- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I'm trying to finalize my 1095a review but it won't accept my modifications. What am I doing wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to finalize my 1095a review but it won't accept my modifications. What am I doing wrong?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to finalize my 1095a review but it won't accept my modifications. What am I doing wrong?

Try clearing out your browser's cache and delete the cookies stored on your computer. A full or corrupted cache can keep TurboTax from functioning properly.

Please see the following TurboTax FAQs to assist with this:

If that doesn't work you can delete the form and re-enter it. Please see How do I view and delete forms in TurboTax Online? for instructions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to finalize my 1095a review but it won't accept my modifications. What am I doing wrong?

It didn't work. I cleared my data, log back in, put my soc where it asks and it's still asking me to fix my soc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to finalize my 1095a review but it won't accept my modifications. What am I doing wrong?

I will suggest you delete the Form 1095-A and then re-enter it.

To remove the form, here are the steps:

In TurboTax online,

1. Sign into your account, select Pick up where you left off

2. Select Tax Tools, click on the drop down arrow

3. Select Tools

4. Under Other helpful links, choose Delete a form

5. Select Delete next to Form 1095-A / Form 8962 and Continue with My Return

To re-enter, follow here:

- At the right upper corner, in the search box, type in "health insurance" and Enter

- Select Jump to health insurance

- Follow prompts

If you are entitled to claim a Premium Tax Credit on Form 8962, it will shows on Schedule 3 line 8 and Form 1040 line 31.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to finalize my 1095a review but it won't accept my modifications. What am I doing wrong?

Deleted and re entered. No dice. Still wanting me to fix the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to finalize my 1095a review but it won't accept my modifications. What am I doing wrong?

Is TurboTax telling you to add the social security number in the Review? When you add the SSN, do you do it in the Review or go back to the 1095-A interview and enter it there (this is better)?

Also please consider that you may have two 1095-A forms in TurboTax.

Try this:

*** Desktop***

1. go to View (at the top), choose Forms, and select 1095-A. Note the Delete Form button at the bottom of the screen. If there is more than one 1095-A, delete all of them.

*** Online ***

1. go to Tax Tools (on the left), and navigate to Tools->Delete a form

2. delete form(s) 1095-A

Now go re-enter your 1095-A.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to finalize my 1095a review but it won't accept my modifications. What am I doing wrong?

Well Bill if you read the post before, you would know I ALREADY DELETED THE FORM AND RE ENTERED IT. I've done it three times now. And yet here I sit. Charged for a program that's not working, and getting the same advice over and over that didn't work in the first place. I have deleted it three times. I have entered it four times. I made sure there wheren't duplicates. I tried the review step. I tried the finalization step. And yet still it will not accept the SSN that I put into the form. I am getting very frustrated at this point.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to finalize my 1095a review but it won't accept my modifications. What am I doing wrong?

I am going to take a guess here - Is the social that you are entering a social security number listed elsewhere on your return? You should not have to enter any social security numbers unless you are doing a shared policy allocation. When you enter a 1095-A, you are asked to enter the Marketplace Identifier # and the Marketplace-assigned policy number - which are boxes 1 and 2 respectively.

Did you mark one of the special situation boxes? If you checked the first box:

Shared Policy Allocation - Do not enter any dashes, only 9 digits, and the social security number entered here should not be listed anywhere else on your return, so this is for sharing the policy with someone not on your tax return. Other than this situation, you should not have to enter any SSN numbers when entering a 1095-A

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to finalize my 1095a review but it won't accept my modifications. What am I doing wrong?

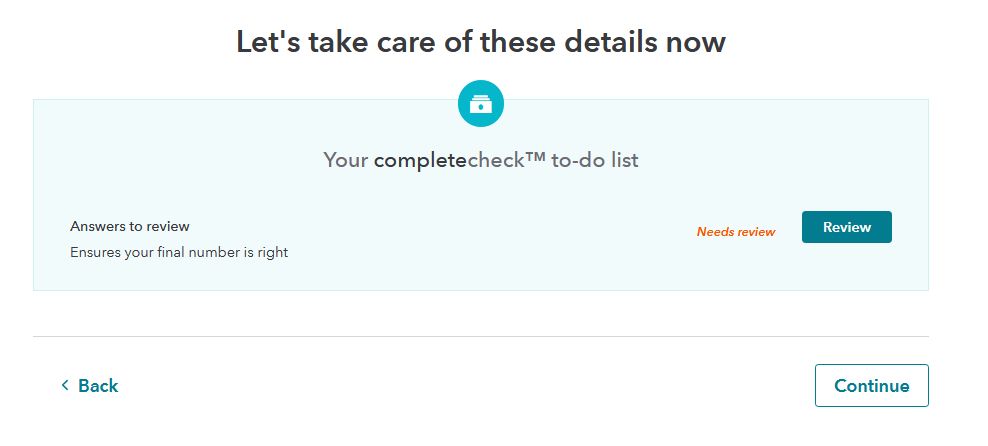

Unfortunately it is very much asking for my social. As far as I am aware I haven't said to the program anywhere that I am doing a shared policy. I entered the Data from Box 1 and 2, and filled in the boxes asking for the monthly credit and use. However it brings me to this screen and asks for my SSN which is box 5 of the 1095a. I input my SSN and it says that something isn't right.

UPDATE: As I was making this post an I was struck with a realization. I went to the beginning and unchecked that I could be claimed as a dependent, and it seemed to do the trick. Thank you for coming to aid.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

boyattjs

New Member

black1761

Level 1

bobproud

New Member

twbutler19

New Member

jes1ntn

New Member