- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Yes, you can and should contribute to your HSA if you meet the qualifications (see below). You can enter as much as you like (maximum $14,000 for a family plan) and deduct it on your tax return.

To be an eligible individual and qualify for an HSA contribution, you must meet the following requirements.

- • You are covered under a high deductible health plan (HDHP), described later, on the first day of the month.

- • You have no other health coverage except what is permitted under Other health coverage, later.

- • You aren’t enrolled in Medicare.

- • You can’t be claimed as a dependent on someone else’s 2021 tax return.

An HSA may receive contributions from an eligible individual or any other person, including an employer or a family member, on behalf of an eligible individual. Contributions, other than employer contributions, are deductible on the eligible individual’s return whether or not the individual itemizes deductions. Employer contributions aren’t included in income.

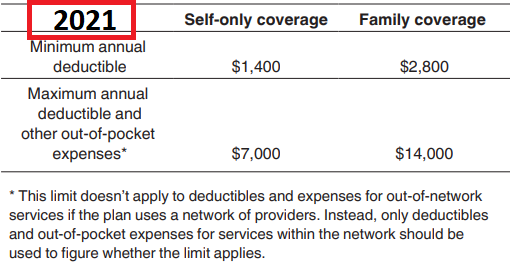

The following table shows the minimum annual deductible and maximum annual deductible and other out-of-pocket expenses for HDHPs for 2021.

**Mark the post that answers your question by clicking on "Mark as Best Answer"