- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I am trying to fill the Form 8615, there is a box needs parent's ssn, however, my parents are foreigners and they don't have ssn. What should I fill in this box?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

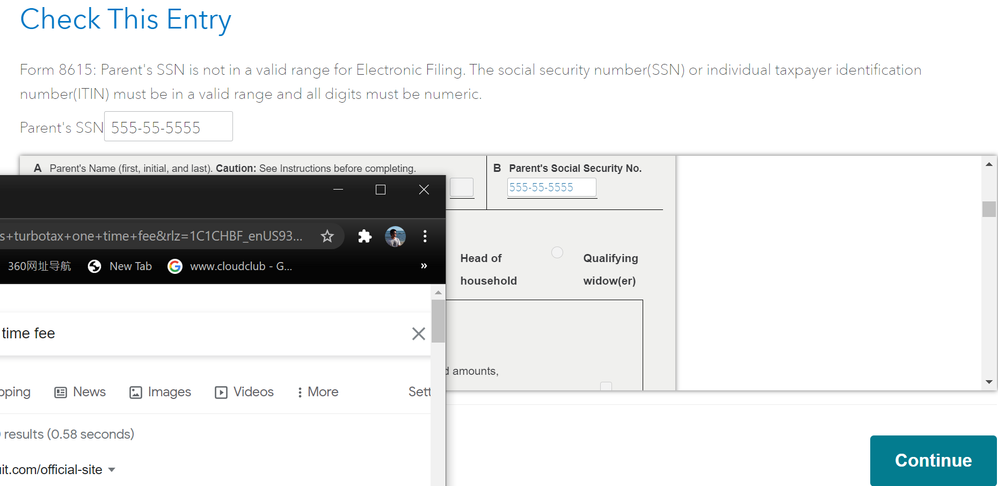

I am trying to fill the Form 8615, there is a box needs parent's ssn, however, my parents are foreigners and they don't have ssn. What should I fill in this box?

I saw there is a question asked before, but it could not solve my problem.

As I tries to continue to the E-file, 8615 form keeps warning me to fix my parent's ssn, but they dont have any. I downloaded the file and hand written them and uploaded onto the website, but the website does not have any option for me to manually replace those file.

Is there any method I can do in order to finish my tax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to fill the Form 8615, there is a box needs parent's ssn, however, my parents are foreigners and they don't have ssn. What should I fill in this box?

The IRS apparently never considered the possibility of a U.S. citizen or resident alien who is required to file IRS Form 8615 and whose parents are foreign or do not file a US tax return. The IRS does not provide any instructions or guidance for this situation.

The best that can be suggested is the following, with thanks to SuperUser, macuser_22, who suggested this approach. To access IRS Form 8615 questions, follow these steps:

- Down the left side of the screen, click on Tax Tools,

- Click on Tools.

- Click on Topic Search.

- At the box I’m looking for, enter 8615. Click Go.

- At the screen Child’s Unearned Income, click Continue.

- Answer the parent questions. When TurboTax asks whether your parents are filing a joint tax return, answer Yes even though they aren't. That will eliminate the question with the three options for filing status.

- When it asks for your parents' taxable income, enter zero. That is true, since they have no U.S. taxable income.

- Leave all the other income questions blank.

- Also leave your parent's Social Security Number blank.

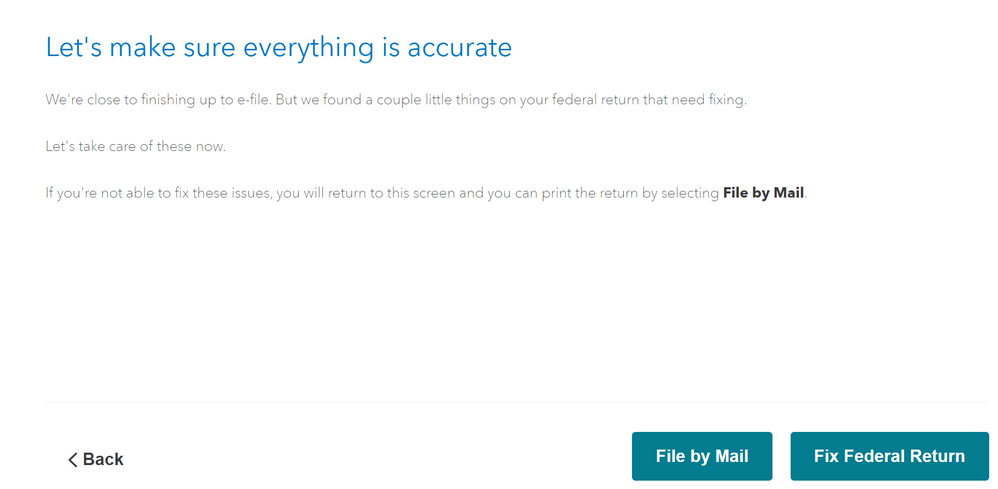

- When the error check tells you that the SSN must be entered, just click Continue. You will not be able to e-file.

- Print the tax return.

- In the space for the parent's Social Security number on Form 8615, write NRA (for NonResident Alien).

- File the return by mail.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

flyday2022

Level 2

genesisvalenzuela106173

New Member

tbduvall

Level 4

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

chapmandebra3

New Member

bgoodreau01

Returning Member