- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I filed married joint. AGI is $155240. Got a 3rd stimulus check of $2800. And told TurboTax. They calculated $1344. Why did my fed tax owed go up $1344? This the same number that TurboTax calculated...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed married joint. AGI is $155240. Got a 3rd stimulus check of $2800. And told TurboTax. They calculated $1344. Why did my fed tax owed go up $1344? This the same number that TurboTax calculated as my 3rd stimulus payment. I’m confused…

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed married joint. AGI is $155240. Got a 3rd stimulus check of $2800. And told TurboTax. They calculated $1344. Why did my fed tax owed go up $1344? This the same number that TurboTax calculated as my 3rd stimulus payment. I’m confused…

"If you qualified for a third payment based on your 2019 or 2020 tax return, the law doesn't require you to pay back all or part of the payment you received based on the information reported on your 2021 tax return,"

The increase in taxes owed should not be a result of the stimulus payment. However, without being able to see your return I am unable to determine what your additional taxes are the result.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed married joint. AGI is $155240. Got a 3rd stimulus check of $2800. And told TurboTax. They calculated $1344. Why did my fed tax owed go up $1344? This the same number that TurboTax calculated as my 3rd stimulus payment. I’m confused…

I understand that what my 3rd stimulus ck is based on my 2019 return ( I haven’t filed my 2020 return when the check was issued) and not my 2021 return .

TurboTax calculated my third check based on my AGI of $155k in 2021to be $1344 married filing jointly. We received $2800. According to TurboTax, my tax owed jumped from $904 to $2248 (the same $1344 they calculated!!)

WHY?? I can’t file yet until I get this straightened out.

There is no chargeback on a stimulus ck issued on a 2019 return (<$150k AGI) verses my 2021 return based on $155k).

HELP!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed married joint. AGI is $155240. Got a 3rd stimulus check of $2800. And told TurboTax. They calculated $1344. Why did my fed tax owed go up $1344? This the same number that TurboTax calculated as my 3rd stimulus payment. I’m confused…

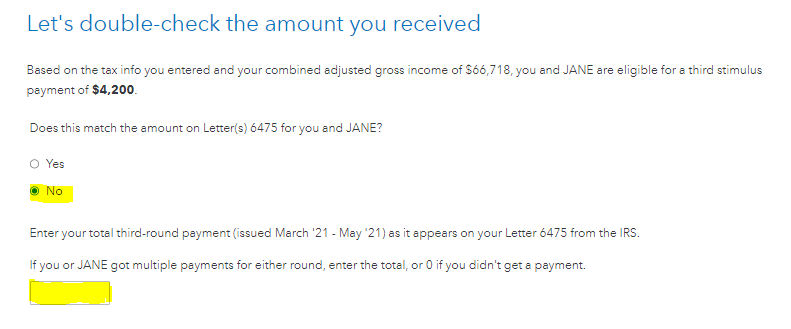

When you get to the page shown below when preparing your return check No and enter the amount of $2800 you received in the box. This should correct the problem you are having.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed married joint. AGI is $155240. Got a 3rd stimulus check of $2800. And told TurboTax. They calculated $1344. Why did my fed tax owed go up $1344? This the same number that TurboTax calculated as my 3rd stimulus payment. I’m confused…

This is what I did and my taxes owed jumped from $904 to $2248 an increase of $1344!!

why did this happen??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed married joint. AGI is $155240. Got a 3rd stimulus check of $2800. And told TurboTax. They calculated $1344. Why did my fed tax owed go up $1344? This the same number that TurboTax calculated as my 3rd stimulus payment. I’m confused…

Since your AGI is over $150,000 but less than $160,000 when filing Married Filing Joint, there is a phaseout against the $1,400 because you are not eligible for the full amount. Please see eligibility requirements for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed married joint. AGI is $155240. Got a 3rd stimulus check of $2800. And told TurboTax. They calculated $1344. Why did my fed tax owed go up $1344? This the same number that TurboTax calculated as my 3rd stimulus payment. I’m confused…

Found the problem. When TurboTax calculated my third stimulus payment, it created a recovery rebate credit which reduced my overall tax owed. When I told TurboTax that I did receive a third stimulus check, it eliminated the rebate which showed an increase in my taxes owed. This confused me.

All is good. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed married joint. AGI is $155240. Got a 3rd stimulus check of $2800. And told TurboTax. They calculated $1344. Why did my fed tax owed go up $1344? This the same number that TurboTax calculated as my 3rd stimulus payment. I’m confused…

Yes, the program assumes you get the credit.

Once you report that the payment was already received, the credit is lowered or eliminated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17557017943

New Member

sonia-yu

New Member

dougiedd

Returning Member

SB2013

Level 2

user17539892623

Returning Member