- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

To enter percentage usage of rental, here are the steps:

In TurboTax online,

- Sign in to your account and select Pick up where you left off

- At the right upper corner, in the search box, type in schedule e and Enter

- Select Jump to schedule e

- Follow prompts

- On screen, "Tell us about your situation this year", select Rented part of your home

- Follow prompts

- On screen,' Since you rented part of your home, would you like us divide your expenses?", select Yes, I will enter total amounts and let TT do the math

- Enter Area of home rented %

- See image below

After you complete entering information in the rental section, your expenses will be calculated based on your percentage. It will show on your Schedule E under Expenses. As far as mortgage interest, you will enter the total amount under Mortgage Interest in the Rental section. The program will allocate it between rental and personal based on your percentage. To enter mortgage interest, follow the steps from above and continue to follow prompts until you see :

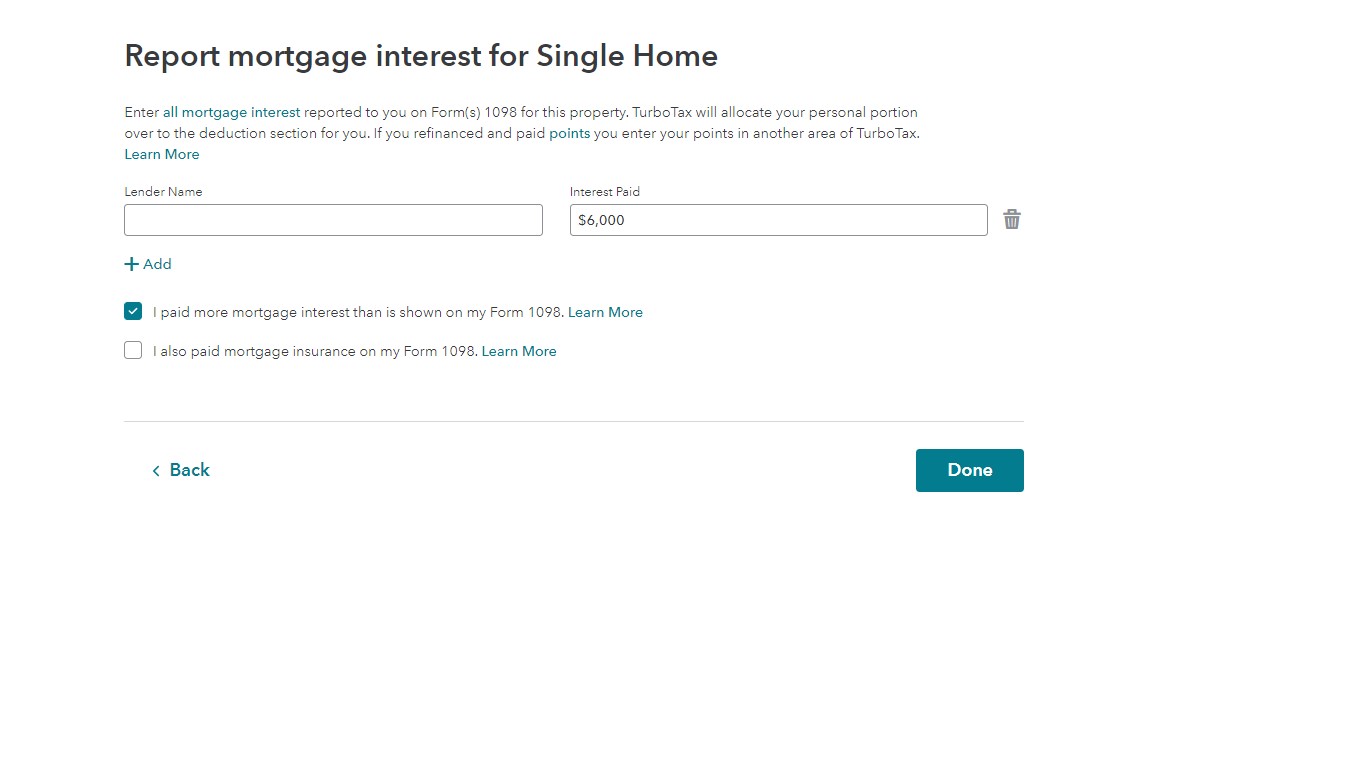

On screen, " Report mortgage interest for rental", enter amount. See image

This rental portion of your mortgage interest will show on line 12 of Schedule E. Your personal portion will be on Schedule A. Note that your mortgage interest might not change your total tax refund. It will only change if your total itemized deductions including the mortgage interest exceeds your standard deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"