- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How to file state taxes? Income generated in one state, lived in another

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file state taxes? Income generated in one state, lived in another

I lived in AR for the entirety of 2022. I was paid in IL and all taxes withheld for 2022 went to IL. How do I file my state taxes? My current approach is file a non-resident IL return, and an AR resident return. How should I get credit for the IL taxes already withheld on my AR return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file state taxes? Income generated in one state, lived in another

Apologies, I didn't see the entire thread.

This situation happens when the nonresident state has a higher tax rate than the resident state. Your resident state will give you a credit up to the amount of tax that you would have had to pay on that income in that state. If you're paying a higher tax rate to the nonresident state, the credit that you would get in your resident state would be less than the tax paid to the nonresident state, as you're seeing in your case.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file state taxes? Income generated in one state, lived in another

You are correct that you will file a resident tax return for the state of Arizona and non-resident tax return for Illinois, but you will not be taxed on the same income in both states.

It is important that you complete your tax returns in the correct order to ensure that the state taxes paid credit will be calculated correctly.

1) Prepare your federal tax return and have it pass an error check

2) Prepare your nonresident state (Illinois) next

3) Lastly, prepare your resident state (Arizona).

For additional information, please review the TurboTax article Multiple States—Figuring What's Owed When You Live and Work in More Than One State.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file state taxes? Income generated in one state, lived in another

Thank you! Can I reset the state entries and start over? Also on the Ark state return, on which screen do I enter that I need the credit from the IL taxe?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file state taxes? Income generated in one state, lived in another

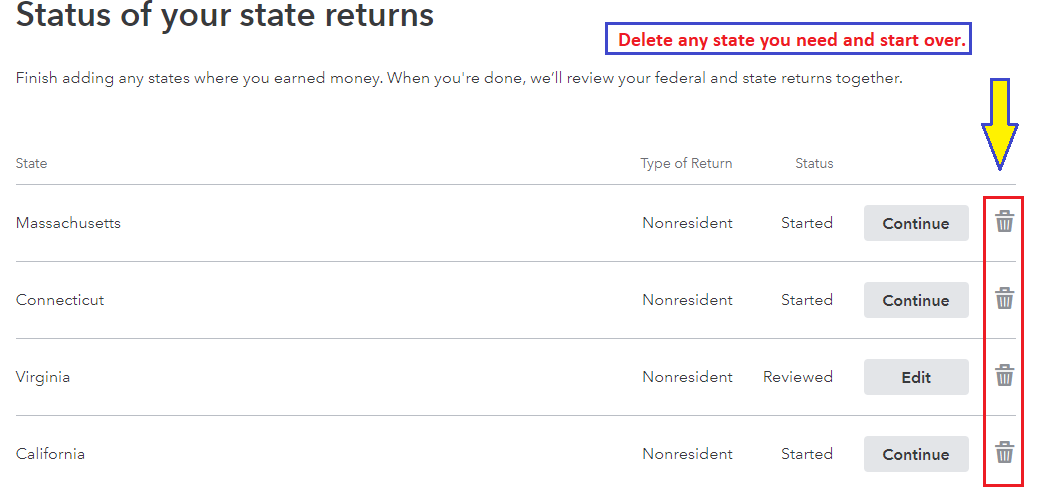

Yes. Under your "State Taxes" you can click the little trash can icon next to your state to delete it. See the image below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file state taxes? Income generated in one state, lived in another

Thank you. On my W2, there are two state filing copies. One for IL, the other for AR. State income tax was withheld for IL during the year, and none was withheld for AR, but income was reported.

How do I now handle this in TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file state taxes? Income generated in one state, lived in another

In TurboTax you will enter all W-2s. TurboTax will capture all information and appropriately transfer needed information to each state as required. Prepare the Federal return first with all of your 2022 tax information. TurboTax will prompt you when it is time to prepare states

As mentioned before to avoid double taxation, it is important to prepare your IL return Non-resident return first. Once that is done, then add the AZ return. AZ return will credit you with taxes paid to IL. TurboTax will do all of the necessary calculations based on the W-2s entered.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file state taxes? Income generated in one state, lived in another

OK I completed them in that order. One observation that I need help with:

On the AR return, when looking at the printed filing records, and namely the "File by Mail Instructions page" I see something odd.

Total tax is $5,000

Total Payments/Credits: $5,512

No refund of Amount Due: $0

If the credit that I applied to my AR tax return (from IL) is higher than my tax obligation for AR, why is the refund $0?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file state taxes? Income generated in one state, lived in another

You get a credit for taxes paid to the other state, but it won't reduce your tax below $0. If that were the case, the resident state would be refunding you taxes paid to another state, which would not make sense to the resident state.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file state taxes? Income generated in one state, lived in another

I follow that, but the issue then is the overpayment of $512. I had to pay IL $123, why is that when AR only credited $5000

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file state taxes? Income generated in one state, lived in another

You may end up with a refund in one state that you owe to another state. This thread is from 2023, are you referencing your 2022 return or your current 2024 with your new post?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file state taxes? Income generated in one state, lived in another

Yes it is for this year, 2024 filings

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file state taxes? Income generated in one state, lived in another

Usually, you will need to file a nonresident tax return for the state where you worked and a resident tax return for the state where you lived.

Make sure you complete your nonresident return first.

When you complete your resident return, you will get a credit for the tax that you paid to the nonresident state.

The exception is that your resident state may have a tax reciprocity agreement with the nonresident state. If that's the case, you won't need to file a return in the nonresident state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file state taxes? Income generated in one state, lived in another

Did all of that in the exact order you mentioned. AR did credit the amount I paid to IL. However, there the difference that is basically "ghost" money. IL keeps it although I did not live there, but on top of that, asking for $139 extra in taxes. That is the part I am not sure about

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file state taxes? Income generated in one state, lived in another

Apologies, I didn't see the entire thread.

This situation happens when the nonresident state has a higher tax rate than the resident state. Your resident state will give you a credit up to the amount of tax that you would have had to pay on that income in that state. If you're paying a higher tax rate to the nonresident state, the credit that you would get in your resident state would be less than the tax paid to the nonresident state, as you're seeing in your case.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

abarmot

Level 1

Katie1996

Level 1

AS70

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

rgrahovec55

New Member

dpa500

Level 2