- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

1. Taxable

The Mexico Income Tax Treaty, page 3 discusses the taxation of your Social Security benefits by the U.S. and page 24 discusses the foreign tax credit available.

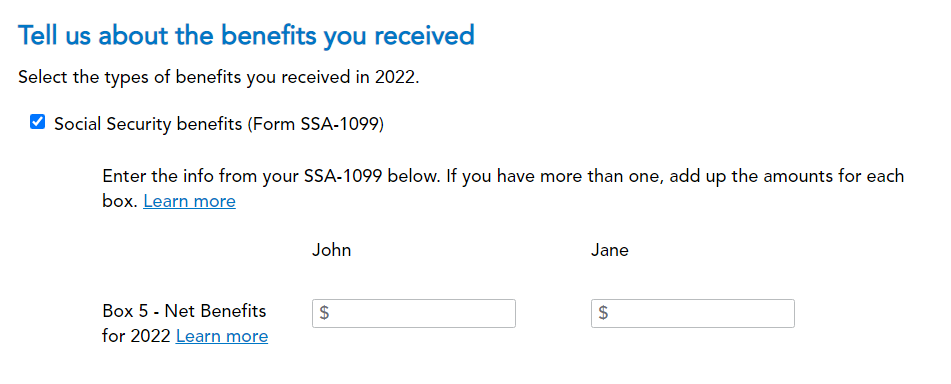

2. Since the income is like Social Security, enter the income in U.S. dollars in the the Social Security section of the program.

3. All foreign tax paid is entered in the same spot. To report the foreign tax paid on your dividends for foreign tax credit:

- Enter foreign tax credit in the search box at the top of the page and click the Jump to link

- Select Yes you paid foreign taxes

- Continue through the screens regarding foreign interest and dividends

- Select yes that you have reported all your foreign income already in TurboTax

- Deduction or Credit? Most people choose the credit since so few itemize deductions. You can try it both ways and determine what is best for you. Select an option.

- Answer question about the Simplified Limitation Election

- Choose income type

- Add the name of your country Mexico

- Enter description - Social Security pension

- Enter Income amount that you previously reported in Social Security section of TurboTax.

- Continue through the foreign tax credit screens until done.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 14, 2023

1:29 PM