- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I need to file Form 8824 for a Like-Kind Exchange (1031) I executed this past year. I do not see how or where to do this anywhere in Turbo Tax Premier. Please help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file Form 8824 for a Like-Kind Exchange (1031) I executed this past year. I do not see how or where to do this anywhere in Turbo Tax Premier. Please help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file Form 8824 for a Like-Kind Exchange (1031) I executed this past year. I do not see how or where to do this anywhere in Turbo Tax Premier. Please help.

What happens in an exchange?

A like-kind exchange doesn't eliminate taxes; it just pushes them into the future. Say you paid $20,000 for a piece of business or investment real estate and sold it for $30,000 ($30,000 - $20,000 = $10,000 capital gain). Rather than have the $10,000 profit taxed as a capital gain, the like-kind exchange allows the gain to be "passed on" to the new property used for business.

For more information, see this LINK.

Follow these steps:

- With your return open in TurboTax, search for like kind (2 words, no dash) and then click the "Jump to" link at the top of your search results.

- This will take you to Any Other Property Sales? Check the second-to-last box from the bottom for like-kind and section 1031 exchanges and click Continue.

- On the next screen, answer Yes and proceed through the interview questions. We'll fill out Form 8824 for you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file Form 8824 for a Like-Kind Exchange (1031) I executed this past year. I do not see how or where to do this anywhere in Turbo Tax Premier. Please help.

I'm having difficulty with form 8824. The 'easy step' questions are not clear. I've read various posts and responses, checked online sources but it's still not so easy. Is there a possibility I can talk with someone by phone to walk me through this form so I can knock it out rather than going back and forth via the web?

Thanks,

Shannon

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file Form 8824 for a Like-Kind Exchange (1031) I executed this past year. I do not see how or where to do this anywhere in Turbo Tax Premier. Please help.

If you are using TurboTax Online, you can get Live Tax Advice by clicking on the icon on the top right of your screen while you are in your return. [See screenshot below.]

You can also call TurboTax and speak with an agent. TurboTax customer service/support does not have a single phone number but has many different phone numbers based on the type of platform used. So that we can direct your call to the best person/department to help you:

- Click on this link: https://support.turbotax.intuit.com/contact/

- Select your TurboTax platform.

- Ask your question / state your problem. Do NOT use the word "refund' or you will get a phone number for tax refunds.

- Click Submit.

- On the next screen, choose the Call option and follow the instructions. You will be given the approximate wait time.

You'll get a toll-free number to a TurboTax expert who is specially-trained to handle your particular issue.

@malletshop

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file Form 8824 for a Like-Kind Exchange (1031) I executed this past year. I do not see how or where to do this anywhere in Turbo Tax Premier. Please help.

I was able to enter my LKE using the jump to link, and the calculations seem correct. However, I am confused on what to do now for the two properties in the rentals and royalties section. Specifically, under the Assets section, do I fill out the Sold Rental Property section? For the new property, do I fill out the New Rental Property section? How do I ensure that depreciation is properly accounted for on each property?

Any help is much appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file Form 8824 for a Like-Kind Exchange (1031) I executed this past year. I do not see how or where to do this anywhere in Turbo Tax Premier. Please help.

The new property is treated like it was the old property, in other words nothing changes except that you may have a new asset to place in service for any buy up/added cash on the exchange. Below are instructions that should help you complete the process and/or review your own steps.

When you have your TurboTax return open you can use the following steps to update the original assets for the exchange.

- First use the Search (upper right) > Type rentals > Press enter > Click on the Jump to... link

- Scroll to Assets/Depreciation > Click Update > Select 'Edit' next to each asset

- Edit beside each asset > Continue to the Tell Us About This Rental Asset

- Select the checkbox beside 'This item was sold, retired, .... traded in ....etc. > enter the date it was traded (sold/retired)

- Answer the question about whether it was 100% business > Enter the date it was placed in service (may be purchase date or later depending on your circumstances)

- Continue to the screen 'Confirm Your Prior Depreciation'

- The amount displayed is only for prior years and does not include the current year.

- Continue until you see the current year amount displayed and make a note to add the two amounts together for the Section 1031 like kind exchange.

- This completes the asset portion of the trade.

Next you will complete the like kind exchange, Form 8824 (Section 1031 exchange):

- Use the Search (upper right) > Type like kind > Press enter > Click on the Jump to... link

- Select the checkbox beside 'Any additional like-kind exchanges (section 1031)' > Continue

- Complete the information for the 'Real estate given up' and 'Like-Kind Property Given Up' > Continue

- Name the event > Continue > Complete the information for the 'Like-kind property received'

- If you did not give unlike property in the exchange click 'No' and continue past these screens, if 'Yes' answer the questions.

- Enter any exchange expenses (sales expenses) > Continue to see your deferred gain.

Go back to your rental activity and then enter the new assets with the exact same information as the property given up with a new name, but with the same date placed in service as the old property, for all assets that are part of the exchange.

Enter a new asset for any buy up/added cash in the exchange including the purchase/selling expenses you paid in the trade. The new asset will begin depreciation on the completion date of the trade/like kind exchange.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file Form 8824 for a Like-Kind Exchange (1031) I executed this past year. I do not see how or where to do this anywhere in Turbo Tax Premier. Please help.

Hello Diane

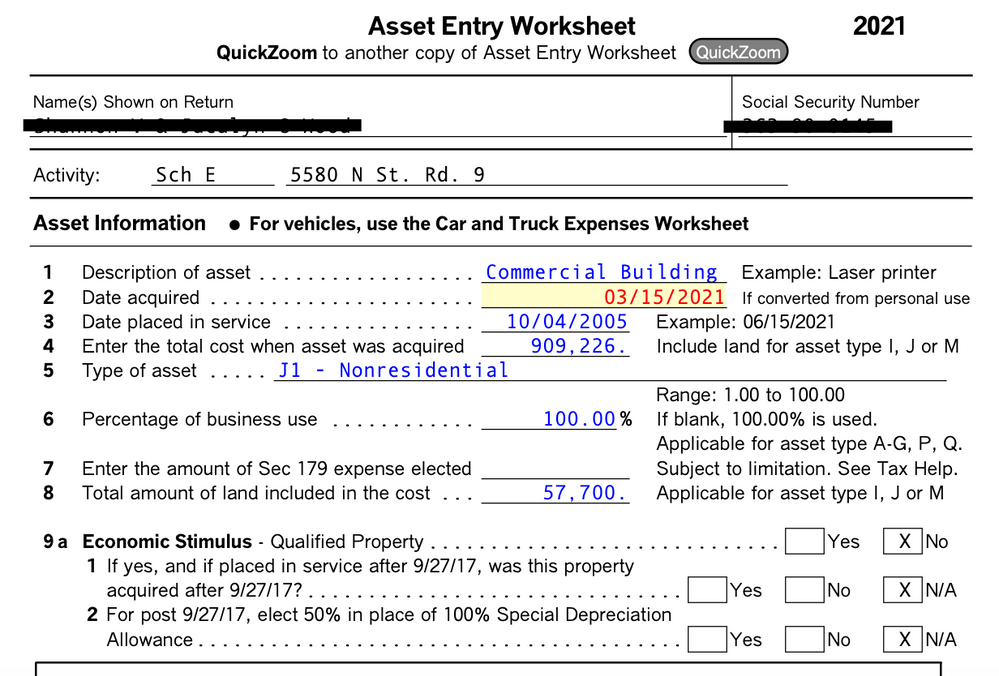

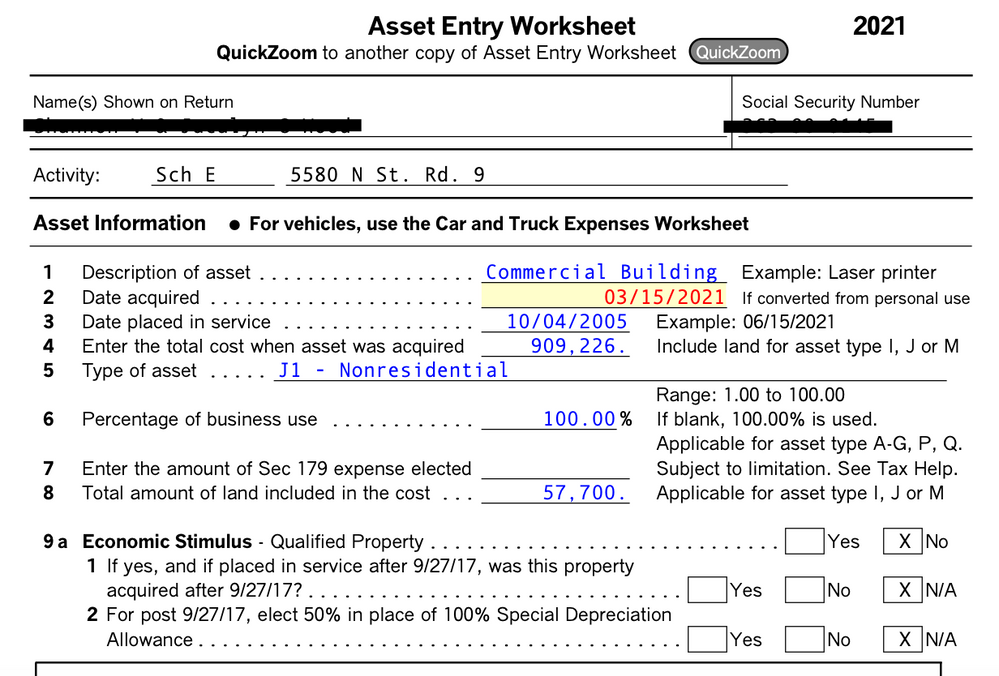

Using the Schedules E Asset Entry Worksheet I've done the following: The like-kind property given up was put into service on 10/04/2005. The like-kind property received was put into service on 03/15/2021. Below I inputed 03/15/2021 in "date purchased or acquired" for the like-kind property received and 10/04/2005 for "date placed in service". It's causing an error. If I use 10/04/2005 for both line 2 and 3 it resolves the error. Can you let me know which date I should be using for both "date purchased or acquired" and "date placed in service" for the like-kind property received? See first screenshot.

Also, is line 10 on the same worksheet where I put prior depreciation? See second screenshot.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file Form 8824 for a Like-Kind Exchange (1031) I executed this past year. I do not see how or where to do this anywhere in Turbo Tax Premier. Please help.

In the case of that form the date acquired is the original date acquired which is most likely the same date as the date placed in service. It is definitely not the date from 16 years later.

That second sheet is where you enter prior depreciation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file Form 8824 for a Like-Kind Exchange (1031) I executed this past year. I do not see how or where to do this anywhere in Turbo Tax Premier. Please help.

Hello Robert

Just to clarify your response, of the two dates, you are saying that the date I should use is 10/04/2005. Correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file Form 8824 for a Like-Kind Exchange (1031) I executed this past year. I do not see how or where to do this anywhere in Turbo Tax Premier. Please help.

Yes, if the date that you acquired the property is the same as the date placed in service. If you remember that you acquired the property even before it was placed in service, then use the date acquired when asked for that date.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file Form 8824 for a Like-Kind Exchange (1031) I executed this past year. I do not see how or where to do this anywhere in Turbo Tax Premier. Please help.

Hello:

Thank you for your response. I still need clarity that the date I'm to use is the date I acquired / placed in service the like-kind property given up rather than the date I acquired / placed in service the like-kind property received. If you could confirm this, my question will have been answered. Thank you -sw

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file Form 8824 for a Like-Kind Exchange (1031) I executed this past year. I do not see how or where to do this anywhere in Turbo Tax Premier. Please help.

@malletshop, To follow-up on the responses from @Irene2805, @DianeW777, @robertb1326, and @ColeenD3, you did need to enter the date you acquired the property you are giving up to acquire the replacement property. In this regard, Form 8824, on line 3, states the following:

3 Date like-kind property given up was originally acquired (month, day, year) .

Thus, enter the month, day, and year that you acquired the property you are giving up.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file Form 8824 for a Like-Kind Exchange (1031) I executed this past year. I do not see how or where to do this anywhere in Turbo Tax Premier. Please help.

Hello

My initial question did not have to do with Form 8824. It has to do with a Sch. E Asset Entry Worksheet. Please see screenshot (same one I provided above).

This asset entry worksheet has to do with the like-kind property received. The question I have has to do with Line 2 and Line 3. Do I input the dates of the like-kind property given up since the like-kind property received is essentially now the same property as the one given up, with a new name and address?

Below line 2 currently has the like-kind property received date, and line 3 has the like-kind property given up date, but I think they both should have the like-kind property given up date, which is 10/04/2005. Is that assumption correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file Form 8824 for a Like-Kind Exchange (1031) I executed this past year. I do not see how or where to do this anywhere in Turbo Tax Premier. Please help.

No. Schedule E refers only to the property that you owned and rented out since 2005. It asks for both dates since the date you originally purchased it, might not have been the same date you placed it in service.

You may have acquired it on 6/4/05 and done repairs for 6 months prior to placing it in service.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file Form 8824 for a Like-Kind Exchange (1031) I executed this past year. I do not see how or where to do this anywhere in Turbo Tax Premier. Please help.

Hello

I'm having trouble getting my question across and answered correctly. I understand that the date one acquires and puts into service might be different. That is not my question. I performed a 1031 exchange in 2020. The property given up was acquired AND put into service on 10/04/2005. The property received was in 2021. I am entering the property received on tax year 2021's return. On schedule E, which date am I to use for the property received, the actual date I acquired it which is 3/15/2021 or the date I acquired the original property aka the like-kind property given up which is 10/04/2005. My understanding is that I am to use the date of the property given up, since the property received is simply exchanged, and all the depreciation needs to move to the property received. Please confirm. Thank you - sw

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

huntertech

Returning Member

llnws

Level 1

rigo1515

New Member

qnwa01

Level 2

agarci16

New Member