- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

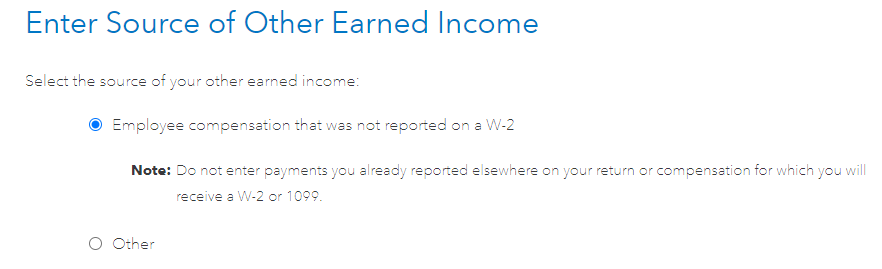

Thank you so much for the information, this is really helpful. One further question: should I report through employee compensation that was not reported on a W-2 or the other option? If I go with the first option, seems like there is no place for me to type the description.

My current report routine is :

1. less common income.

2. Miscellaneous Income, 1099-A, 1099-C

3. Other income not already reported on a Form W-2 or Form 1099 (not sure about this also, should I go with the last option: other reportable income?)

Since I already had a 1042-S form, I don't think it's necessary for me to file the SS-8 form so I'm a bit confused about this.

March 23, 2021

2:26 PM