- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

It sounds as if you are using TurboTax for Desktop/Download.

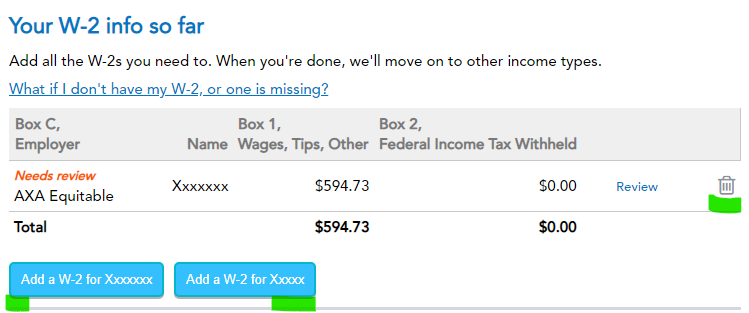

When you go into Wages and Salaries Form W-2 to add a W-2, it will ask you to click if it is yours or your spouse's. It sounds as if it was entered for your spouse and that is why it is not showing in the proper place. I am glad you caught that as this is important for your social security account accuracy.

If it is listed for the wrong person, you can use the trash can icon to delete the current W-2 and reenter it under the correct person.

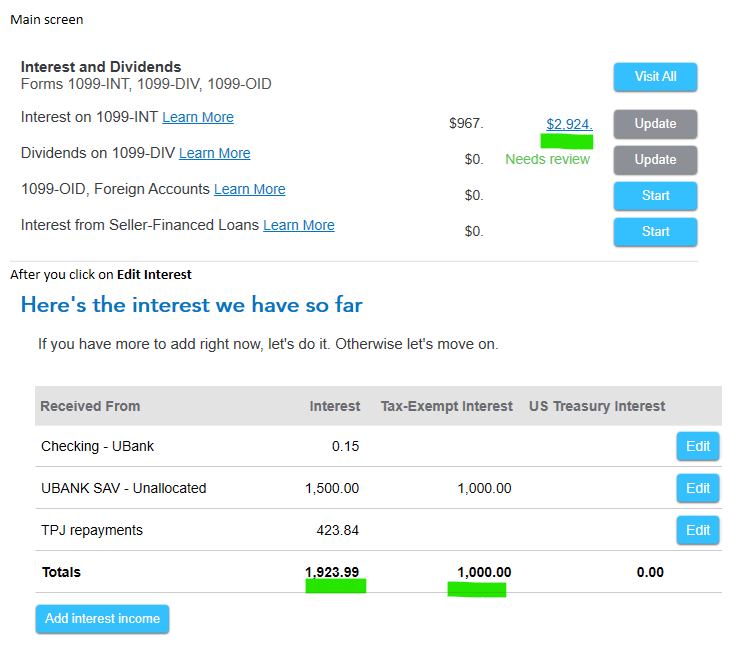

The Interest Summary may include tax exempt interest, which will not be included in the calculations on Form Schedule B. That may be the difference in the two numbers.

If this does not completely solve your question, please let us know more details, so we may better assist you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"