- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

@ cali wrote:>>A bank doesn't have to send a 1099-INT if the amount was less than $10, but you still have to report the interest even if below $10.>>

How do I report less $10 in TurboTax Desktop?

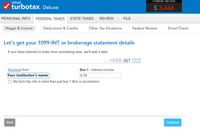

I'll provide an image below. You enter the small interest "as though" you got it on a 1099-INT even if you didn't.

- Federal Taxes tab. (or Personal tab in Home and Business)

- Subtab Wages & Income.

- Blue button: "I'll choose what I work on."

- On Your 2020 Income Summary screen, scroll down to Interest and Dividends.

- For topic "Interest on 1099-INT" click the Start or Update button.

- If asked how you want to enter it, choose "I'll type it in myself."

- Then you should get a screen like the image below.

- After entering the institution name and interest (Box 1), continue on answering any screens until you come to an Interest summary screen. Verify all is correct there, and if so, click DONE to finish that topic.

.

March 26, 2021

10:49 PM