If you have a disallowed wash sale the tax loss will be disallowed if you buy the same security, or a "substantially identical" security, within 30 days before or after the date you sold the loss-generating investment.

After you sell the newly purchased security the loss on the wash sale will be added to the tax basis, and a new profit or loss will be generated.

Your broker will typically keep track of any carryover Wash Sales.

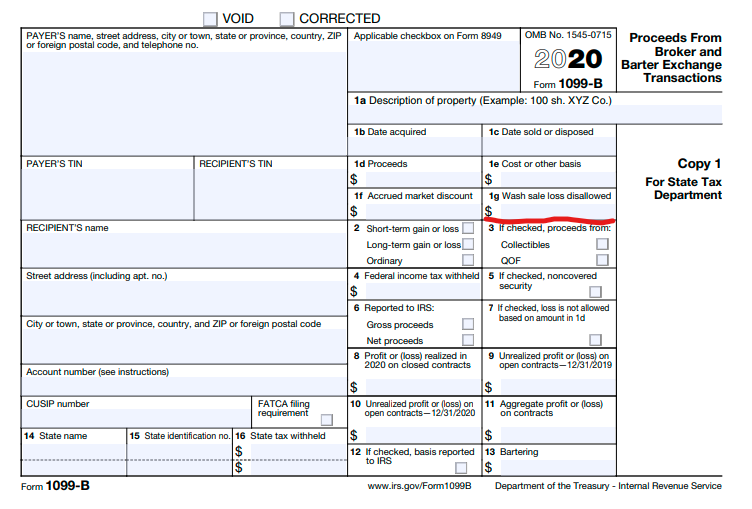

Although the form layouts are somewhat different. You can find the Wash Sale in box 1g of the 1099-B form.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"