- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Rather than entering the proceeds of the sale of qualified small business stock on your K-1, enter the figure under stock sales in order to indicate that the sale was "qualified small business stock." It's not going to matter that the entry is not on the K-1. Please follow these steps

- Click on Federal Taxes > Wages & Income > Investment Income section click on the Start/Revisit box next to Stocks, Mutual Funds, Bonds, Other.

- If you have already entered some investment sales, you will see a screen Here's the investment sales info we have so far. Click on Add More Sales.

- If you haven't yet entered some investment sales, you will see a screen Did you sell any investments in 2020? Click the Yes box.

- Answer No to the question, Did you get a 1099-B...? Or select 'Other ' box for online version as shown below.

- On the screen, Choose the type of investment you sold, mark the button for Stocks and click Continue.

- You will be asked questions about the date of sale and purchase and the cost and sales price. If you don't have the exact information, you can just make entries so that the information results in the figure on line 9a of your K-1 (the net gain; long-term sale, etc.)

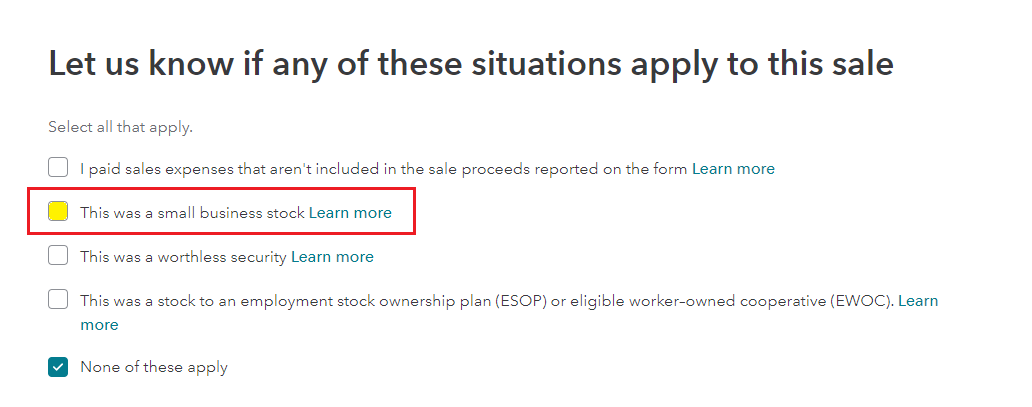

- When you come to the screen, Do Any Special Situations Apply to This Sale? mark the button next to Small business stock and click Continue. Then, continue with additional screens to enter the specifics of your Small Business Stock Sale."

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 17, 2021

8:47 AM

1,239 Views