- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Husband-Wife LLC part of married joint filing

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband-Wife LLC part of married joint filing

@wongkcus wrote:

Thanks!

Yes that's what I am inquiring about.

Currently I have the Home & Business.

How do I 'call' for the K-1s? when following the 'dialogue' or walkthru manner, it only would give the option to have separate Schedule C which isn't what I want.

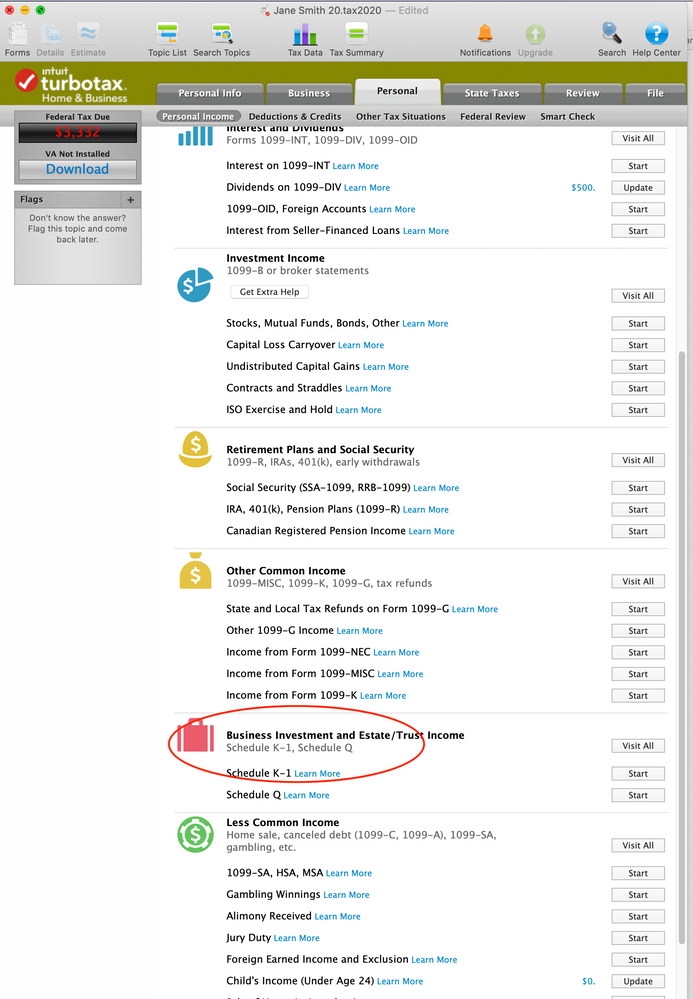

Its not in the "Business" section, it's under Personal income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband-Wife LLC part of married joint filing

I think I'm progressing with filing final return for 1065.

As partnership or form 1065 does not allow home office deduction, and also does not allow partner's vehicle reimbursement, I have read that my way to do this on the married join filing as part of Schedule E.

So if I am filing in the Home & business, on top of K-1 i would then file Schedule E for both of us to recognize the costs of home office and car mileage used for our business activities, is this correct?

Best regards

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

3cb788b21812

New Member

schnelle

New Member

tanyahudson5158

New Member

dh_wi-hotmail-co

New Member

dp3_nm

New Member