- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Importing large 1099-B from gainskeeper crashes Turbotax Premier

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Importing large 1099-B from gainskeeper crashes Turbotax Premier

I have about 250 pages of 2020 1099-B from TDAmeritrade and

I normally import them from Gainskeeper into Turbotax Premier.

I have done this in the past years (2019, 2018..) and have no problems.

Granted, I traded a lot in 2020 and have thousands of transactions more.

After importing (took like 10-15 minutes), turbotax then proceed to think

about it and then crashes. I restarted the program after saving just before

it bailed, it goes and do it re-computation and then crashes again.

You get the picture.

Basically, it choked on large 1099-B transactions.

Please help.

I can't possibly type in all the thousands of entries in Form 8949..

Know any tax SW product that doesn't choke on large 1099 imports??

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Importing large 1099-B from gainskeeper crashes Turbotax Premier

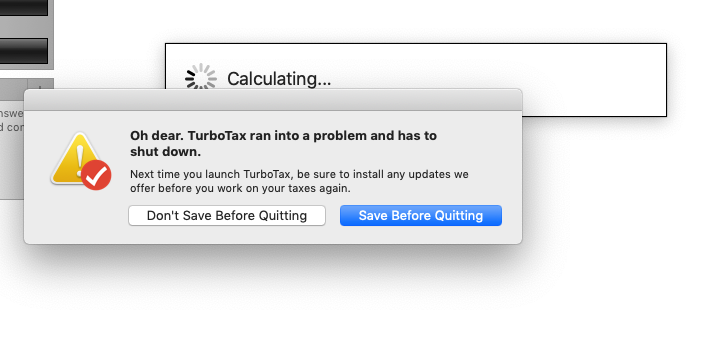

One more info - hopefully this will be useful for

the developers fixing this problem, The import was

appeared to be successful but crashed on "Calculating:..

Also I have over 3000+ transactions (3020 to be exact..)

Hope this helps..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Importing large 1099-B from gainskeeper crashes Turbotax Premier

This Turbo Tax FAQ will provide steps on troubleshoot and running TurboTax for Windows Troubleshooting Windows

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Importing large 1099-B from gainskeeper crashes Turbotax Premier

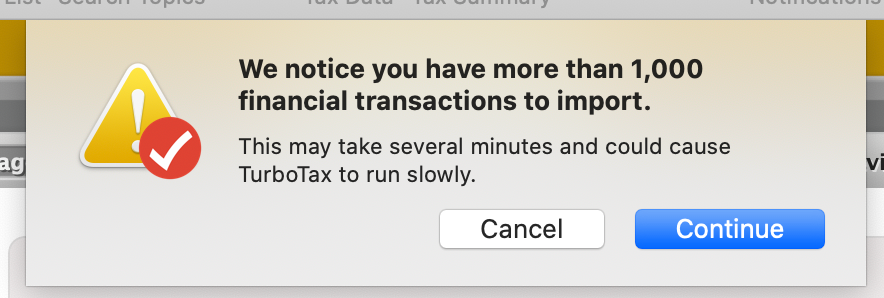

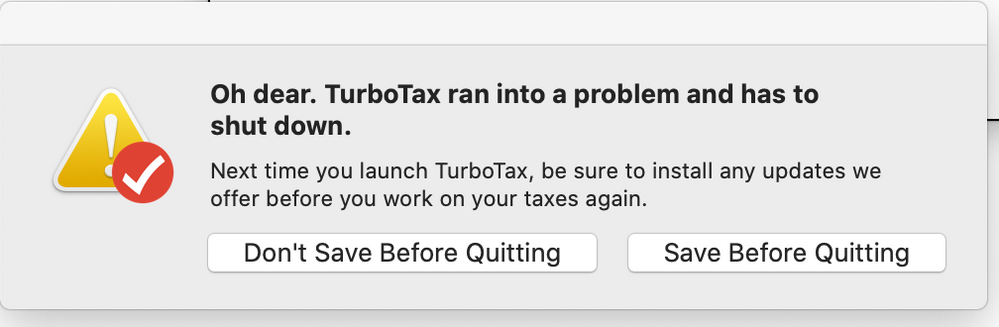

TurboTax Deluxe also fails for the Mac Download as well after importing a large number of 1099-B transactions. The result is that TurboTax crashes every time it opens and fails to allow you to continue. Re-installation does not remedy this, and I have been online with technical support for over 45 minutes to no avail.

You first get a message that states that there are over 1000 transactions.

Followed by:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Importing large 1099-B from gainskeeper crashes Turbotax Premier

A simple fix to this is, If you are able to extract your year end statement and it provides you with totals of S/T vs. L/T transactions (you might even have 4 different categories on your statement - depending on if basis was/was not reported to the IRS, so be sure to not miss any sections of the statement), you should separate them out yourself on a spreadsheet, tally up the information for each category of transaction, and enter as such. This is, making sure, of course, that the firm you use is providing you with cost basis and sales price as well as #shs per transaction.

You can also extract to Excel, but that takes more work than step one. What the IRS is looking for is the following:

1. Net S/T Capital Gains/<Losses> , based on purchase date, cost basis, sale date, and proceeds

2. Net L/T Capital Gains/<losses>, based on purchase date, cost basis, sale date, and proceeds

In short, each section of your statement that has a total that states "Has Been Reported to the IRS", will be treated as one transaction for taxability purposes. So, if you have 1, 2, 3, or 4 of these totals lines, then that would be the corresponding number of transactions you will have. Make sure that you do not include any section that starts with "Transactions NOT Reported to the IRS" as these are categorized already by your brokerage firm for you as non-reportable pieces of information.

ALSO, make sure you do not miss any dividend and interest income, Foreign Income Taxes Paid, etc., if your statement is all you rely on to report your information to the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Importing large 1099-B from gainskeeper crashes Turbotax Premier

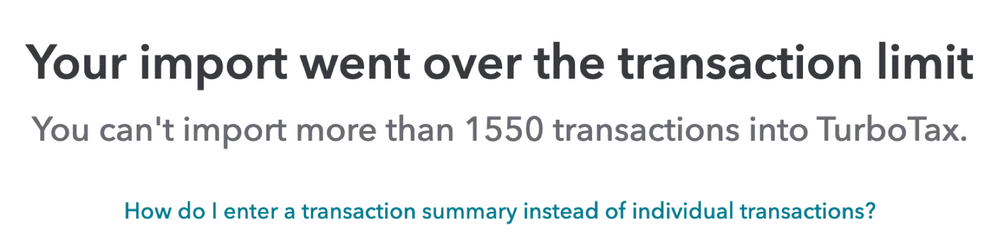

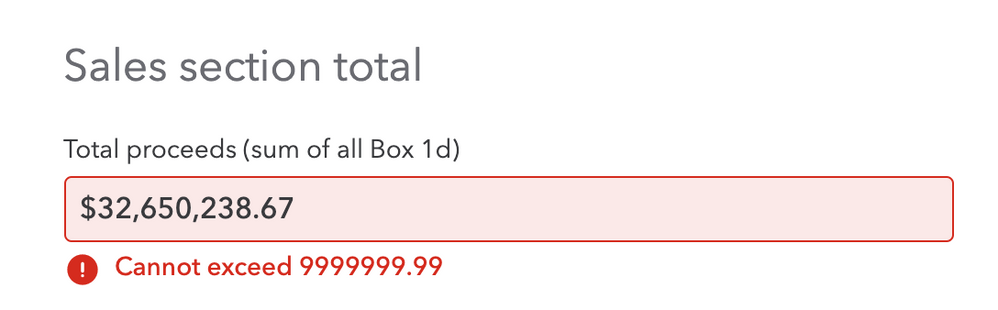

This suggested solution does not work in all cases.

You cannot import over a certain number of transactions, even in the online version of TurboTax Premier.

Even if you instead enter sales totals, as suggested, the online version of TurboTax Premier will not let you enter certain sales totals:

Dead in the water.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Importing large 1099-B from gainskeeper crashes Turbotax Premier

A simple fix to this is (and this is something that is encountered using even the most "sophisticated" of tax software systems), If you are able to extract your year end statement and it provides you with totals of S/T vs. L/T transactions (you might even have 4 different categories on your statement - depending on if basis was/was not reported to the IRS, so be sure to not miss any sections of the statement), you should separate them out yourself on a spreadsheet, tally up the information for each category of transaction, and enter as such. This is, making sure, of course, that the firm you use is providing you with cost basis and sales price as well as #shs per transaction.

You can also extract to Excel, but that takes more work than step one. What the IRS is looking for is the following:

1. Net S/T Capital Gains/<Losses> , based on purchase date, cost basis, sale date, and proceeds

2. Net L/T Capital Gains/<losses>, based on purchase date, cost basis, sale date, and proceeds

In short, each section of your statement that has a total that states "Has Been Reported to the IRS", will be treated as one transaction for taxability purposes. So, if you have 1, 2, 3, or 4 of these totals lines, then that would be the corresponding number of transactions you will have. Make sure that you do not include any section that starts with "Transactions NOT Reported to the IRS" as these are categorized already by your brokerage firm for you as non-reportable pieces of information.

ALSO, make sure you do not miss any dividend and interest income, Foreign Income Taxes Paid, etc., if your statement is all you rely on to report your information to the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Importing large 1099-B from gainskeeper crashes Turbotax Premier

Seeing this issue also, on desktop Premier. I have over 1000 stock transactions total, and about 25 RSU transactions that I have to update manually with cost basis. Each RSU transaction entry freezes for a long time, eventually comes back, but it is taking over 20 min to update each transaction, on an 8-core processor with 32GB of memory. I'm still in the middle of updating the RSU data. I hope the software doesn't choke on this data when I try to check and file, making this all a waste of time.

Something tells me that a novice programmer used a bubble-sort algorithm in this code.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Importing large 1099-B from gainskeeper crashes Turbotax Premier

I am also seeing this issue. I want to switch from Turbotax Premier 2020 online to desktop because it apparently can handle more than online, but I already paid for the darn thing online. Might need to get a refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Importing large 1099-B from gainskeeper crashes Turbotax Premier

your information is completely wrong

With one exception, IRS requires details for all sell transactions...

That includes transactions in B or E category "basis not reported to IRS".

There is no exception for those categories.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Importing large 1099-B from gainskeeper crashes Turbotax Premier

Hi. I was wondering how you "reset" the Turbotax software so that the "Uh No" message doesn't come up. How do you stop the "buggy message" from coming up and crashing the system?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Importing large 1099-B from gainskeeper crashes Turbotax Premier

I had 1100 transactions in 2020 and online version was able to import it directly from Ameritrade, some of the options had 0 cost basis and Ameritrade reported them as blank, during review phase it wanted a number instead of blank and the page will hang.

Support said that online version can only handle 1099 with max 150 transactions and use desktop version.

I was able to download the tax file from online and import on desktop after multiple tries, I was able to pass the review phase in desktop version, albeit very slowly, however if I go directly to see the capital gains section and click update the software just hangs.

Were you able to resolve your issue if yes how did you do it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Importing large 1099-B from gainskeeper crashes Turbotax Premier

After I left it for 30 min, finally it (TT desktop) came back and I was able to update and file.

Interestingly my tax due in TT online was 6K less than in TT desktop, I thought I would compare the two so I tried uploading the TT desktop tax file to online but it never completed (37MB file).

I am surprised that the top selling software is so buggy, they must have a massive technical debt.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Importing large 1099-B from gainskeeper crashes Turbotax Premier

I have less than a 100 transactions and am having the same problem with my Vanguard and TD Ameritrade accounts. I also have Premier so it must be Premier! AS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Importing large 1099-B from gainskeeper crashes Turbotax Premier

Are you still experiencing the issue with importing your 1099-B?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RichInPitt

Level 3

swaairforce

New Member

user26879

Level 1

StirFry

Level 2

carriebdixon

New Member