- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I enter minister's housing allowance in Home & Business, with no W2 or 1099?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter minister's housing allowance in Home & Business, with no W2 or 1099?

My housing allowance is my only remuneration so there is no actual income to report, so I do not get a 1099 or W2.

I cannot find any place in Home & Business that lets me add a new business (Clergy - 813000 code) when there is no 1099 or W2 to start the housing allowance workflow.

I do not want to go straight to the form because in the past it wouldn't let me file online if I do an exception like that.

In prior years this was possible - I just can't seem to find where to kick off the workflow this year. I go through everything in the "business" tab, and I'm not seeing any "add a business" option anywhere.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter minister's housing allowance in Home & Business, with no W2 or 1099?

You need to enter it as though you had received a 1099-MISC for your clergy income. Go back to the 'Wages and Income' section and scroll down to 1099-MISC and follow the step by step guide there.

Here's a guide to entering the clergy housing allowance in TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter minister's housing allowance in Home & Business, with no W2 or 1099?

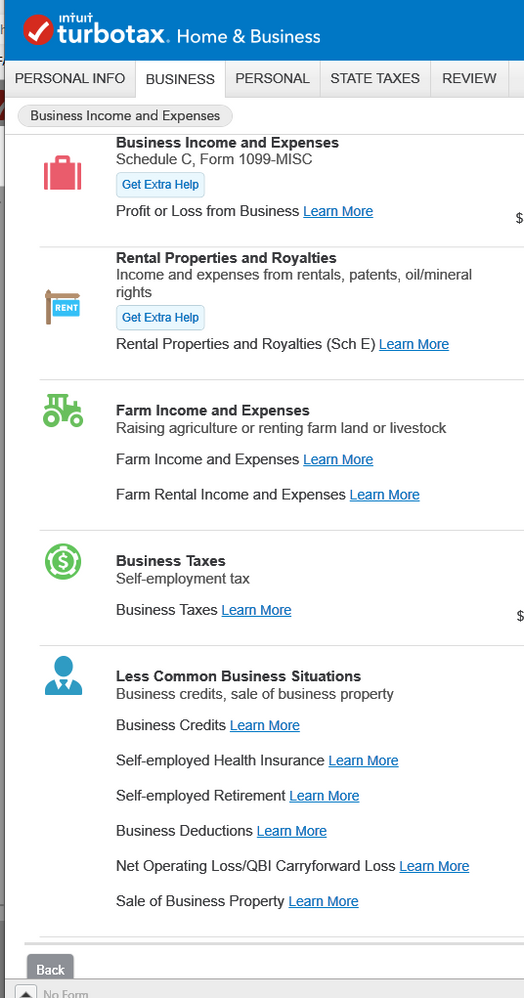

I am stuck on this screen. There is no button or link to do anything like add a business. What am I missing?

The only other link is one at the bottom that says "Done with Business"

If I click on the button at the top that says "Business Income and Expenses" it just takes me back to the prior screen. That's it, nothing else I can interact with here.

Kond of frustrating.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter minister's housing allowance in Home & Business, with no W2 or 1099?

You need to enter it as though you had received a 1099-MISC for your clergy income. Go back to the 'Wages and Income' section and scroll down to 1099-MISC and follow the step by step guide there.

Here's a guide to entering the clergy housing allowance in TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter minister's housing allowance in Home & Business, with no W2 or 1099?

Thanks @RobertB4444 . that was where it was hiding!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DaltonY

New Member

davidttotten

New Member

kibshop

New Member

jaski3715

New Member

djenkins71378

New Member