- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Husband-Wife LLC part of married joint filing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband-Wife LLC part of married joint filing

I'm using Home & Business PC version to file my 2020 Tax.

When I am inputing our LLC business, the tool recommended us to separately file Schedule C by splitting the income and expenses. I am fine with that and in fact did it.

However, since we are in a non-community property state, Form 1065 will still have to be filed which I understand will generate K-1 when that does.

While I have no issue to file Form 1065 outside the TurboTax world (since I spent already paid for TT Home & Business edition that does not support Form 1065). At the same time though, I understand K-1 form is available within the realm of Home & Business (just that you can't file Form 1065)

What do I do really, I have until 3/15/2021 to file Form 1065.

Is my best course to file that and then what do i do with my married joint filing and the two schedule C that I have created based on advice of the Turbo Tax tool?

Advice greatly appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband-Wife LLC part of married joint filing

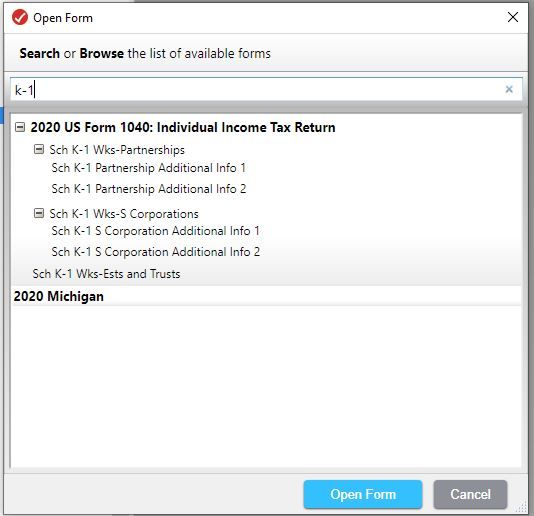

Then To enter a K-1 in the Home & Business version go to

Personal

Personal Income

Choose I'll choose what I work on

Then scroll way down to Business Investment and Estate/Trust Income

Schedule K-1 - Click the Start or Update button

Be sure to pick the right kind of K-1. There are 3 kinds, 1041, 1065 & 1120S

Enter each K-1 Separately.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband-Wife LLC part of married joint filing

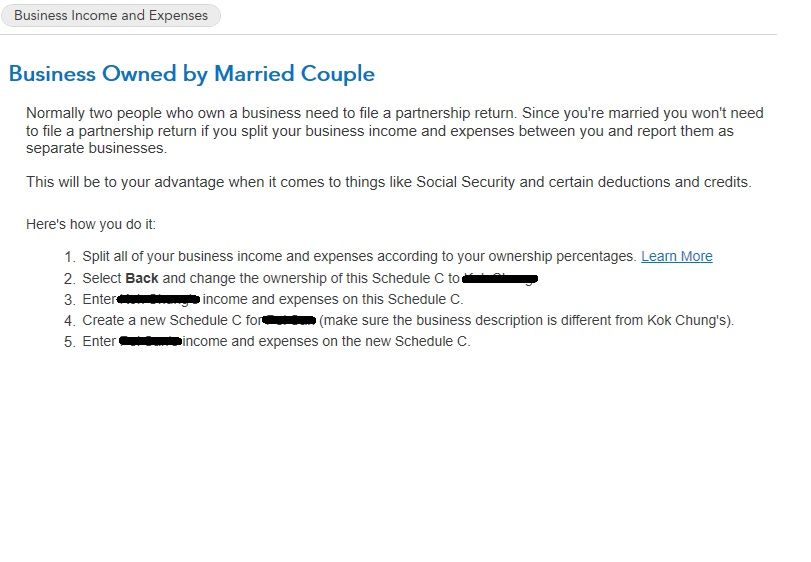

I screenshot below as to the advice coming from Turbo Tax.

I am happy to do it this way too, just isn't sure if I'm fine since i am in a non community property state.

Turbo Tax should know I'm filing from a non-community property state too, so i hope this method checks out fine, hoping to click on that e-file now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband-Wife LLC part of married joint filing

You must file a Form 1065. You may not file the Schedule C to report your income.

The screen shot above is describing a qualified joint venture.

A qualified joint venture is a joint venture that conducts a trade or business where (1) the only members of the joint venture are a married couple who file a joint return, (2) both spouses materially participate in the trade or business, and (3) both spouses elect not to be treated as a partnership.

An LLC does not qualify as a QJV unless it is in a community property state.

A qualified joint venture, for purposes of this provision, includes only businesses that are owned and operated by spouses as co-owners, and not in the name of a state law entity (including a limited partnership or limited liability company.

Spouses as Joint Venture LLC Owners.

However, if the joint venture is incorporated as a legal entity -- such as an LLC -- under state law, the IRS qualification is not allowed and the venture is treated as a partnership unless the married joint venture owners live in a community property state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband-Wife LLC part of married joint filing

So I guess it looks like you have to delete the schedule Cs from your return. You need to file the 1065 business return either using Turbo Tax Business or somewhere else. The 1065 will prepare the K-1s that you enter into your personal return. You can't file your personal return until you file the 1065 and get the K-1. You can enter the K-1 you receive into the Home & Business version. Actually into any desktop program. All the Desktop programs have the same forms even schedule C. So you could have bought a lower version like Deluxe.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband-Wife LLC part of married joint filing

Thanks Colleen,

So apparently filing for Form 1065 is not included as part of Turbo Tax Home & Business.

What options do I have, can I file Form 1065 first (to invoke the K-1s) and then still file my married joint filing thru Turbo Tax with those K-1s?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband-Wife LLC part of married joint filing

Sorry Home & Business version is for personal returns that need Schedule C.

Since you have a Windows computer you can buy the separate Turbo Tax Business. Turbo Tax Business is not available to do online or on a Mac. You can buy the Window's (Win 8 or newer) version here. And you can have both TT Business and TT Home & Business (or any personal version) installed on your computer at the same time.

https://turbotax.intuit.com/small-business-taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband-Wife LLC part of married joint filing

Thanks Volvo Girl.

I think I will withdraw myself as a member of the LLc and let my wife then be a single member LLc.

That should allow filling under Home & Business and doesn't require 1065 anymore, right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband-Wife LLC part of married joint filing

Bumping up this thread again.

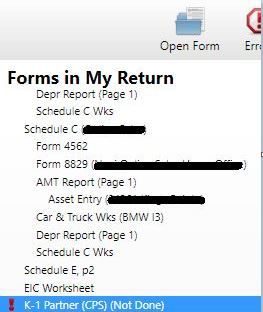

As I will file 1065 separately, K-1 forms are available within the Home & Business Version.

Appreciate some guidance please as to how I could achieve

1) Remove the Schedule C's for the LLC and replace with the 2 K-1s

2) Attach the 2 K-1s

All that and still reflect the business revenue and loss, ultimately e-file this from the Home & Business version.

Screenshots below show me navigating the Forms and find the K-1 and then have them added to deck.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband-Wife LLC part of married joint filing

@wongkcus wrote:

Thanks Volvo Girl.

I think I will withdraw myself as a member of the LLc and let my wife then be a single member LLc.

That should allow filling under Home & Business and doesn't require 1065 anymore, right?

Don't make a bigger mess of things. Get an attorney's help.

You made an LLC, you are stuck with the legal and tax consequences until you change it. If you were a member of the LLC in 2020, the LLC must file a form 1065. If you withdraw in 2021, that might relieve you of filing form 1065 for 2021, but what then? Will you be an employee of the LLC? That has implications you need to know about. Will you be a subcontractor? Will you simply participate but hide your participation and not report any income? (That's a terrible idea for several reasons.). Changing the ownership of the LLC also has tax consequences. Some of it is paperwork -- the LLC needs a new EIN if it changes owners. Some may be of more consequence--is the other member (your spouse) going to buy you out? Are you giving them your equity? Do you know what effect that will have if you later sell the business?

Don't wreck your financial life because you don't want to spend an extra $200 for a tax program. You can also file a form 7004 to request an extension of the deadline to file the 1065.

https://www.irs.gov/forms-pubs/about-form-7004

You may want to take your entire situation to a tax professional this year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband-Wife LLC part of married joint filing

@wongkcus wrote:

Bumping up this thread again.

As I will file 1065 separately, K-1 forms are available within the Home & Business Version.

Appreciate some guidance please as to how I could achieve

1) Remove the Schedule C's for the LLC and replace with the 2 K-1s

2) Attach the 2 K-1s

All that and still reflect the business revenue and loss, ultimately e-file this from the Home & Business version.

You must first prepare the K-1 using Turbotax Business as part of preparing and filing the 1065.

If you are filing a 1065 for the LLC, you need to remove both schedule Cs from your personal return. Then, you can add the K-1 statements just like you would add other income statements like a 1099-B for investments.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband-Wife LLC part of married joint filing

Thanks.

I am going to file 1065 as is required. Along with the two K-1s.

In that filing i will check it as a final return as I'm withdrawing ownership to the LLC.

After withdrawal, i am no longer participating in the LLC or its activities.

Does want to know though how can i proceed with filing with the Home & Business TT software, whether i have to include the K-1s (for the last time even) as part of 2020 married join file?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband-Wife LLC part of married joint filing

@wongkcus wrote:

Thanks.

I am going to file 1065 as is required. Along with the two K-1s.

In that filing i will check it as a final return as I'm withdrawing ownership to the LLC.

After withdrawal, i am no longer participating in the LLC or its activities.

Does want to know though how can i proceed with filing with the Home & Business TT software, whether i have to include the K-1s (for the last time even) as part of 2020 married join file?

You don't pay any business tax on the 1065. That form lists all the business income and expenses for IRS information and then reports each partner's share of the income and expenses on a K-1. The partners must report the K-1 on their tax return in order to report the income and pay the tax. You and your spouse will each list your K-1 separately on your personal tax return (form 1040) which you can prepare with Turbotax.

Using the desktop program installed on your own computer, any version Deluxe or higher will support the K-1s. In Turbotax Online, you need Premier or Self-employed to report the K-1s.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband-Wife LLC part of married joint filing

Thanks!

Yes that's what I am inquiring about.

Currently I have the Home & Business.

How do I 'call' for the K-1s? when following the 'dialogue' or walkthru manner, it only would give the option to have separate Schedule C which isn't what I want.

-or-

Upon filing the Form 1065, K-1s are actually generated by the IRS.

After which I will now include them (or that information) to part of my married joint filing return?

I guess ultimately I am asking about the Turbo Tax Home & Business, how is it that I really include those two K-1 to our filing.

Best regards

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband-Wife LLC part of married joint filing

No. Neither of that. You need to prepare a separate 1065 Business return. That will generate the K-1s you need to manually enter into your personal return. You do not do Schedule C. So in your Home & Business version skip the Business tab. That is only for Schedule C.

TO DO THE 1065

You need Turbo Tax BUSINESS (not Home & Business). Are you on Windows?

Turbo Tax Business is not available to do online or on a Mac. You can buy the Window's version here. And you can have both TT Business and TT Home & Business (or any personal version) installed on your computer at the same time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband-Wife LLC part of married joint filing

Then To enter a K-1 in the Home & Business version go to

Personal

Personal Income

Choose I'll choose what I work on

Then scroll way down to Business Investment and Estate/Trust Income

Schedule K-1 - Click the Start or Update button

Be sure to pick the right kind of K-1. There are 3 kinds, 1041, 1065 & 1120S

Enter each K-1 Separately.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

colehabbels

New Member

elliottulik

New Member

tigerxducky

New Member

julianknndy87

New Member

ajm2281

Returning Member