- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- IHSS; EIC and Excluded income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IHSS; EIC and Excluded income.

Hello everyone, so I am a live-in provider for two recipients. This will be my first time filing by myself, so I am a bit lost here. I’m adding both W-2’s to receive Earned Income Credit, however, both W-2 forms show a 0 in box one. Box 3-6 are not blank on either form. I have done a bit research and I did add IRS Notice 2014-7 excludable income on the description box. However, what exactly do I need to add on the amount box? I kept reading on discussion forums to add a negative amount or something like that, but that’s the part that confuses me.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IHSS; EIC and Excluded income.

You need to add your wages to Box 1, Form W-2. If you have no wages listed in Box 1 of your W-2 form you will need to enter your wages so that they are included for earned income tax credit (EITC). Box 3 and Box 5 would show your social security and medicare wages, which should be the same as Box 1. It would be best to check with your employer to be sure there is no difference in the wages for any reason such as fringe benefits as example.

Once you know the number you should enter it in Box 1 so that TurboTax knows you have wages that qualify for IRS Notice 2014-7 excludable income.

Likewise you still enter the negative income to remove it from taxable income. This will allow it to be reviewed in TurboTax for the EITC.

Note: These wages are included as earned income for earned income tax credit (EITC) even if you do not include those wages as taxable income.

If your payments qualify to be excluded you should complete your tax return.

- Medicare Waiver Payments Exclusion

- IRS Publication 596 (will show the income chart for EITC)

- Form 1040 Instructions, page 40.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IHSS; EIC and Excluded income.

Diane,

thank you so much for your response! Is it mandatory for me to add in W-2 forms or is it only if I want to receive Earned Income Credit?

Also, is there any way I can forward you one of the forms? So you can take a quick glance at

it. I have received my W-2 form this way since 2017/18, so not sure how exactly my previous tax preparer filed for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IHSS; EIC and Excluded income.

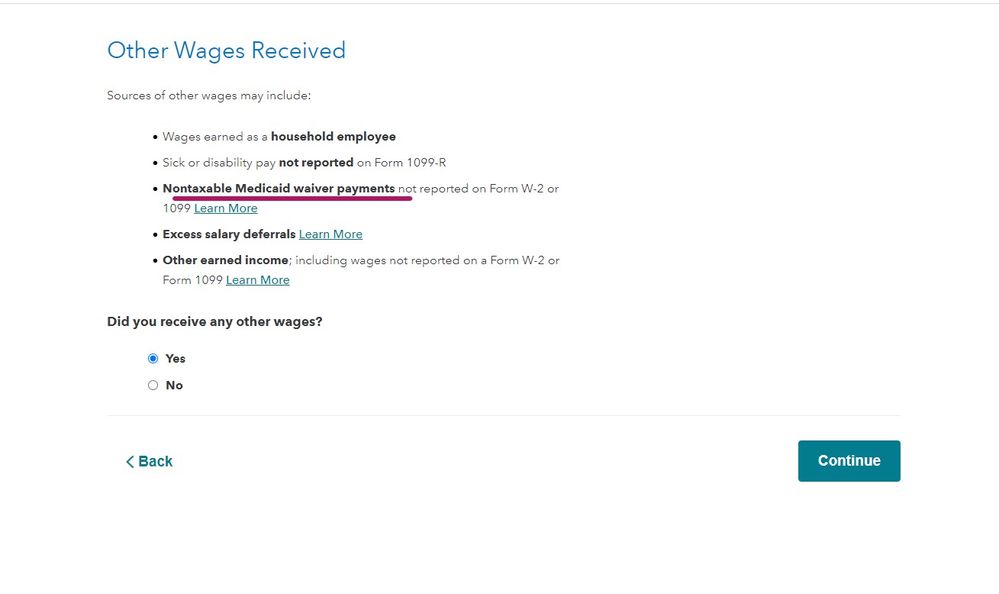

Ok ... this is kind of backwards ... if you get a W-2 with ZERO already in box 1 do NOT enter the W-2 at all in the program. You enter it in LESS COMMON INCOME and then make the election to include the income for the credits only ... be patient and go slow ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IHSS; EIC and Excluded income.

@Critter-3, thank you so much for your help! I truly appreciate it. Since I have 2 W-2 forms (two recipients), would I need to do this twice or would I have to sum both?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IHSS; EIC and Excluded income.

If they are both for you then just sum it up ... the IRS forms only get the total.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IHSS; EIC and Excluded income.

Your post has been a great help. For Roth IRA contributions purposes, can I put just a partial of my excluded income for earned income? Also, is there a section that I would put the amount as a deduction and type in “IRS Notice 2014-7 excludable income”?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IHSS; EIC and Excluded income.

Yes, you can enter this in the following manner.

- Log into your account

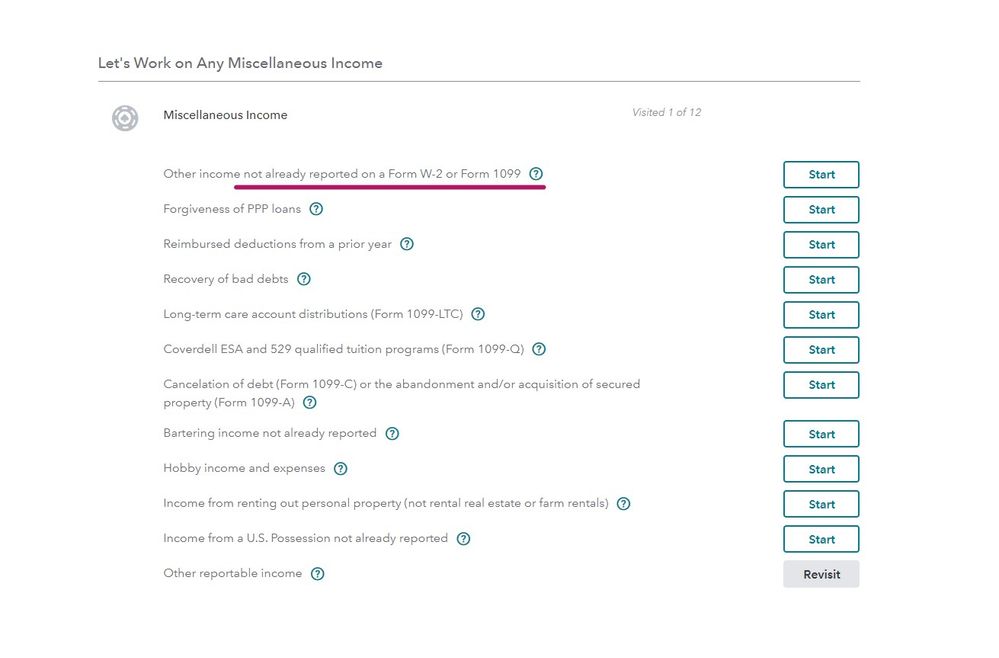

- Select Wages and income>other income

- Miscellaneous Income, 1099-A, 1099>start

- Scroll to the bottom of the page to Other Reportable Income

- Other taxable income, answer yes

- Then give this a description "IRS Notice 2014-7 excludable income” and then record the amount of the excluded income with a minus sign in front of the amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IHSS; EIC and Excluded income.

Hello. Did you follow Diane’s (employee tax expert) instructions to put total wages in Box 1… or did you do it how Critter showed, leaving Box 1 blank?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IHSS; EIC and Excluded income.

Following the instructions provided by @DianeW777 to enter Form W-2 for IHSS will work. See this TurboTax help article for more information; however, there is currently an issue if you have "0" in box 1, in that entering '0" in Box 1 causes an error. I have reported this issue for further review.

In the meantime, if you have "0" in Box 1 of a W-2, you can enter "1" instead, or the amount in Box 3 or Box 5 from your W-2 if applicable, in Box 1 in TurboTax. This will resolve the error and allow you to include Social Security and Medicare information from your W-2 if they are included, and still be able to exclude the IHSS difficulty-of-care payment from income.

From the help article referenced above:

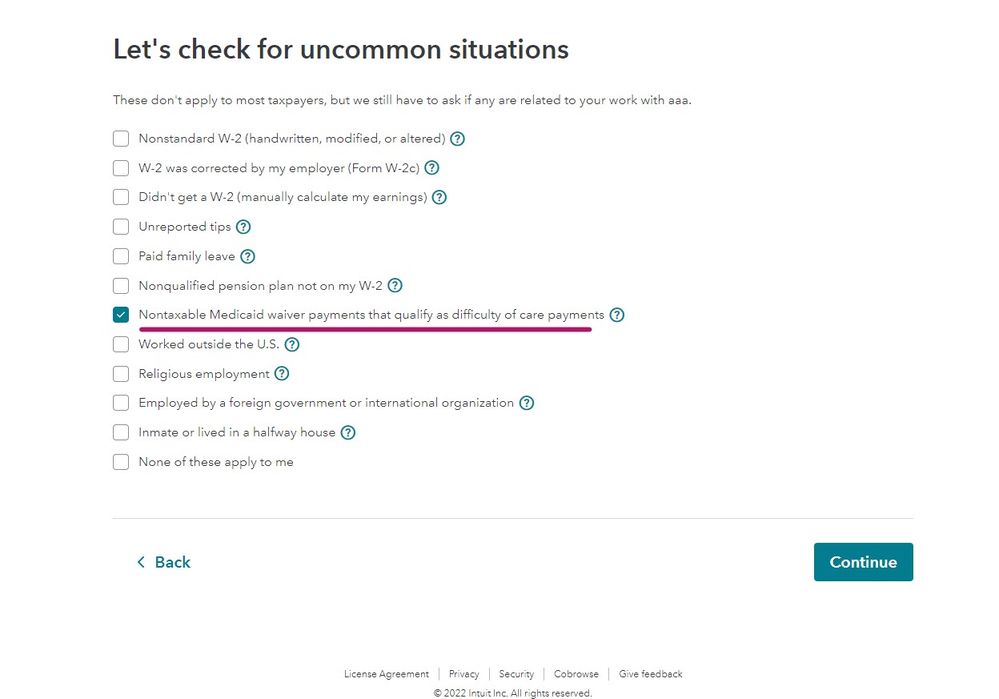

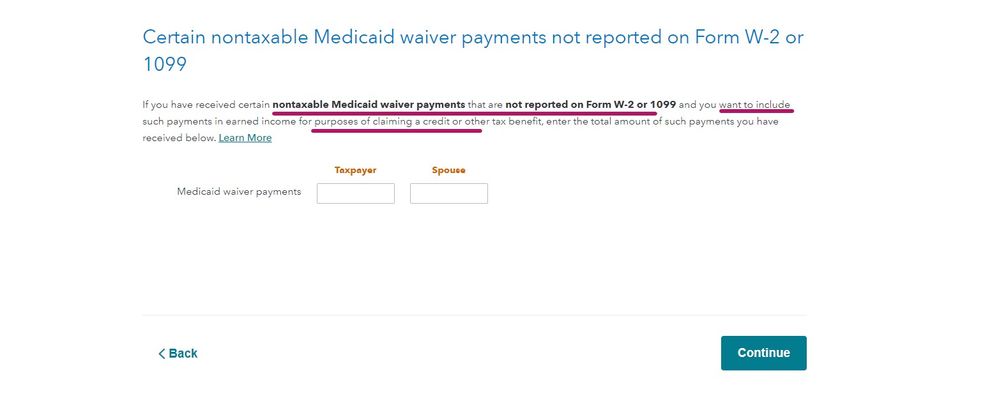

- Enter all your W-2 info.

- On the Let’s check for uncommon situations screen, select the box next to Nontaxable Medicaid waiver payments that qualify as difficulty of care payments.

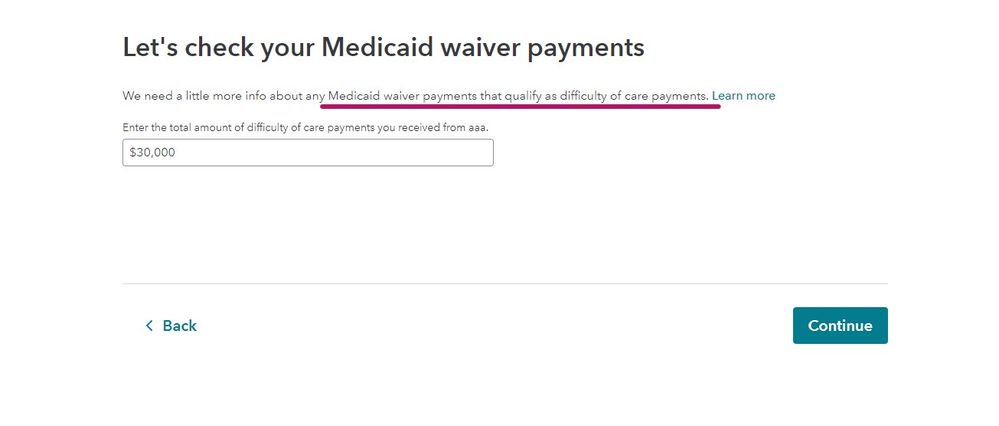

- Enter the amount of Medicaid waiver payments into the difficulty of care payment you received from IHHS box.

- This is the same amount reported in boxes 3 and 5 of your W-2.

- Your payments are nontaxable, but TurboTax uses this number to calculate credits you may qualify for.

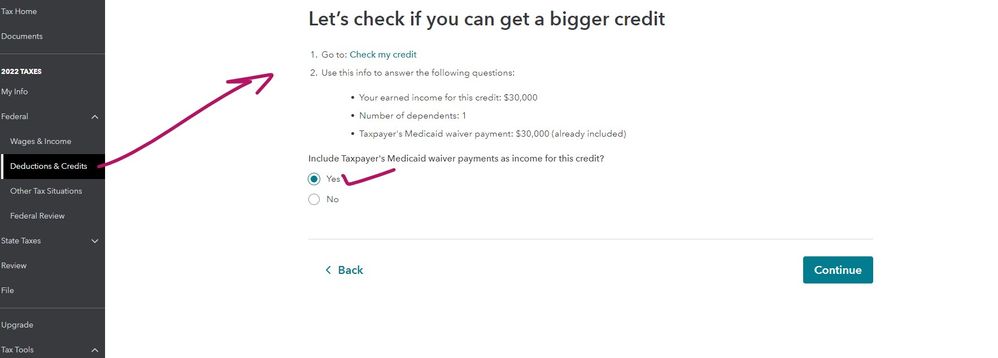

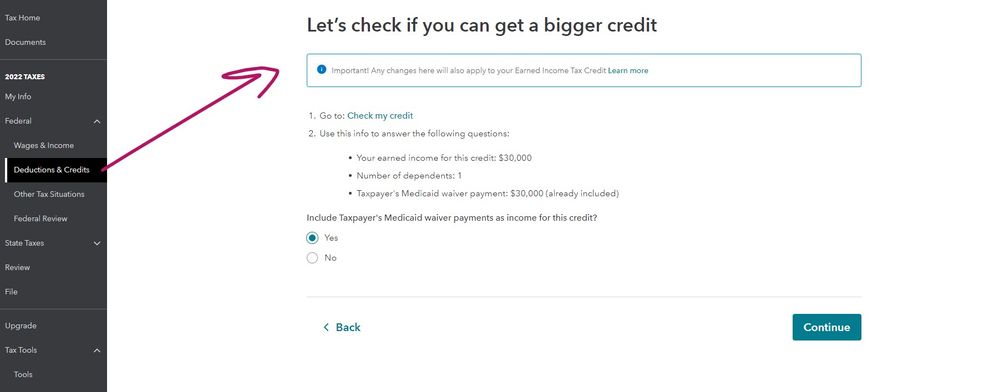

- When you get to the Earned Income Credit section in Deductions and Credits, we’ll ask if you want to add your Medicaid waiver payment to your income for this credit. You can answer based on what benefits you most.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IHSS; EIC and Excluded income.

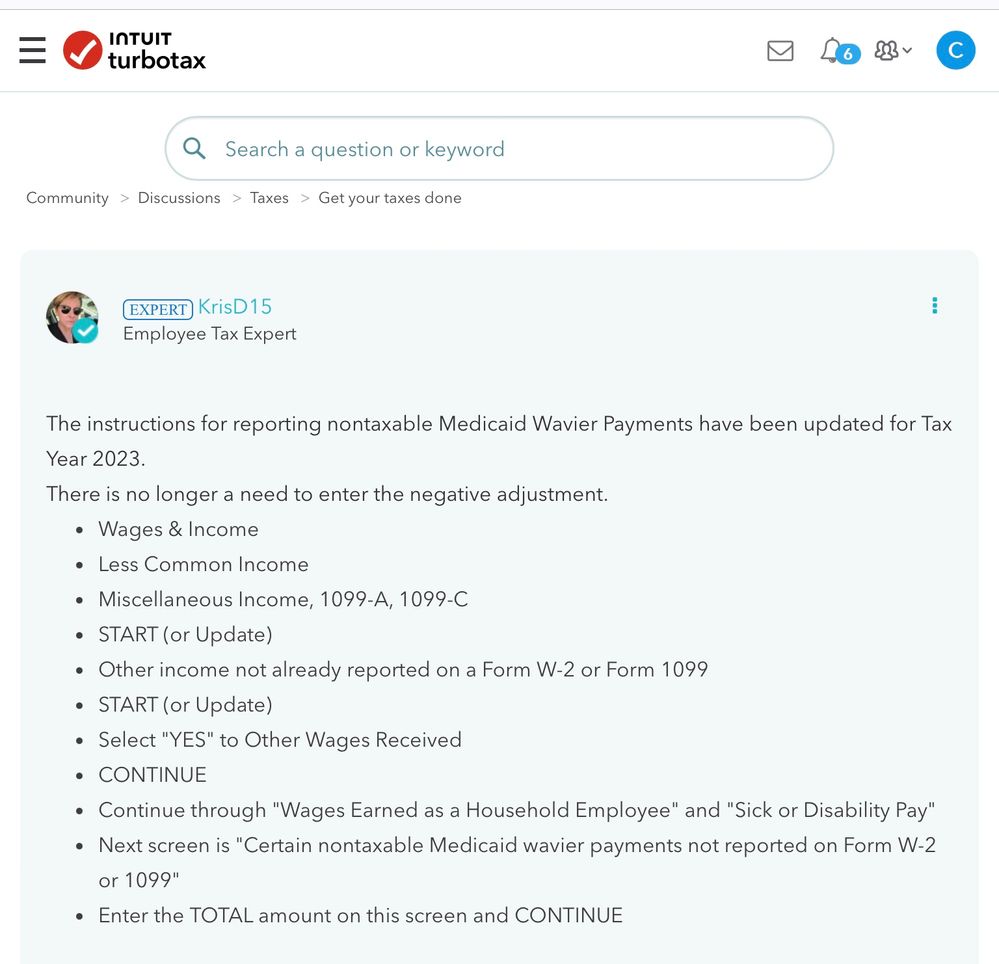

According to @KrisD15 there has been an update to 2023 Tax Year… no longer need to enter the negative adjustment. Would really appreciate it, if you can confirm.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IHSS; EIC and Excluded income.

That's correct.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

uvcatastrophe

Level 2

user17717734672

New Member

StevenHubbell

Returning Member

ksray

New Member

kds66

New Member