- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

It sounds like you may still have another empty 1099-MISC included. This will happen if you entered a 1099 as self-employment and then entered another one as non-self-employment income. Delete the empty 1099-MISC and then delete Schedule C as well.

- With your return open, search for Schedule C.

- Select the Jump to link in the search results.

- On the Your 2020 self-employed work summary screen, select the trash can icon next to the defunct business.

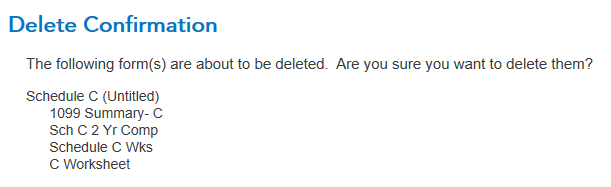

- Answer Yes, delete this info to confirm the removal of all business-related forms. You will confirm the removal of Sched C, the summary, the worksheet, the comparison, and the 1099s associated with Schedule C. See the image below - if you don't see a confirmation to remove the business, it will remain part of your return.

How do I view and delete forms in TurboTax Online? - use these instructions to remove any empty 1099s that did not get removed with the Schedule C. @pembe-ercen

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 19, 2021

2:09 PM

3,570 Views