- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I didn't select estimated tax option last year. Why am I being penalized this year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I didn't select estimated tax option last year. Why am I being penalized this year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I didn't select estimated tax option last year. Why am I being penalized this year?

If you are asking why estimated tax vouchers are printed out, you do not have to use them they are just a suggestion.

If you got an underpayment penalty, the IRS will not charge you an underpayment penalty if the following is met:

- You pay at least 90% of the tax you owe for the current year, or 100% of the tax you owe for the previous tax year, or

- You owe less than $1,000 in tax after subtracting withholdings and credits

For high-income taxpayers, the rule is slightly different. If the Adjusted Gross Income on your previous year’s return is over $150,000 (over $75,000 if you are married filing separately), you must pay the lower of 90% of the tax shown on the current year’s return or 110% of the tax shown on the return for the previous year.

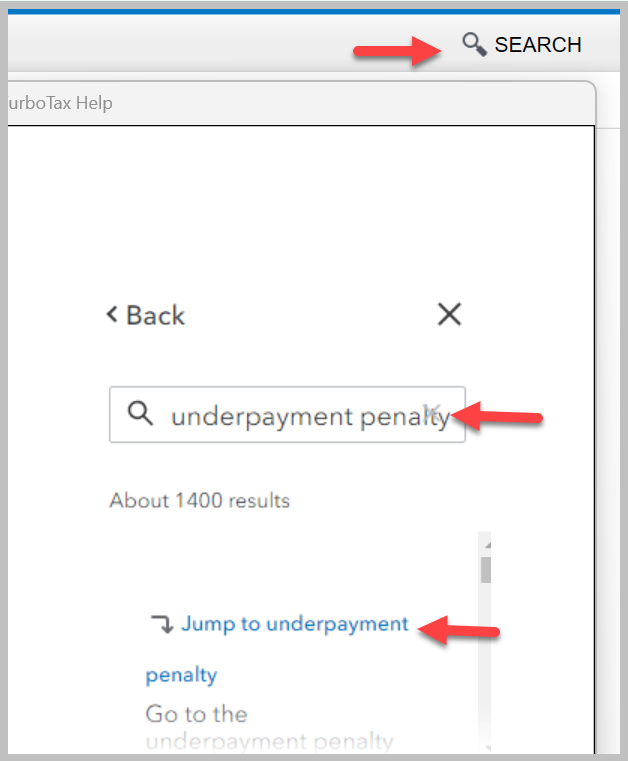

Your TurboTax screens will look something like this:

Click here for Estimated Taxes: How to Determine What to Pay and When

Click here for Underpayment of estimated tax by individuals penalty

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I didn't select estimated tax option last year. Why am I being penalized this year?

to avoid a penalty, you need to have paid the smaller of 100% of your 2023 tax liability (110% if AGI > 150k), or 90% of your 2024 tax liability, whichever is smaller (this is the 'safe harbor' amount) on a timely basis either thru withholding or estimated taxes.

if you have a penalty check under Other Tax Situations / Underpayment Penalty to confirm the 2023 information in the calculation and figure out what your 'safe harbor' is and you can determine if you underpaid. This calc happens on Form 2210, if you are on TT Online it may be in the PDF with "all forms and worksheets".

you should look at this for 2025 planning also if you expect similar income for 2025 then you either need to increase withholding to avoid penalty or start paying estimated taxes. TT will default ES vouchers assuming the "100% of 2024" option and assumes your 2025 withholding will be the same as 2024, unless you provide estimates for 2025 under Other Tax Situations / Form W-4 and Estimated Taxes.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Resbeht

New Member

jlimmer

Level 1

Little Hawk

New Member

temoniaellie36

New Member

chef_rozy

New Member