- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

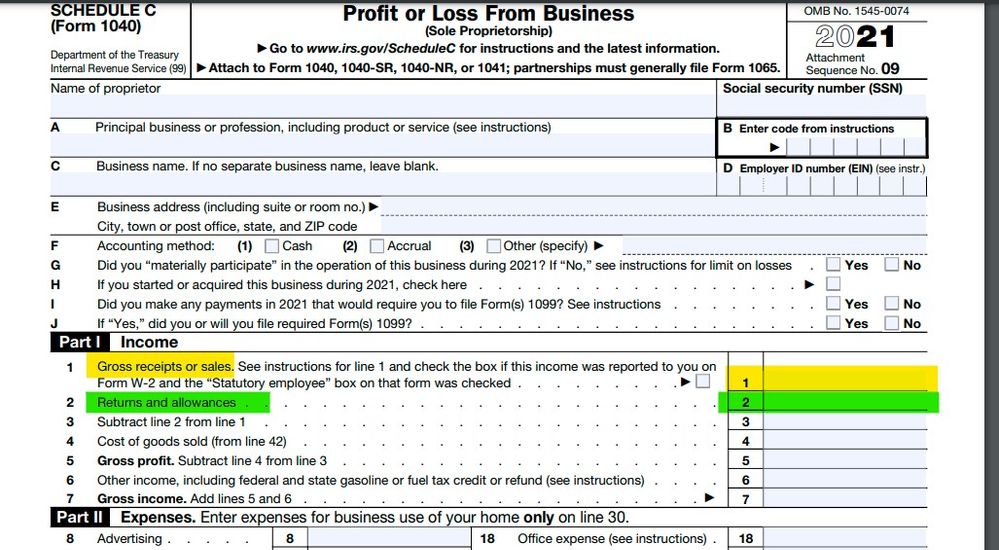

You don't get to deduct income you did not make if you were a cash based business (1)... you just have less income to report. However, if you use your bookkeeping records and enter ALL the sales made as income then you can deduct the amounts you had to refund back due to the fraud situation (2). But you cannot report less income AND take the deduction of the "refunds" ... it is one or the other but not both.

If your CC 1099-K reported all the sales then you must match that figure on the Sch C as income then take a deduction for the "returns" ... but if they netted out the returns from income you use the first option.

December 18, 2021

6:33 AM

146 Views