- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I get the 1099-INT form from Bank of America?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the 1099-INT form from Bank of America?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the 1099-INT form from Bank of America?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the 1099-INT form from Bank of America?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the 1099-INT form from Bank of America?

A bank doesn't have to send a 1099-INT if the amount was less than $10, but you still have to report the interest even if below $10.

If you have online banking with BOA, you'd have to look in your account to see if you were paid any interest, and if so, whether they allow people to download a 1099-INT from a tax forms section.

Or if you don't know if you were supposed to get one, phone your BOA customer service and ask them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the 1099-INT form from Bank of America?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the 1099-INT form from Bank of America?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the 1099-INT form from Bank of America?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the 1099-INT form from Bank of America?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the 1099-INT form from Bank of America?

See above discussion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the 1099-INT form from Bank of America?

Bank of America did not mail one to me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the 1099-INT form from Bank of America?

@hornsbjm48 wrote:Bank of America did not mail one to me.

What is it you need to know? Did you review the comments in this thread? Is your situation the same or different?

Did you receive interest payments from Bank of America during 2020?

In general, if your bank interest is less than $10, then a financial institution is not required to provide you a 1099-INT. But even then you are still required to report the interest. If you received interest from Bank of America, but don't know the amount to enter, or if you think you "should" have received a 1099-INT from Bank of America but didn't, then you'll need to speak to your bank's customer service for info.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the 1099-INT form from Bank of America?

>>A bank doesn't have to send a 1099-INT if the amount was less than $10, but you still have to report the interest even if below $10.>>

How do I report less $10 in TurboTax Desktop?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the 1099-INT form from Bank of America?

@ cali wrote:>>A bank doesn't have to send a 1099-INT if the amount was less than $10, but you still have to report the interest even if below $10.>>

How do I report less $10 in TurboTax Desktop?

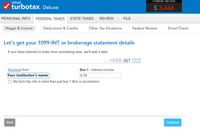

I'll provide an image below. You enter the small interest "as though" you got it on a 1099-INT even if you didn't.

- Federal Taxes tab. (or Personal tab in Home and Business)

- Subtab Wages & Income.

- Blue button: "I'll choose what I work on."

- On Your 2020 Income Summary screen, scroll down to Interest and Dividends.

- For topic "Interest on 1099-INT" click the Start or Update button.

- If asked how you want to enter it, choose "I'll type it in myself."

- Then you should get a screen like the image below.

- After entering the institution name and interest (Box 1), continue on answering any screens until you come to an Interest summary screen. Verify all is correct there, and if so, click DONE to finish that topic.

.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the 1099-INT form from Bank of America?

One 1099-INT entry for each account (e.g. checking, savings, etc.) or just sum them up for as long as they're from the same financial institution?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get the 1099-INT form from Bank of America?

@ cali wrote:One 1099-INT entry for each account (e.g. checking, savings, etc.) or just sum them up for as long as they're from the same financial institution?

As long as the Payer is the same financial institution, you can add them together.

So you have multiple accounts at the same institution, and when you add up all the interest, the total is still less than $10? If they were to add up to over $10, I'm surprised they didn't send a 1099-INT.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ashraf-yacoub6

New Member

danilol

Level 4

nicole-l-marquis

New Member

moneybelle

New Member

zzz2

Level 3