the distribution amount blank. The software did not know how to treat a blank i.e. null amount and posted last year (?) or some unknown (?) percentage for the 2021 distribution for this beneficiary this caused more than 100% for the total distribution and cause the error. When I entered $0.0 the program work OK.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

csbarbero

Level 2

manca1

New Member

user17708699379

New Member

user17702236067

New Member

Mike_not_a_CPA

New Member