- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I get include a “Qualified Small Business Stock” 1202 data in the 1099-B section of the Online filing version of turbo-tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get include a “Qualified Small Business Stock” 1202 data in the 1099-B section of the Online filing version of turbo-tax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get include a “Qualified Small Business Stock” 1202 data in the 1099-B section of the Online filing version of turbo-tax?

Here's how to enter a Qualified small business stock exclusion (Section 1202):

Although the below steps involve editing an existing stock sale entry, you may do well to delete the sale and start fresh.

- With your return open, search for 1099-B (upper- or lower case, with or without the dash) in your program's search box.

- Click the Jump to 1099-B link in the search results.

- On the Did you sell any investments? screen, answer Yes.

- If you land on the Summary of All Accounts screen instead, click Edit

- “If you have additional info about this sale, you can enter it on your own, or we can guide you.”, Select Guide me step-by-step (See the attached screenshot below. Click to enlarge.)

- Click My sale involves one of these uncommon situations. (See the attached screenshot below. Click to enlarge.)

- On Choose the type of investment you sold, choose "Stock" (See the attached screenshot below. Click to enlarge.)

- Review Some Basic Info About this Sale, Click Continue

- Click through several screens

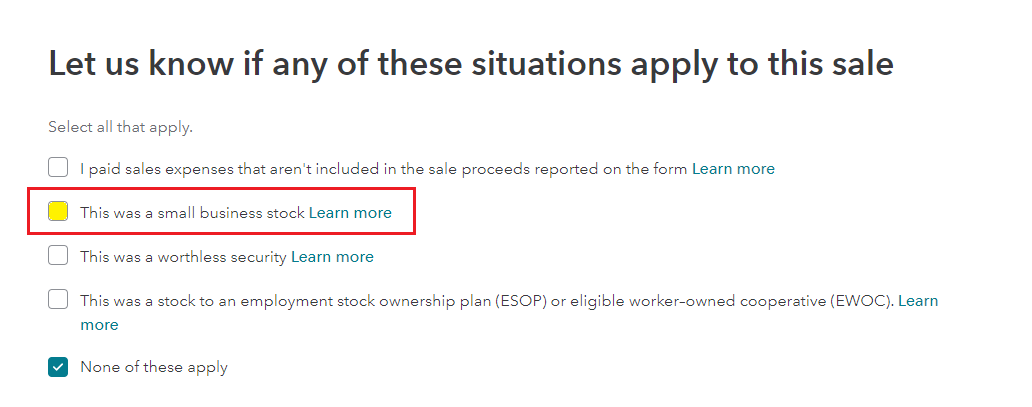

- On "Do Any Special Situations Apply to This Sale?", select "Small business stock" click Continue (See the attached screenshot below. Click to enlarge.)

- On "What Kind of Small Business Stock?" select the appropriate section 1202 type, click Continue

Continue through the interview

If you qualify, you'll see a “Net adjustments to gain.” (See the attached screenshot below. Click to enlarge.)

Specialized Small Business Investment Company (SSBIC)

If you invest the proceeds from the sale of publicly traded securities in an SSBIC, you may be able to roll over, or postpone, the gain on your securities sale, if you qualify.

Qualified small business stock

When you sell qualified small business stock for a gain, you may be able to postpone paying income tax on the sale if you used the proceeds to purchase other qualified small business stock under section 1045.

If you did not buy other qualified stock, you may qualify to treat 50%, 60%, 75% or 100% of the gain as tax-free under section 1202 if you held the stock longer than five years.

Section 1244 Stock

Losses on sales of section 1244 stock qualify for special treatment when sold. Instead of a capital loss, section 1244 losses are considered ordinary losses and can reduce your taxable income up to $50,000, or up to $100,000 if you're married filing jointly. (No more than $3,000 of net capital losses can be used to reduce other income each year.

This answer was provided by

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get include a “Qualified Small Business Stock” 1202 data in the 1099-B section of the Online filing version of turbo-tax?

I am trying to figure out how to report a qualified small business stock sale on my partnership return. My understanding is that the availability of the Section 1202 exlusion is made at the partner level, but I don't see how to reflect on the K-1s the amount of the potential Section 1202 exclusion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get include a “Qualified Small Business Stock” 1202 data in the 1099-B section of the Online filing version of turbo-tax?

Rather than entering the proceeds of the sale of qualified small business stock on your K-1, enter the figure under stock sales in order to indicate that the sale was "qualified small business stock." It's not going to matter that the entry is not on the K-1. Please follow these steps

- Click on Federal Taxes > Wages & Income > Investment Income section click on the Start/Revisit box next to Stocks, Mutual Funds, Bonds, Other.

- If you have already entered some investment sales, you will see a screen Here's the investment sales info we have so far. Click on Add More Sales.

- If you haven't yet entered some investment sales, you will see a screen Did you sell any investments in 2020? Click the Yes box.

- Answer No to the question, Did you get a 1099-B...? Or select 'Other ' box for online version as shown below.

- On the screen, Choose the type of investment you sold, mark the button for Stocks and click Continue.

- You will be asked questions about the date of sale and purchase and the cost and sales price. If you don't have the exact information, you can just make entries so that the information results in the figure on line 9a of your K-1 (the net gain; long-term sale, etc.)

- When you come to the screen, Do Any Special Situations Apply to This Sale? mark the button next to Small business stock and click Continue. Then, continue with additional screens to enter the specifics of your Small Business Stock Sale."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

moumourocks

New Member

user17663503933

New Member

dan-a-isbell

New Member

Sophias_Dad

New Member

xiaoning

New Member