- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I got a PayPal 1099-K for mostly personal transactions. How do I handle this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got a PayPal 1099-K for mostly personal transactions. How do I handle this?

This year I received a 1099-K from PayPal for $1,297 in transactions. The vast majority of these transactions were personal: reimbursements from friends/family for stuff I paid for, and a few small cash gifts. There *are* a couple class action settlement payments included, which count as taxable income. But the 1099-K lumps it all together.

I've read about 10 different posts and articles on how to navigate the 1099-K thing this year and I still have zero clue as to how I go about handling this: especially since my 1099-K includes a majority of PayPal transactions that are not taxable, but a couple of small ones that are. What makes it even more complicated is that I happen to be self-employed, but none of these transactions (including the taxable ones) were related to my business.

Any advice is greatly appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got a PayPal 1099-K for mostly personal transactions. How do I handle this?

Here’s how to enter a Form 1099-K in TurboTax when some items are reimbursements, gifts or personal items sold at a loss while a few are taxable income:

- Type 1099-k in Search (magnifying glass) in the upper right

- Tap Jump to 1099-k

- On “Did you get a 1099-K?" say Yes

- On “Choose which type of income your 1099-K is for," select Personal item sales

- On “Let’s get the info from your 1099-K," fill in boxes, then Continue

- On “Personal Items Sales,” select Enter the total proceeds for items sold at a loss or no gain in the box. Enter the total value of non-taxable transactions. This number should be less than Box 1a of Form 1099-K.

Learn more at Form 1099-K Frequently Asked Questions: General.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got a PayPal 1099-K for mostly personal transactions. How do I handle this?

Thanks for the response. I tried taking these steps but when I selected "personal sales items" as the basis of the 1099-K, the form was categorized under Investments and I'm now being told to enter what's essentially investment sale information for every personal transaction that's lumped into the 1099-K total, which I can't really wrap my head around because these personal transactions are either direct reimbursements for stuff I paid for (ie, dinner out with friends) or some small cash gifts from friends or family.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got a PayPal 1099-K for mostly personal transactions. How do I handle this?

You may consider reporting the 1099-K as Hobby Income.

To report Hobby income, follow these directions.

- Down the left side of the screen, click Federal.

- Down the left side of the screen, click Wages & Income.

- Click Show more to the right of Other Common Income.

- Under Your income and expenses, click the Edit/Add button to the right of Form 1099-K.

- At the screen Did you get a 1099-K? click Yes.

- At the screen How would you like to enter your 1099-K? click Type it in myself. Click Continue.

- At the screen Choose which type of income your 1099-K is for, select the button for Hobby income. Click Continue.

- At the screen Let’s get the info from your 1099-K, enter the information. Click Continue.

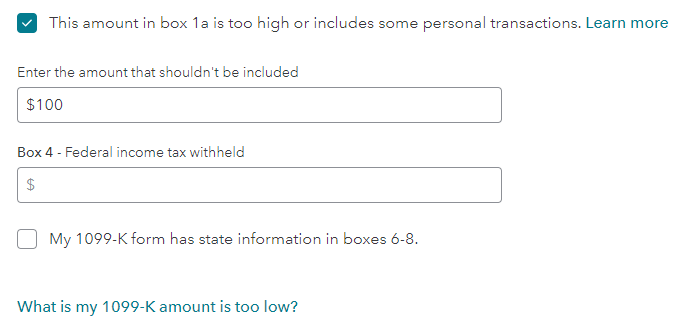

- Click the box The amount in box 1a is too high.....

- At the screen Your 1099-K summary, notice that the income relates to ‘Hobby’. Click Done.

The entry will be reported:

- on line 8j of Schedule 1 of the Federal 1040 tax return, and

- on line 8 of the Federal 1040 tax return.

Hobby income expense is not allowed to be reported.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got a PayPal 1099-K for mostly personal transactions. How do I handle this?

I am looking into starting a class action against them after trying for weeks to get them to remove the goods and services classification from an insurance payment I received from Traveler's (reimbursement for money we spent literally 2 years ago), and they are unable to and said they will be issuing me a 1099-K no matter what. BoA/Traveler's tried to recall the payment AS PAYPAL suggested and PayPal corporate told them it was too late, the payment had already went through successfully (even though PayPal had a hold on it because we never supplied a Tax ID because we ARE NOT SELLERS of any kind!). They also would not give me the option to send it back so it is sitting there unclaimed because I refuse to accept it and get a 1099-K for it as goods and services because Paypal automatically categorizes business payments as goods and services! I am certain this has happened to thousands of people and many have probably had to pay extra to file their taxes and pay a tax expert to help them navigate it. Please reach out if you would like to try and help me find people for a class action. I have literally lost sleep over it and it has ruined and consumed my life over the past few weeks, as it is FAFSA time too.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

spurlockp

New Member

mayorcleve

New Member

SusanROA

Level 2

SusanROA

Level 2

hd92fxrp

New Member