- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How to Upgrade Edition on Windows Desktop Install?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Upgrade Edition on Windows Desktop Install?

I purchased the Home and Business edition from Costco and I've found I actually need the Premier edition. However I cannot find any option within the application to upgrade; there is no option at the top or bottom of my screen (as other search results suggest) nor is there anything within help menus, including after opening my return. How do I go about upgrading my edition?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Upgrade Edition on Windows Desktop Install?

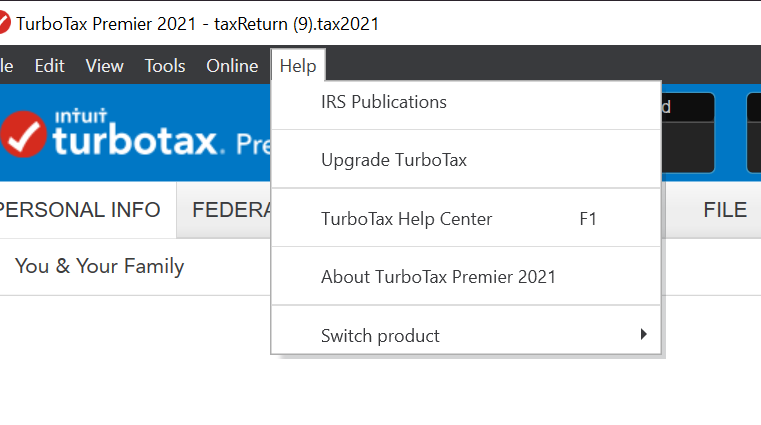

It is actually located under the Help topic at the top of your screen in TurboTax. Please see the below image for reference.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Upgrade Edition on Windows Desktop Install?

Thanks Michelle for the reply. Unfortunately that option doesn't appear for me:

Here's my version information:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Upgrade Edition on Windows Desktop Install?

Click on 'Switch Product' in the Help menu.

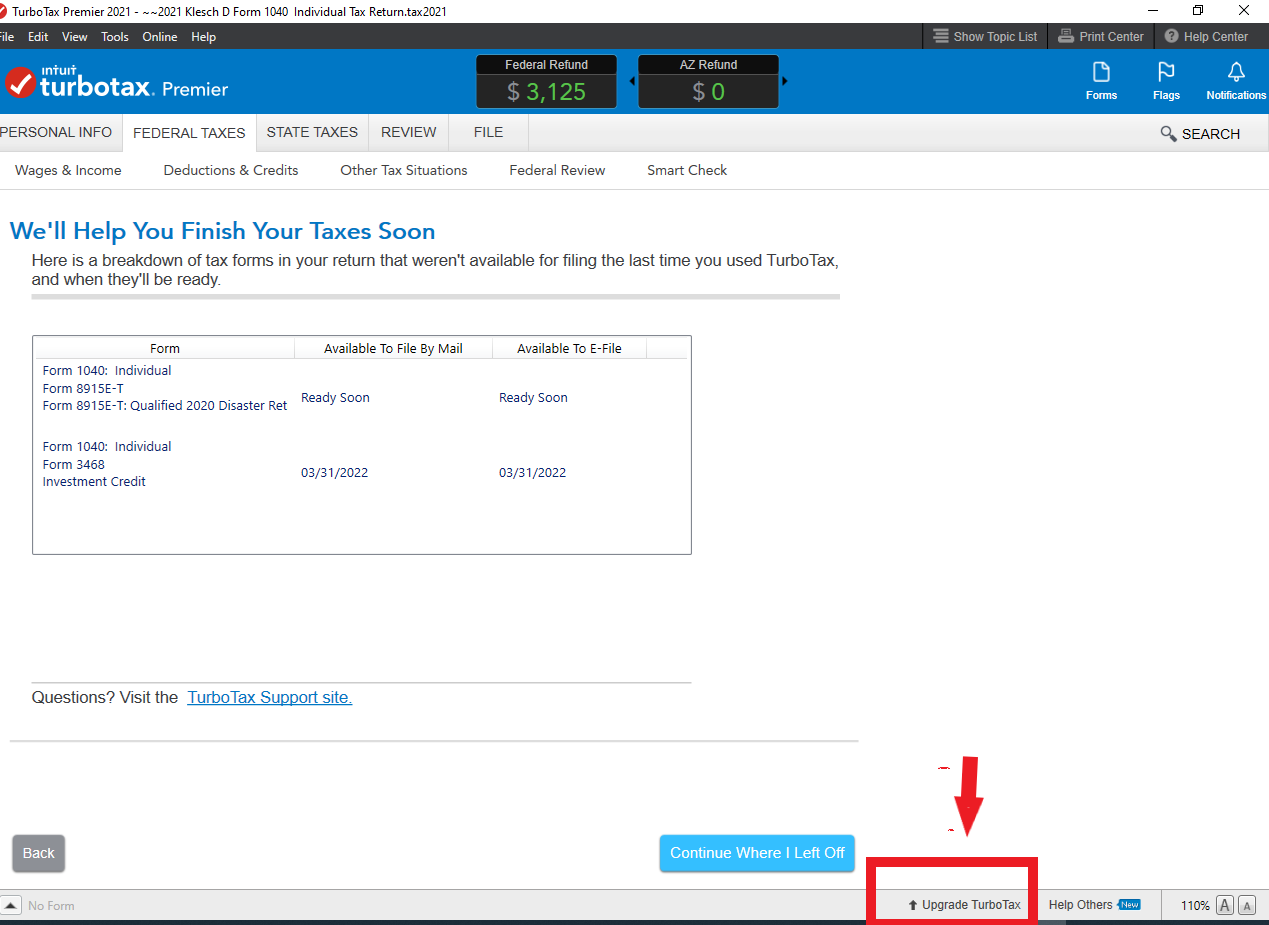

OR, click on 'Upgrade TurboTax' at the bottom of the screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Upgrade Edition on Windows Desktop Install?

"Switch Product" prompts me to enter a new license key and mentions nothing about upgrading. There is no "upgrade" button at the bottom of my screen, even after I've opened my return I'm working on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Upgrade Edition on Windows Desktop Install?

Home and Business is the highest version you can buy. To switch to Premier would be a downgrade to a lower version. You don't need to downgrade if you wanted Premier.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Upgrade Edition on Windows Desktop Install?

Then why is it that I have no options to import cryptocurrency sales as you can in the Premier version? There are instructions to do so I've found in a number of TurboTax documents but they all point to options not present in the Home and Business edition. As far as I can find the only option I have is to manually enter all of the transactions as if I received a 1099-B, which I did not. I'd much rather import a CSV of my transactions as provided by Coinbase.

Based on those missing features I have to think this isn't the best edition I can purchase.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Upgrade Edition on Windows Desktop Install?

If you are able to convert your .csv file to a .txt file, it may be uploaded to TurboTax Desktop Home and Business version or TurboTax Desktop Premier version.

Follow these steps.

- Create a .csv file with all transactions using the format shown at Easytxf.

- Used Easytxf to convert the .csv file into .txf file.

- Import .txf file into Turbotax Desktop: File / Import / From Accounting Software / Other Financial Software (TXF) file / Continue / Choose a File to Import / Import now.

- A 1099-B with all Crypto transactions is now created. This entry can now be edited to include the account details. Each transaction can be edited as well.

@JdeFalconr

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Upgrade Edition on Windows Desktop Install?

Thanks, so why can't I directly import the CSV from Coinbase and why can't I upgrade this edition to one that can? This seems like kind of a frustrating limitation to have to manually reconfigure a spreadsheet like this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Upgrade Edition on Windows Desktop Install?

I'm a bit concerned about mapping the fields in the CSV Coinbase gave me to the fields required by that EasyTXF website. Can you please help there? The fields in the Coinbase file and an example line of data:

| Transaction Type | Transaction ID | Tax lot ID | Asset name | Amount | Date Acquired | Cost basis (USD) | Date of Disposition | Proceeds (USD) | Gains (Losses) (USD) | Holding period (Days) | Data source |

| Sell | 000aaaaa-1111-222A-0A00-000000AAAAAA | 000aaaaa-1111-222A-0A00-000000AAAAAA | BTC | 1.12345678 | 6/1/2021 | 5 | 7/15/2021 | 4.123456 | 0.123456 | 45 | Coinbase |

And the fields required by EasyTXF:

| Symbol | Quantity | Opening Date | Opening Net Amount | Closing Date | Closing Net Amount |

Can you tell me if I'm correct with these mappings:

- Symbol = Asset Name

- Quantity = Amount

- Opening Date = Date Acquired

- Opening Net Amount = Cost Basis

- Closing Date = Date of Disposition

- Closing Net Amount = Gains (Losses) (USD)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Upgrade Edition on Windows Desktop Install?

If you can't import the txf or csv file into the Desktop program there might be another way.

You can only import crypto into the Online version. For Desktop program you can start a free Premier online return to import it then switch and open your return in the Desktop program. See the last answer by Expert Patricia here,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Upgrade Edition on Windows Desktop Install?

And since All the Desktop programs have the same forms it doesn't matter what version you have. You have Home & Business. It is the highest version and has everything that Premier has.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Upgrade Edition on Windows Desktop Install?

It has everything except the Cryptocurrency options, unfortunately. But thank you very much, I think your idea to start online, complete the crypto portions and then export the file to finish in my desktop software will probably be the best route. I'll give it a shot. The only downside is that I'll lose all of the work I already put in on the desktop version; I was 90% done there. Oh well.

Thanks again for the advice!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Upgrade Edition on Windows Desktop Install?

Just wanted to come back and say this worked like a charm, thanks again. If I'd only known about this to start I wouldn't have wasted time last weekend starting a return I had to abandon. As there's no way to merge two returns I just re-entered everything.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Upgrade Edition on Windows Desktop Install?

Great! I'm glad you knew how to do that and download the online file etc. Or I could have posted the steps. Sorry you had to start over, but that's the only way.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lasersail12

Level 2

3564428

New Member

Bailey7557

Level 2

Wulin

New Member

lw15

Level 3