- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

If you are asking why estimated tax vouchers are printed out, you do not have to use them they are just a suggestion.

If you got an underpayment penalty, the IRS will not charge you an underpayment penalty if the following is met:

- You pay at least 90% of the tax you owe for the current year, or 100% of the tax you owe for the previous tax year, or

- You owe less than $1,000 in tax after subtracting withholdings and credits

For high-income taxpayers, the rule is slightly different. If the Adjusted Gross Income on your previous year’s return is over $150,000 (over $75,000 if you are married filing separately), you must pay the lower of 90% of the tax shown on the current year’s return or 110% of the tax shown on the return for the previous year.

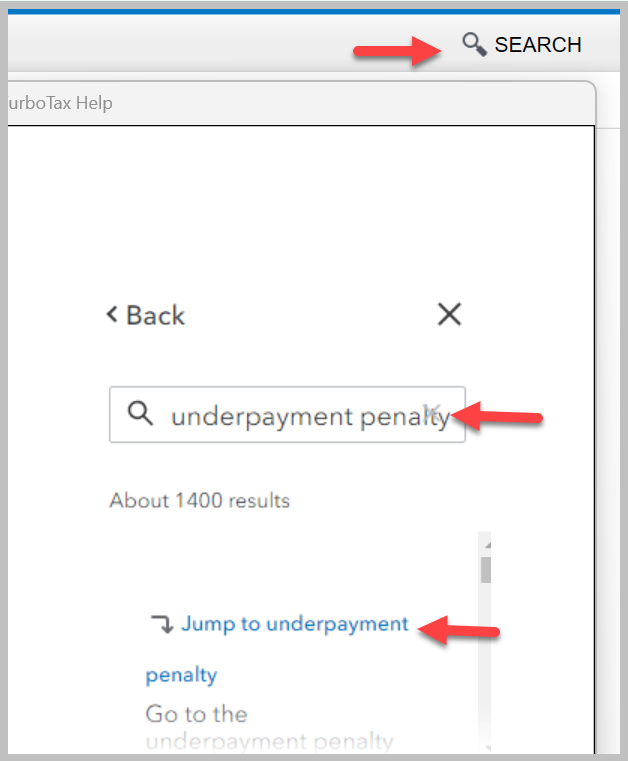

Your TurboTax screens will look something like this:

Click here for Estimated Taxes: How to Determine What to Pay and When

Click here for Underpayment of estimated tax by individuals penalty

**Mark the post that answers your question by clicking on "Mark as Best Answer"