- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How to file taxes with 1042-S (income code 20, resident alien)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file taxes with 1042-S (income code 20, resident alien)

Hi, I'm a Korean F1 student with no W2 and only 1042-S working at my school. The income code is 20 and exemption code is 3a-04, 4a-16.

Due to US tax treaty with Korea and my income being under $2000, I have no income tax withheld. How should I report this and are there any other forms I need to fill out? Please be as detailed as possible because I have no idea what I'm doing. Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file taxes with 1042-S (income code 20, resident alien)

Per instructions, for income code 20, it refers to Compensation during studying and training, you will enter as follows :

- After sign in / select Take me to my return /From the top, select tab Federal Taxes /Wages and Income / Scroll down to Less Common Income section. Choose Miscellaneous Income. Select the very first option at the top "Other income not already reported on a Form W-2 or Form 1099". Then follow the prompts.

- If you qualify for the treaty benefit, follow the above steps and enter the negative amount of $2,000.

- Download and fill in a Form 8833 or 8843 from IRS to claim an exception. https://www.irs.gov/pub/irs-pdf/f8833.pdf or https://www.irs.gov/pub/irs-pdf/f8843.pdf

- You cannot e-file. You can still use the TurboTax program to prepare your tax forms, but you need to print them out and submit by mail along with the form 8833.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file taxes with 1042-S (income code 20, resident alien)

Hi, I'm a little confused when you said "the negative amount of $2,000". If I earned $663 from the school with the tax treaty exemption, does it mean that I should type -$1,337 when claiming it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file taxes with 1042-S (income code 20, resident alien)

@wx1997 Report your income of $663 in the 'Other Income' section, then make a second entry of -$663, with the description of 'Tax Treaty Income'.

This gives a net effect of $0 income.

Click this link for more info on Tax Treaty Income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file taxes with 1042-S (income code 20, resident alien)

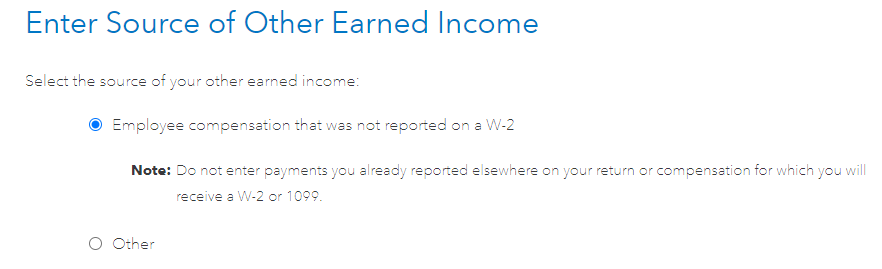

Thank you so much for the information, this is really helpful. One further question: should I report through employee compensation that was not reported on a W-2 or the other option? If I go with the first option, seems like there is no place for me to type the description.

My current report routine is :

1. less common income.

2. Miscellaneous Income, 1099-A, 1099-C

3. Other income not already reported on a Form W-2 or Form 1099 (not sure about this also, should I go with the last option: other reportable income?)

Since I already had a 1042-S form, I don't think it's necessary for me to file the SS-8 form so I'm a bit confused about this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file taxes with 1042-S (income code 20, resident alien)

Must you have Deluxe to be able to file with 1042-S?

I too am a resident alien for tax purposes with no W-2, only 1042-S, and with code 20.

When I go to "Less Common Income-Miscellaneous Income", it tells me that I should purchase Deluxe to keep filing...

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file taxes with 1042-S (income code 20, resident alien)

The 1042-S is for Foreign Person's with U.S. Source Income Subject to Withholding

If you haven't been in the US more than 5 years, you need to file a non resident return.

Although TurboTax doesn't support IRS Form 1040-NR (U.S. Nonresident Alien Income Tax Return), we have partnered with Sprintax to offer both federal and state tax preparation for international students, scholars, and nonresident foreign professionals.

Please visit the TurboTax/Sprintax site for more info.

If you have been in the US for five years or more, You will need to enter the income in the self-employment section of TurboTax.

You will need TurboTax Self-Employed you will post this under:

- Income & Expenses

- Self-Employment Income & Expenses

- If you've already started entering the business you will select REVIEW

- Select Add income for this work

- Under Common Income

- Select Form 1099-NEC

You may need to upgrade to include this income

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file taxes with 1042-S (income code 20, resident alien)

Thank you for the reply.

I am have been in the states for more than five years. I have worked the same part-time job for about three years now and have filed with Turbo Tax free successfuly in the first two years.

Given my situation, is there an alternative that I could file for free? The income from this part-time job is very minimal and the cost of either TurboTax Deluxe or TurboTax Self-Employed will be comparable to whatever tax refund I am hoping to receive.

Is there an alternative that I can file for free with Turbo Tax? I have read elsewhere of people in a similiar situation with me filing with the IRS Free File Program delivered by TurboTax? If that works, should I file as self-employed with my 1042-S even though I am employed and paid by the University?

Thank you for your time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file taxes with 1042-S (income code 20, resident alien)

Yes, you can use either the TurboTax Free or the IRS Free File program. You are not self employed with the Form 1042-S.

You would enter under "Other Income". See my post from above.

This amount will show on line 8 of Schedule 1 and Form 1040.

@ruhtra86

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

test5831

Returning Member

aashish98432

Returning Member

Katie1996

Level 2

IndependentContractor

New Member

Danielvaneker93

New Member