- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- HSA contributions won't let me continue

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA contributions won't let me continue

I am trying to file my taxes for this year. I have been employed since february and my job allows me to have my own HDHP with an HSA. However I am still a student, I'm 21, live at home and have everything else of my living expenses paid for by my parents. So I still claim to be a dependent. I try to report my HSA contributions from my employer but cannot proceed with filing because I claim to be on a self-only plan. I was under my parents plan until March when I had my own. However Turbo-Tax doesn't allow me to select any option under my HSA for the months march-dec 2023. How do I progress past this despite having an HSA and being a dependent.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA contributions won't let me continue

1. Were you capable of being claimed as a dependent for all year (you don't do dependent month by month)? If so, you are not eligible to make any contributions to your HSA at any point during the year.

2. When you are not under HDHP coverage with no conflicting elements, like Medicare, or other employer insurance, or being a dependent, then you enter Self or Family (depending on what HDHP you have), and NONE in every other case (except when you have Medicare).

3. Since you can be claimed as a dependent for the year (whether or not you actually are), when you see the question, "Was [name] covered by a High Deductible Health Plan (HDHP) in 2023?", answer "No, I did not have coverage." The fact that you had an HSA is irrelevant, as well as the fact that you had HDHP coverage.

4. If you say "No, I did not have coverage", you won't be asked for month by month coverage.

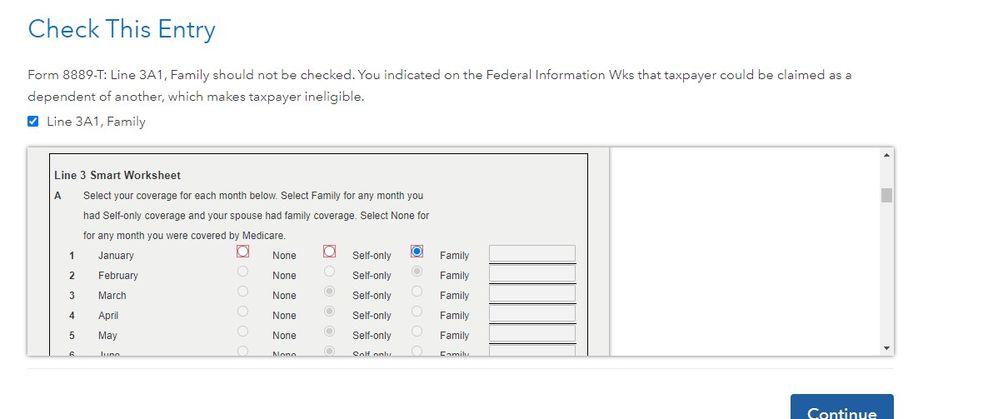

5. The only catch will be that during the Federal Review, TurboTax will get confused on why you are in the form 8889 when you don't have any HDHP coverage. The Review then asks you what entry do you want to put on line 1: Self or Family?

6. Since you have already said that you had no coverage, entering Self won't hurt anything, but it will get you past this Review question.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA contributions won't let me continue

Hi. I’m in the same situation as original poster. I’m being claimed as a dependent by my parents because I was a student. Started a job in June and enrolled in a HDHP and HSA. When trying to complete taxes I’m stuck in the loop of saying No to having a HDHP and then needing to say Yes to the Self Only for the months I was enrolled then getting the error message that I can’t have a HSA because I’m claimed as a dependent. How do I get out of the loop? My parents have already filed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA contributions won't let me continue

As you see, a dependent can't make contributions to an HSA.

I am not sure at what point you are getting stuck in a loop.

When you are in the HSA interview, tell TurboTax that you did NOT have HDHP coverage. This should simplify things for you. TurboTax will declare that all of your contributions are in excess, and if all of your contributions were on the code W in box 12 on your W-2, then this will be the excess amount

This excess will be added back automatically to Other Income (which is correct, since the contributions were removed from Wages in boxes 1, 3 and 5 when your W-2 was created.

If you can, you should agree to withdraw the entire excess. Otherwise any excess that is not withdrawn will be carried over to next year and charged a 6% penalty. If, next year you have HDHP coverage and are no longer a dependent, then TurboTax will try to use this carryover as a personal contribution on line 2 on the 8889. So don't try to contribute the max amount in 2025, because you have to allow for this carryover (if you do the carryover).

You will continue although the way through the HSA interview until the HSA Summary.

In the federal Review, you will likely hit a question that TurboTax demands that you answer Self or Family. TurboTax does this because it is confused - why do you have an HSA if you don't have HDHP covered. Not to worry, just enter Self. You have already said that you didn't have HDHP coverage, so the numbers on the 8889 will be correct. Entering Self is just a workaround.

If you have any more difficulties, come on back here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

CluelessCamper

Level 1

fpho16

New Member

masvelez19

New Member

EKrish

Level 2

crossmack36

New Member