- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I ONLY HAVE A HARD COPY OF MY 1099-R FROM Fifth Third bank

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I ONLY HAVE A HARD COPY OF MY 1099-R FROM Fifth Third bank

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I ONLY HAVE A HARD COPY OF MY 1099-R FROM Fifth Third bank

You'll get a 1099-R if you received $10 or more from a retirement plan. Here's how to enter your 1099-R in TurboTax:

- Open (continue) return if you don't already have it open.

- Inside TurboTax, search for 1099-R and select the Jump to link in the search results.

- Answer Yes on the Your 1099-R screen, then select Continue.

- If you land on the Your 1099-R Entries screen instead, select Add Another 1099-R.

- Select how you want to enter your 1099-R (import or type it in yourself) and then follow the instructions. You can add up to 20 1099-Rs.

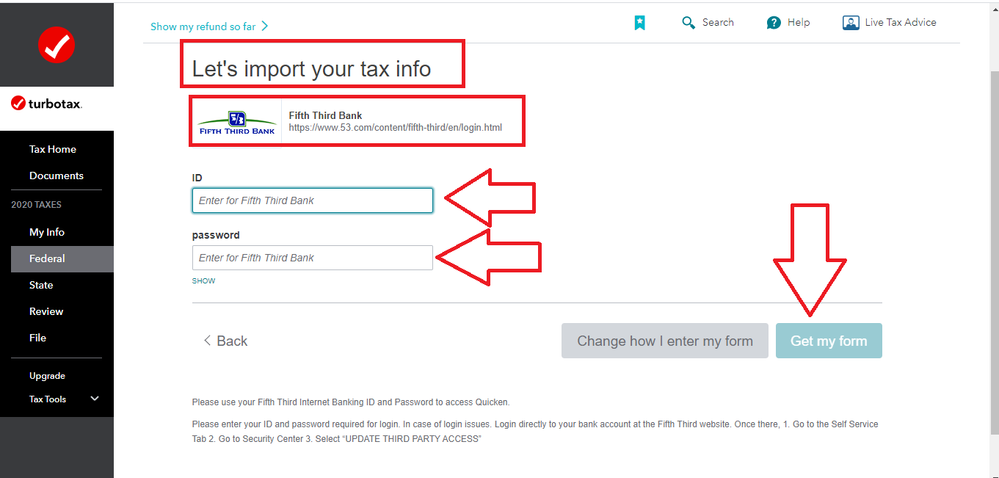

[Edited 2-2-2021|8:41 am Added screenshot]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I ONLY HAVE A HARD COPY OF MY 1099-R FROM Fifth Third bank

In the 10990R interview when you add a 1099-R it will ask if you want to import. Say yes and select the financial institution form the list.

Enter a 1099-R here:

Federal Taxes,

Wages & Income

(I'll choose what I work on - if that screen comes up)

Retirement Plans & Social Security,

IRA, 401(k), Pension Plan Withdrawals (1099-R).

OR Use the "Tools" menu (if online version left side) and then "Search Topics" for "1099-R" which will take you to the same place.

Be sure to choose which spouse the 1099-R is for if this is a joint tax return.

Be sure to pick the correct 1099-R type: Standard 1099-R, CSA-1099-R, CSF-1099-R, RRB-1099-R.

[NOTE: When you get to the "Your 1099-R Entries" screen where you can add another 1099-R, use "continue" to keep going as there are additional interview questions after that screen in most cases. You can always return as shown above.]

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Tater19

Level 1

NANCYHIRD46

New Member

elle25149

Level 1

Angel_eyes_4eva

New Member

chrisdeteresa

New Member