- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How to enter rental expenses for part of my house properly in Premier (online version)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter rental expenses for part of my house properly in Premier (online version)

I started renting out a part (~1/3) of my house this year, and I chose TurboTax Premier because I know this option can handle rentals. However, I've run into two problems.

1) It is not clear if I should enter 100% of my home expenses (e.g $99 for utilities) under the rental expenses or 1/3 of my home expenses (e.g., $33 for utilities) - as that would be the amount used by the rented section of my house. I don't see any instructions - and it never asks me what percentage of my house is being rented. However, I can tell that it is doing some sort of calculation (maybe based on the number of days rented?) to the number that I'm entering (currently 100% of my home expenses). What is the correct thing to do in the Premier version?

2) For the rental expenses, there seems to be a glitch in the software. If I enter in "mortgage interest" - the data I've entered for other categories - e.g., utilities, supplies, etc., disappear from the summary page and it tells me "not started". Similarly, if I take out the value for "mortgage interest" - I can now enter all the other types of expenses. What is going on - is there a reason for this, or is a problem with the software?

Thank you so much for your help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter rental expenses for part of my house properly in Premier (online version)

To enter percentage usage of rental, here are the steps:

In TurboTax online,

- Sign in to your account and select Pick up where you left off

- At the right upper corner, in the search box, type in schedule e and Enter

- Select Jump to schedule e

- Follow prompts

- On screen, "Tell us about your situation this year", select Rented part of your home

- Follow prompts

- On screen,' Since you rented part of your home, would you like us divide your expenses?", select Yes, I will enter total amounts and let TT do the math

- Enter Area of home rented %

- See image below

After you complete entering information in the rental section, your expenses will be calculated based on your percentage. It will show on your Schedule E under Expenses. As far as mortgage interest, you will enter the total amount under Mortgage Interest in the Rental section. The program will allocate it between rental and personal based on your percentage. To enter mortgage interest, follow the steps from above and continue to follow prompts until you see :

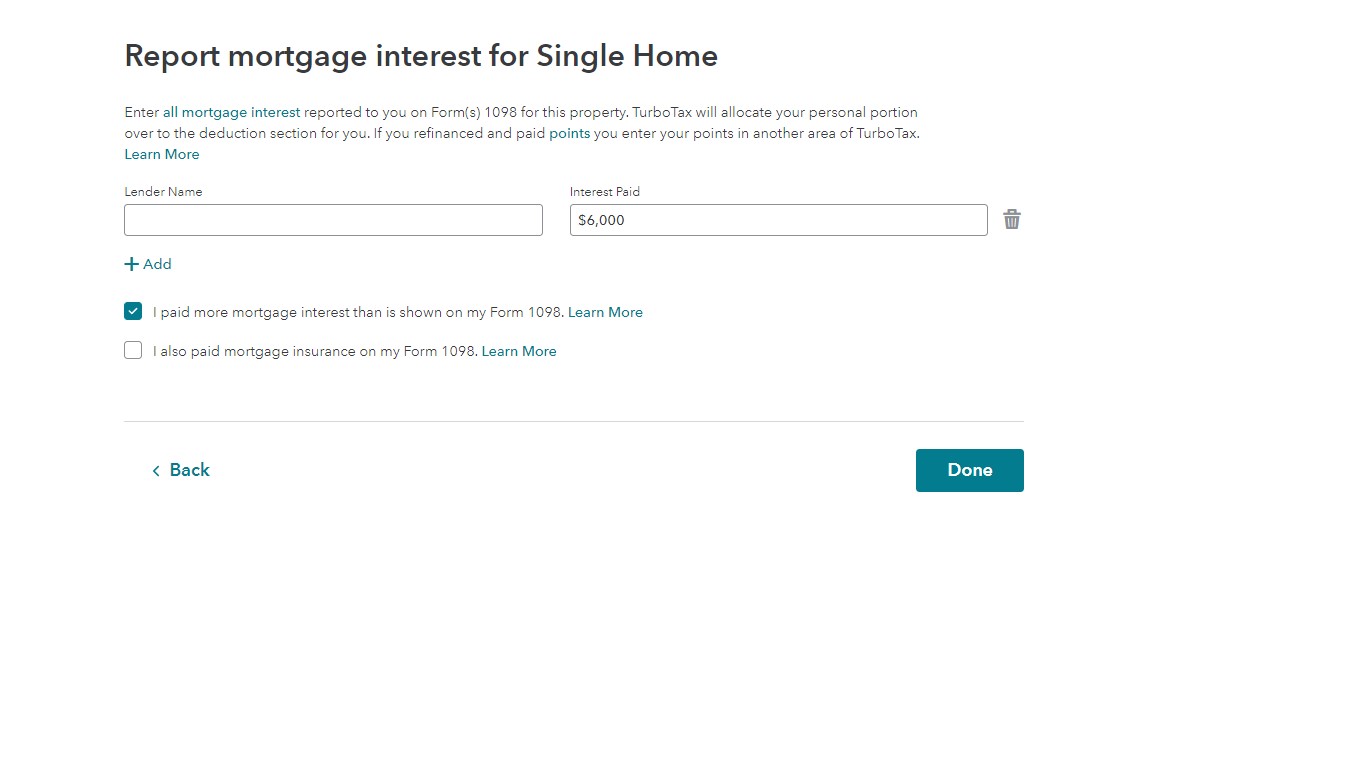

On screen, " Report mortgage interest for rental", enter amount. See image

This rental portion of your mortgage interest will show on line 12 of Schedule E. Your personal portion will be on Schedule A. Note that your mortgage interest might not change your total tax refund. It will only change if your total itemized deductions including the mortgage interest exceeds your standard deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter rental expenses for part of my house properly in Premier (online version)

Thank you so much - this was really a clear and easy to follow response. However, I added in a "new" rental and went through every prompt and never got to the page where I enter the percentage of my home that is rented. Nor could I find that page for the rental I had already entered. In any case, I moved forward to the "review" part of the program - and as part of the review - it caught that I hadn't entered a percentage of my house and asked me to add it. The prompt did not look like the page above, bur rather like a picture of the actual tax form itself. And now, all of the rental expenses are showing that they are 1/3 of the overall expense - so I believe my tax return is correct now. Strange, but I think ok in the end. Thank you again.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jeffry-jackson

New Member

fellynbal

Level 3

user26879

Level 1

jawckey

Level 4

gurtbfrobe

New Member