- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I enter the sale of some shares in my S Corp turbo tax 2023

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the sale of some shares in my S Corp turbo tax 2023

I sold some shares to another shareholder but can not find anyware to enter this in my "TurboTax Home and Business 2023".

Anyone know how to enter it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the sale of some shares in my S Corp turbo tax 2023

Yes, you would enter this as an investment sale with our without a 1099-B form. It would be treated the same as any sale of stock shares. The key for you will be to determine your cost basis which would begin at the start of your S Corp as an ongoing changing amount based on profits and losses and capital either contributed or taken out.

Once you have your information you will complete the entry in TurboTax using the following steps.

- Open (continue) your return if it isn't already open.

- In TurboTax, search (upper right) > Type 1099B (even if you don't have one) Press enter > then select the Jump to link

- Answer Yes to Did you sell stocks, mutual funds, bonds, or other investments in 2023?

- If you see Here's the info we have for these investment sales, select Add More Sales.

- Answer NO to Did you get a 1099-B or brokerage statement for these sales?

- Follow the instructions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the sale of some shares in my S Corp turbo tax 2023

Diane,

thanks for replying!

I have tried this but I get stuck on the next page which asks for Broker information and wont let me leave the broker name blank. From what I understand they removed the option to say I do not have a 1099-B.

Should I just put the S-corp company name or N/A or will this cause problems?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the sale of some shares in my S Corp turbo tax 2023

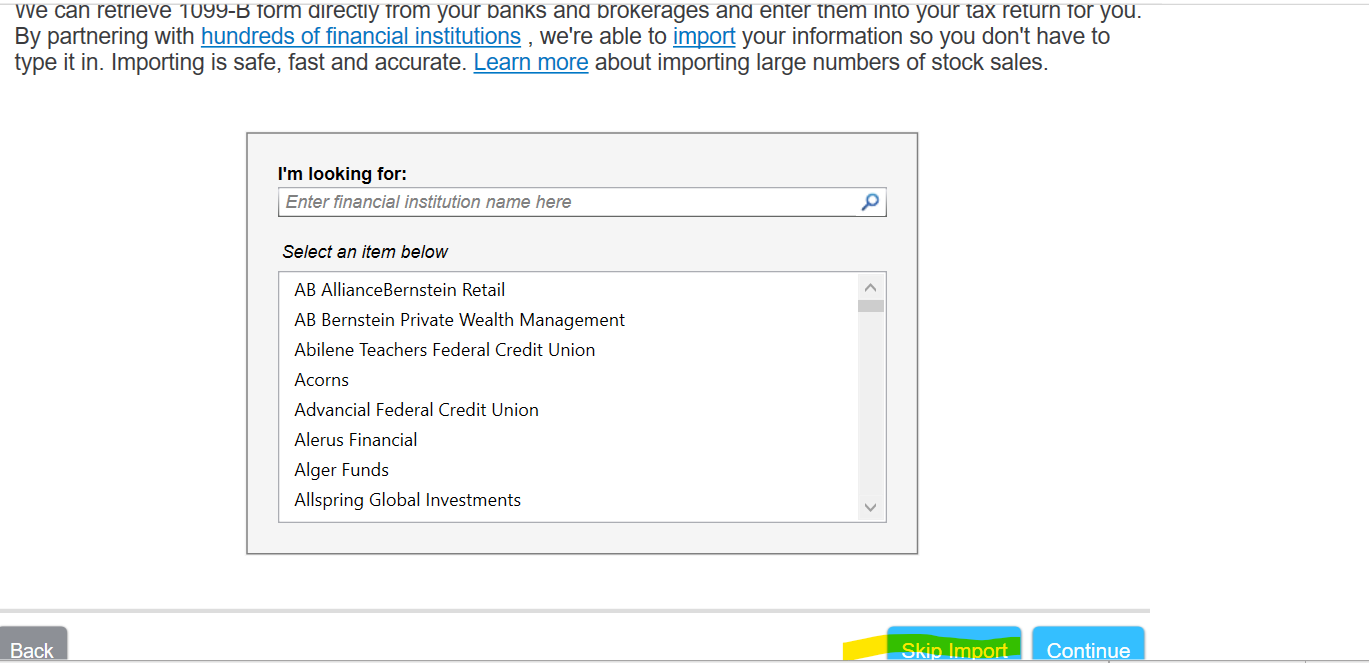

I think you may be on this screen, on which you can answer that you want to skip the import, and on the next screen you can type in any name you want for the broker.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

curtis-sawin

New Member

MaxRLC

Level 3

MaxRLC

Level 3

seple

New Member

SB2013

Level 2