- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

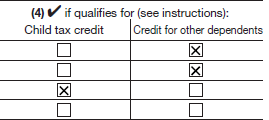

all my children are under 6 year old. I believe I am asking for the advance child tax credit payment specifically. we should have received $900 for all 3 children, but I only received $300; so when I went to check my tax return form 2020 I noticed the youngest was marked for "child care tax" and my other two older children are marked as "credit for other dependents" on the dependents section, I entered their socials correctly as well.

ages are 5, 2 and 1 year old. should I file amendment to get the full CTC on my 2020 tax return then?

is this affecting the fact that I only got the advanced payment for one child??

Please advise. thank you

July 15, 2021

7:27 PM