- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I have 3 children and just noticed that only one is marked for child care tax and my other two children are marked as credit for other dependents. we only got $300 on this first installment of the chi...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

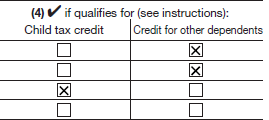

I have 3 children and just noticed that only one is marked for child care tax and my other two children are marked as credit for other dependents. we only got $300 on this first installment of the child credit payment.

should I amend my tax return form 2020 so I can get everything i should be eligible for? please advise.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have 3 children and just noticed that only one is marked for child care tax and my other two children are marked as credit for other dependents. we only got $300 on this first installment of the child credit payment.

Are you asking about the advance child tax credit payment? Or the child tax credit on your 2020 tax return? Or both?

On a 2020 tax return you get the CTC for a child who was UNDER the age of 17 at the end of 2020. If the child was older than 16 at the end of 2020 you only get the credit for other dependents. Or if the child was born in 2020 you had to say they lived with you the WHOLE year to get the CTC. And they need Social Security numbers----did you enter SSN's for them?

Post back with some more information. What are the ages of the children? Amending is not going to get you the advance payments because it takes six months or more for the IRS to process amended returns. But you might need to amend to get the CTC on your 2020 return.

If you are eligible to get the CTC for all of the kids you will eventually get it on your 2021 tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have 3 children and just noticed that only one is marked for child care tax and my other two children are marked as credit for other dependents. we only got $300 on this first installment of the child credit payment.

all my children are under 6 year old. I believe I am asking for the advance child tax credit payment specifically. we should have received $900 for all 3 children, but I only received $300; so when I went to check my tax return form 2020 I noticed the youngest was marked for "child care tax" and my other two older children are marked as "credit for other dependents" on the dependents section, I entered their socials correctly as well.

ages are 5, 2 and 1 year old. should I file amendment to get the full CTC on my 2020 tax return then?

is this affecting the fact that I only got the advanced payment for one child??

Please advise. thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have 3 children and just noticed that only one is marked for child care tax and my other two children are marked as credit for other dependents. we only got $300 on this first installment of the child credit payment.

You must have answered something incorrectly in My Info about the children because you should have received the CTC for all of them if they have Social Security numbers. When you amend----make sure you say they lived with you the WHOLE YEAR---even the baby. You have to say that for a baby born in 2020. And when it asks that weird question about whether the child paid for over half his own support say NO to that.

And yes, this is affecting the advance payments. If you cannot get this sorted out to get the advance payments for all of them you will still be able to get the CTC for them on your 2021 tax return. If the five year old turns 6 in 2021 you get the lower amount of $3000 for him, but the ones who are under 6 at the end of 2021 get $3600 each.

The other thing-----did you use the recovery rebate credit on your 2020 return to get the stimulus money for them----if you did not receive it yet? You should have received stimulus money for each one too unless your income was too high. So when you amend make sure you explore the recovery rebate credit.

The stimulus check is an advance on a credit you can receive on your 2020 tax return. If something went wrong or you did not get the stimulus check in 2020, you can get it when you file your 2020 return in early 2021

The Recovery Rebate Credit will be found in the FEDERAL REVIEW section. ( you should see "Let's make sure you got the right stimulus amount”) If you are eligible it will end up on line 30 of your 2020 Form 1040.

Make sure that you enter ALL of the stimulus money received for the 1st and 2nd stimulus for yourself, your spouse and your children.

https://ttlc.intuit.com/questions/1901539-how-do-i-preview-my-turbotax-online-return-before-filing

Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

Select your tax year for amending instructions:

What does it mean to "amend" a return?

· Do I Need to Amend my Tax Return?

Even during “normal” times it takes about four months for the IRS to process an amended return. During the pandemic and due to the severe backlog at the IRS it is taking much longer—six months or more for many amended returns. Do not expect quick results from amending. When the IRS issues a refund for an amended return it will be by check. They do not make direct deposits for refunds for amended returns. You can watch for information here:

https://www.irs.gov/Filing/Individuals/Amended-Returns-(Form-1040-X)/Wheres-My-Amended-Return-1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have 3 children and just noticed that only one is marked for child care tax and my other two children are marked as credit for other dependents. we only got $300 on this first installment of the child credit payment.

the baby (1 year old) is the one who is marked as child care tax, so I did something wrong when entering the info for the oldest children then. quite honestly not sure how I entered this wrong.

basically I qualified for $3600 credit for each child, my oldest just turned 5 years old.

I definitely received the last stimulus payment with no issues, my income qualified us definitely, my spouse does not work. We've received all stimulus payments without issues until now.

do you think I should amend now or wait until I file my 2021 tax return? if I amend now I will need to wait for it to be resolved before I file for 2021, so I can get all I am eligible of the 2021 Child tax credit, right?

thank you

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

MummyatLilliput

New Member

Stavros13

New Member

Oeb

Level 1

zalmyT

Returning Member

ewaite27

New Member