- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- HSA - HR mistake, not putting money in

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA - HR mistake, not putting money in

I contribute every year into HSA (family maximum). Last year 2021 my works HR put their contribution in ($800) but did not pull out my portion out of my paychecks. Not sure why. I tried to contact them to find out more but haven’t heard back yet.

I know there is a form I can fill out and send money into my HSA account now for last year but would that be smart?

The money I would send in is not pre taxed anymore.

Will it lower my taxable income?

I never spend any money from the HSA and use it only to invest the money sitting in there.

Any input will be highly appreciated since searching for this issue is not successful since this situation don’t happen a lot.

Thank you 🙂

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA - HR mistake, not putting money in

Yes, you can and should contribute to your HSA if you meet the qualifications (see below). You can enter as much as you like (maximum $14,000 for a family plan) and deduct it on your tax return.

To be an eligible individual and qualify for an HSA contribution, you must meet the following requirements.

- • You are covered under a high deductible health plan (HDHP), described later, on the first day of the month.

- • You have no other health coverage except what is permitted under Other health coverage, later.

- • You aren’t enrolled in Medicare.

- • You can’t be claimed as a dependent on someone else’s 2021 tax return.

An HSA may receive contributions from an eligible individual or any other person, including an employer or a family member, on behalf of an eligible individual. Contributions, other than employer contributions, are deductible on the eligible individual’s return whether or not the individual itemizes deductions. Employer contributions aren’t included in income.

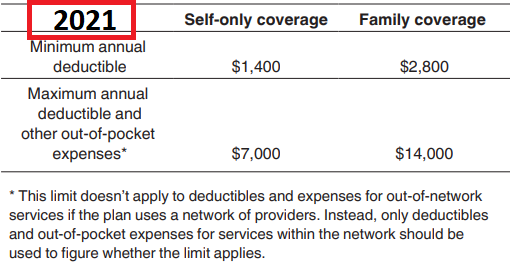

The following table shows the minimum annual deductible and maximum annual deductible and other out-of-pocket expenses for HDHPs for 2021.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA - HR mistake, not putting money in

that $14K you cite is the amount required under a HDHP to be eligible for an HSA contribution. the mac for family is $7200, each spouse can contribute and additional $1000 to their HSA if over 55 and qualified

-

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA - HR mistake, not putting money in

you need to talk to your company. they may put in the 2021 money and report it on your w-2c as a 2021 contribution so if you contribute personally, for 2021, you'll have an over contribution.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

seewise-media

New Member

mason-jennifer-a

New Member

aj-sanchez111

New Member

cosentinogabe

New Member

jeyhanturker

New Member