- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- If Turbotax says that our EIP2 should be $2400 and we got $1200 and we added the $1200. why did IRS has deny it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

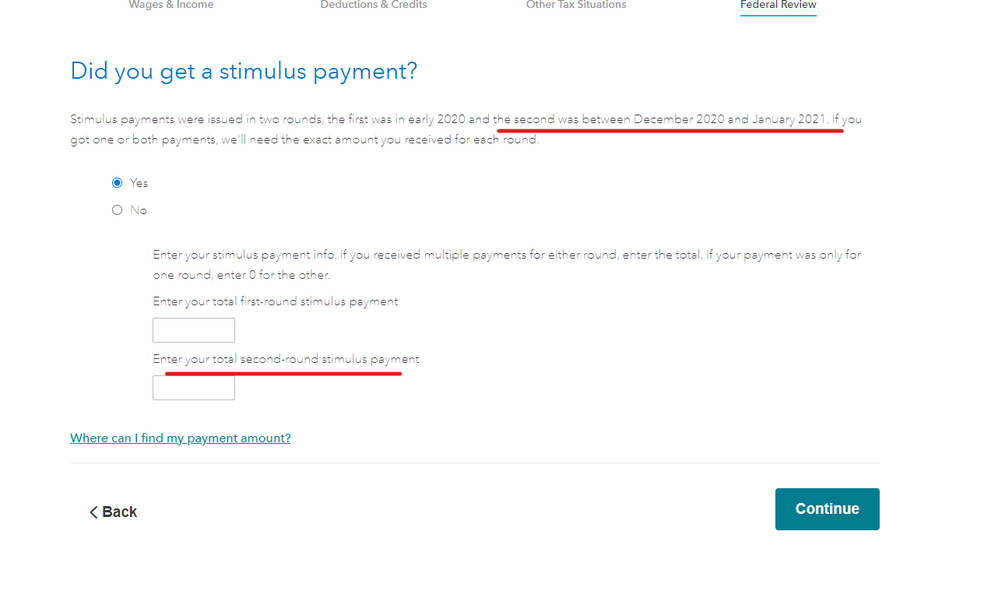

If Turbotax says that our EIP2 should be $2400 and we got $1200 and we added the $1200. why did IRS has deny it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If Turbotax says that our EIP2 should be $2400 and we got $1200 and we added the $1200. why did IRS has deny it?

How many people are on your tax return? The first EIP round 1 was 1,200 (2,400 married) and 500 for each dependent. The second EIP was 600 per person. The EIP2 would be 2,400 for Married with 2 dependents or Single with 3 dependents.

If you claimed a missing stimulus payment on your return but the IRS took it off you have to ask the IRS. They think they already sent it to you. Maybe it went to an account you don't remember. Or you got a check or a card. It was probably easy to miss the debit card in the mail and think it was junk mail. They have to put a trace on it.

See Question G4 here,

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-g-correcting-issues-after-the-2020-ta...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If Turbotax says that our EIP2 should be $2400 and we got $1200 and we added the $1200. why did IRS has deny it?

EIP2 was $600 for each taxpayer and each eligible dependent, so four eligible persons would total $2,400.

Apparently the IRS has records that show they sent you $1,200 for EIP2 so therefor denied $1,200 of the $2400 you send you did Not receive.

Did you receive EIP2 in January or February of 2021 in the amount $1,200? If so, you should have indicated it was received and then there would not be the $2,400 as a Recovery Rebate Credit on the Form 1040 Line 30.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If Turbotax says that our EIP2 should be $2400 and we got $1200 and we added the $1200. why did IRS has deny it?

Did you enter the amount you actually got in the program as directed ... if you are a married couple the first stimulus was $1200 x 2 = $2400 and the second one was $600 x 2 = $1200

If the program said the second one was supposed to be $2400 that would be $600 x 4 people on the return and the dependents had to be under 17. So how many people were listed on the return? How many under 17?

If you did not enter the correct amount then the program would have given you the wrong credit amount and the IRS corrected the error.

Review those screens in the program to see what you did enter ...

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

michellemorris08

New Member

ecenurcosar

New Member

scotttiger

Level 4

dsmith48302

New Member

GreenwichBetty7

Level 1