- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Inconsistencies Between Forms and Interview

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inconsistencies Between Forms and Interview

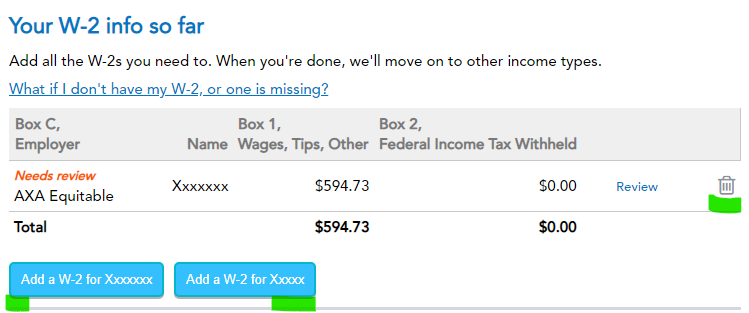

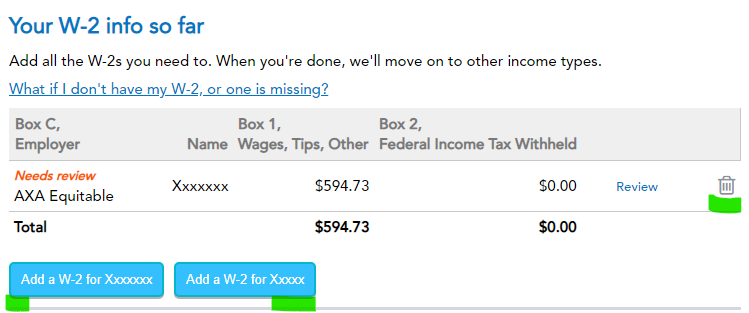

I am seeing 2 inconsistencies. First, I have a W2 entered through the step-by-step interview. It is properly included in that view but it is not included on the form view, Form 1040 Line 1a. Clicking through from the form, it is not shown on the Form 1040 Line 1 Wage, Salary and Tips Worksheet. But clicking on the missing "spouse" (line a) of that form opens the linked and completed Form W2. What can be causing this?

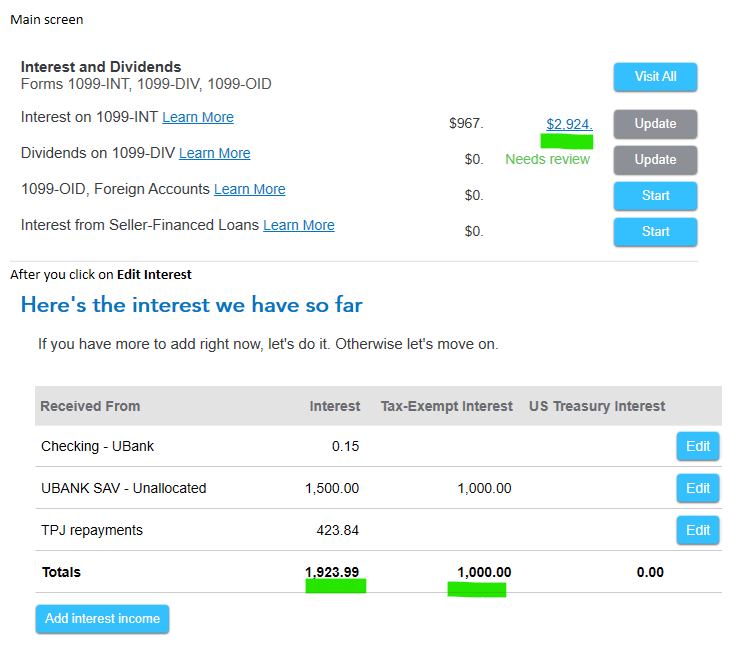

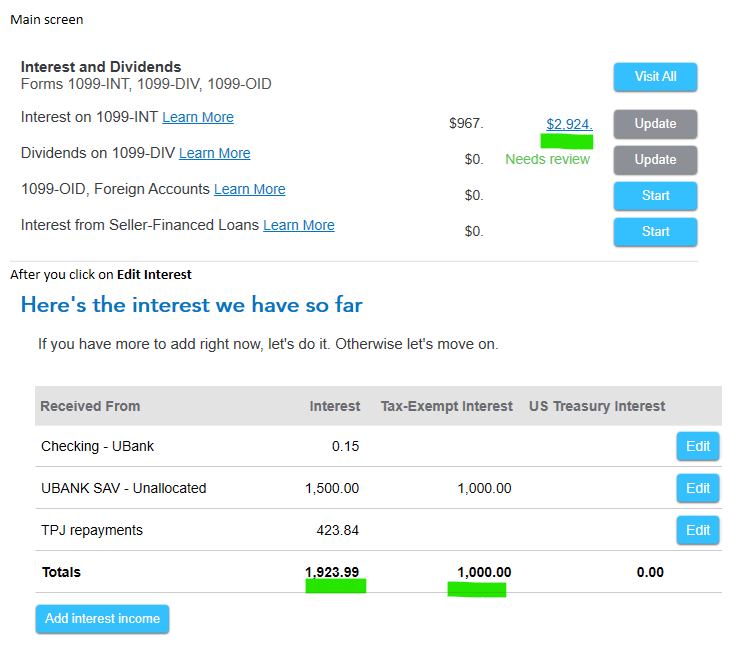

Also, the Interest amount is correct on the Form Schedule B but on the step-by-step view, the summary amount is way off. Clicking on the Start button allows me to see the entries I made that match the Form view but not the summary amount. Any ideas?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inconsistencies Between Forms and Interview

It sounds as if you are using TurboTax for Desktop/Download.

When you go into Wages and Salaries Form W-2 to add a W-2, it will ask you to click if it is yours or your spouse's. It sounds as if it was entered for your spouse and that is why it is not showing in the proper place. I am glad you caught that as this is important for your social security account accuracy.

If it is listed for the wrong person, you can use the trash can icon to delete the current W-2 and reenter it under the correct person.

The Interest Summary may include tax exempt interest, which will not be included in the calculations on Form Schedule B. That may be the difference in the two numbers.

If this does not completely solve your question, please let us know more details, so we may better assist you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inconsistencies Between Forms and Interview

It sounds as if you are using TurboTax for Desktop/Download.

When you go into Wages and Salaries Form W-2 to add a W-2, it will ask you to click if it is yours or your spouse's. It sounds as if it was entered for your spouse and that is why it is not showing in the proper place. I am glad you caught that as this is important for your social security account accuracy.

If it is listed for the wrong person, you can use the trash can icon to delete the current W-2 and reenter it under the correct person.

The Interest Summary may include tax exempt interest, which will not be included in the calculations on Form Schedule B. That may be the difference in the two numbers.

If this does not completely solve your question, please let us know more details, so we may better assist you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

eshahmir

Level 2

newusernameagain

Level 3

user17718192850

New Member

dislikeTax

Level 1

ajh2868

New Member