- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I received social security payments from Mexico. Is that considered income in the US?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received social security payments from Mexico. Is that considered income in the US?

My mother receives social security pension payments from Mexico, but she is a US resident now. She is a retiree and receives a monthly deposit from IMSS (Social Security Administration from Mexico). Does she need to declare that income in the US and pay taxes, or are there any rules that social security income from Mexico is not taxable in the US?

If it is taxable, where in TurboTax should be included? And how do we get credit for the income taxes she paid in Mexico?

If not taxable, how do I report it without TurboTax to calculate taxes owed?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received social security payments from Mexico. Is that considered income in the US?

1. Taxable

The Mexico Income Tax Treaty, page 3 discusses the taxation of your Social Security benefits by the U.S. and page 24 discusses the foreign tax credit available.

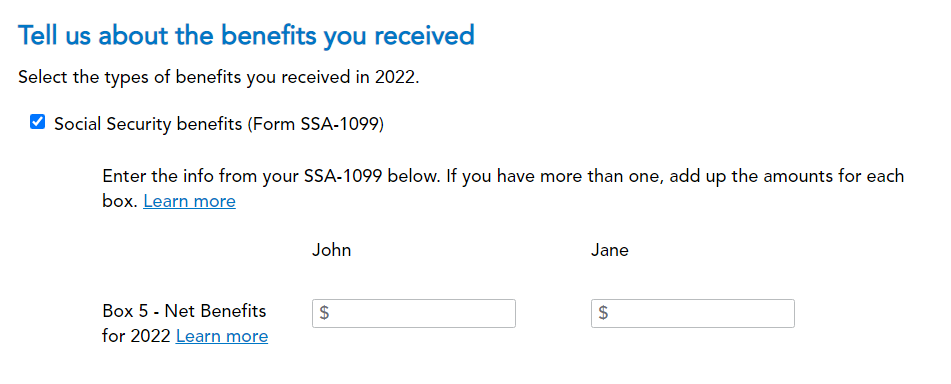

2. Since the income is like Social Security, enter the income in U.S. dollars in the the Social Security section of the program.

3. All foreign tax paid is entered in the same spot. To report the foreign tax paid on your dividends for foreign tax credit:

- Enter foreign tax credit in the search box at the top of the page and click the Jump to link

- Select Yes you paid foreign taxes

- Continue through the screens regarding foreign interest and dividends

- Select yes that you have reported all your foreign income already in TurboTax

- Deduction or Credit? Most people choose the credit since so few itemize deductions. You can try it both ways and determine what is best for you. Select an option.

- Answer question about the Simplified Limitation Election

- Choose income type

- Add the name of your country Mexico

- Enter description - Social Security pension

- Enter Income amount that you previously reported in Social Security section of TurboTax.

- Continue through the foreign tax credit screens until done.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received social security payments from Mexico. Is that considered income in the US?

Thank you! Is there a problem that I don't have a Form SSA-1099 because it does not exist in Mexico? I read in another similar post (not specific to Mexico) that I should report it as Other Income and call it "Mexico Social Security." What would be your recommendation?

Based on the treaty you sent me, it looks like social security payments are only taxable on the Contracting State, which in this case would be Mexico. How will TurboTax or the IRS know this is from Mexico and not the US?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received social security payments from Mexico. Is that considered income in the US?

1. No problem with not having the form.

2. The IRS likes things reported where they belong when possible. You do have two choices.

- If you report it on SSA-1099, the IRS compares to others from Social Security in the US and realizes yours does not match. Then it sees you have foreign tax paid to Mexico, it all makes sense.

- If you report it as other reportable income, the IRS will not be able to compare it to anything, they will read the line, and eventually realize there is a foreign tax on the same income.

Both methods work, just a matter of preference.

3. When you enter the foreign tax, you are entering Mexico and the tax paid on the tax form. Follow the steps above in #3. There is no other option for entering foreign tax paid. You must follow the steps above for the tax paid.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

waynelandry1

Returning Member

Lukas1994

Level 2

rodiy2k21

Returning Member

johntheretiree

Level 2

tonyholland1940

New Member