- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I received a 1099-Misc for Paid Family Leave, How will I file this through Turbo Tax ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-Misc for Paid Family Leave, How will I file this through Turbo Tax ?

I keep doing that, but it still keeps pulling a Schedule C.

I removed the form, but it keeps showing up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-Misc for Paid Family Leave, How will I file this through Turbo Tax ?

What if part of my paid family leave was in 2021? If i select I intend to receive in 2021 it automatically puts a schedule c.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-Misc for Paid Family Leave, How will I file this through Turbo Tax ?

It sounds like you may still have another empty 1099-MISC included. This will happen if you entered a 1099 as self-employment and then entered another one as non-self-employment income. Delete the empty 1099-MISC and then delete Schedule C as well.

- With your return open, search for Schedule C.

- Select the Jump to link in the search results.

- On the Your 2020 self-employed work summary screen, select the trash can icon next to the defunct business.

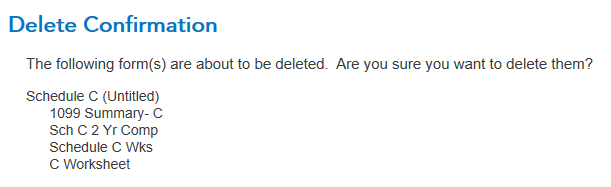

- Answer Yes, delete this info to confirm the removal of all business-related forms. You will confirm the removal of Sched C, the summary, the worksheet, the comparison, and the 1099s associated with Schedule C. See the image below - if you don't see a confirmation to remove the business, it will remain part of your return.

How do I view and delete forms in TurboTax Online? - use these instructions to remove any empty 1099s that did not get removed with the Schedule C. @pembe-ercen

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-Misc for Paid Family Leave, How will I file this through Turbo Tax ?

Has this been resolved?

It seems Turbotax has now cost me thousands of dollars in taxes from 3 different tax returns due to it adding a Schedule C for PFL.

Any idea how to fix it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-Misc for Paid Family Leave, How will I file this through Turbo Tax ?

Yes, this is resolved. You just need to enter the information following the instructions.

If you have already entered your 1099-MISC incorrectly, you will need to delete your 1099-MISC and Schedule C.

If your PFL is on a 1099-MISC and you have received an error message about Schedule C and you do not have a business (including gig work), you need to delete the problem forms first.

If you are using TurboTax Online:

From inside the return, scroll down to Tax Tools on the bottom of the left side menu.

- Select Tools.

- Click on Delete a form (third on the list at the bottom of the screen).

- Find Form 1099-MISC on the list of forms.

- Click Delete to the right.

- Confirm your Delete.

- Find Schedule C on the list of forms.

- Click Delete to the right.

- Confirm your Delete.

- Click Continue in the lower right.

- Click Continue with my return.

If you are using the Desktop version (disc or download):

- Click Forms toward the upper right corner.

- Find Form 1099-MISC on the list on the left.

- Highlight it, then click Delete in the lower left corner of the reading pane.

- Find Schedule C on the list on the left.

- Highlight it, then click Delete in the lower left corner of the reading pane.

- Click on Step by Step in the upper right corner to return to the interview.

After deleting the forms, run the Federal review or Smart Check to make sure all the error messages are resolved.

To enter the 1099-MISC for PFL:

- Select Federal on the left side menu.

- Select Income and Expenses toward upper left.

- Expand/ scroll down the list and find the section called, Less Common Income.

- Scroll all the way down and select Miscellaneous Income, 1099-A, 1099-C.

- Select Other income not already reported on a Form W-2 or Form 1099

- Answer the first question Yes.

- Click Continue until you get to the page titled, Any Other Earned Income?

- Answer Yes and click Continue.

- Select Other and click Continue.

- Enter a description and amount on this page, click Continue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-Misc for Paid Family Leave, How will I file this through Turbo Tax ?

If you paid attention to other people's responses, even when adding the 1099-Misc to the correct place, it was adding a Schedule C. The same exact thing happened to me. I added it to the correct place and it was still making issues for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-Misc for Paid Family Leave, How will I file this through Turbo Tax ?

After being on the phone with a chat expert and following your instructions, they were very helpful.

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-Misc for Paid Family Leave, How will I file this through Turbo Tax ?

How did this cost thousands in taxes? We’re your taxes accepted ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-Misc for Paid Family Leave, How will I file this through Turbo Tax ?

The PFL income reported on the 1099-Misc is added to your other income (it is replacing wages, remember). It's not taxable in California, though.

If you didn't have tax withheld on this income, you may owe tax.

Click this link for more info on Paid Family Leave

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-Misc for Paid Family Leave, How will I file this through Turbo Tax ?

thank you that worked, now it didn't add a schedule C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-Misc for Paid Family Leave, How will I file this through Turbo Tax ?

I input the 1099-misc per above

my refund dropped by 50% of the income reported on the 1099

that seems very high

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-Misc for Paid Family Leave, How will I file this through Turbo Tax ?

When you enter income from self-employment or as an independent contractor, your refund could drop for several reasons.

- You are subject to self-employment taxes which would be 15.3% of your net income from self-employment.

- Your income increased causing you to pay more in taxes overall. You could be in a higher tax bracket or just have more income being taxed that you did not have taxes withheld on

- You had certain credits decrease or you lost them all together. Credits like the Earned Income Tax Credit go up as your income creases until it reaches a peak, then it drops down the more you make until it is completely gone.

You can look at lines 15-30 with the 1099 Misc income entered, write down the numbers, then remove the 1099-Misc and look at the numbers again to compare where the changes in your refund is coming from.

You can see your 1040 by selecting Tax Tools>>Tools>>View Tax Summary>>Preview My 1040.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-Misc for Paid Family Leave, How will I file this through Turbo Tax ?

excellent... exactly the info i needed!

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

powelltyler95

New Member

courtneyskeen2

New Member

q1williams

New Member

psberg0306

Level 2

yenmde8

New Member