- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- If my business (LLC) loss money due to being a victim of fraudulent purchases (Individual using stolen credit cards to purchase merchandise), what are my options?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my business (LLC) loss money due to being a victim of fraudulent purchases (Individual using stolen credit cards to purchase merchandise), what are my options?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my business (LLC) loss money due to being a victim of fraudulent purchases (Individual using stolen credit cards to purchase merchandise), what are my options?

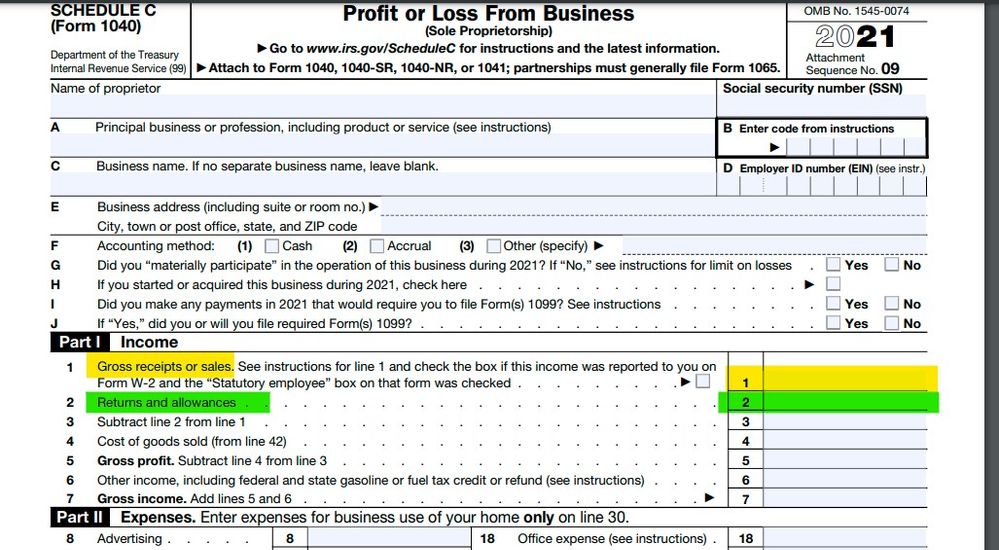

You don't get to deduct income you did not make if you were a cash based business (1)... you just have less income to report. However, if you use your bookkeeping records and enter ALL the sales made as income then you can deduct the amounts you had to refund back due to the fraud situation (2). But you cannot report less income AND take the deduction of the "refunds" ... it is one or the other but not both.

If your CC 1099-K reported all the sales then you must match that figure on the Sch C as income then take a deduction for the "returns" ... but if they netted out the returns from income you use the first option.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kenlewallen

New Member

Zman8228

Level 2

afeister

New Member

Dev333

Level 2

amybri617

New Member