- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I deleat a 1040/1040SR form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deleat a 1040/1040SR form

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deleat a 1040/1040SR form

Here's the general procedure for viewing the forms list and deleting unwanted forms, schedules, and worksheets in TurboTax Online:

- Open or continue your return in TurboTax.

- In the left menu, select Tax Tools and then Tools.

- In the pop-up window Tool Center, choose Delete a form.

- Select Delete next to the form/schedule/worksheet in the list and follow the instructions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deleat a 1040/1040SR form

Why do you want to delete Form 1040? Did you decide not to file an income tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deleat a 1040/1040SR form

Can't delete Tax & Insterest work sheet as it lets me deduct state taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deleat a 1040/1040SR form

Don't want to delete it but says "Not Done". Worked taxes step by step. Never had the 1040xx show up. Ready to file but can't clear the errors on blank 1040/1040SR or identify the error on the Tax and Int error as only thing I can see 01/01/2019 first block came up in red, but it try to reenter, still read and still reads error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deleat a 1040/1040SR form

How can I complete my taxes if it won't id the error. Never used the 1040 as went thru step-by-step, and never saw the blank 1040 to my knowledge. Just followed the prompts on the menu.

So can a get a refund on my turbo Tax as no real person to help me clear "not worked"?

Then I could use somebody else's tax program and may be real support as opposed to telephone call from somebody who can fix the return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deleat a 1040/1040SR form

@hunterabq wrote:

Don't want to delete it but says "Not Done". Worked taxes step by step. Never had the 1040xx show up. Ready to file but can't clear the errors on blank 1040/1040SR or identify the error on the Tax and Int error as only thing I can see 01/01/2019 first block came up in red, but it try to reenter, still read and still reads error.

If you have a reference to a Form 1040X, then you will have to clear the 1040X from your return.

If that is not the problem, then clear the return and start over -

If you have not paid for the online edition you are using, have not filed your tax return or registered the Free edition, then you can clear your return and start over with a lower priced edition. Click on Tax Tools on the left side of the program screen while working on the 2019 online tax return. Click on Clear & Start Over.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deleat a 1040/1040SR form

Only thing left to do is print and then file. But cannot due as as 1040 (not worked) yet it has data from the interview process.

the Int & Local Taxes says not worked, but only error I can see is the start date in 1/1/2019 comes out in red and can delete it but if reenter it comes back in red.

With now real tech support like a it person than can fix this stuff, what do I get with my paid Turbo Tax. Can' file with errors.

Have 4 requests for help and number 454 191964, 455 470709 and 455 472 426. Every time I seek chat I get another number. Will I get an answer before Apr 15????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deleat a 1040/1040SR form

If you have not paid for the tax return or registered the tax return, you can use Clear and Start Over.

Clear and Start Over will wipe all the data you have already entered. You will be starting over from scratch.

To Clear and Start Over in TurboTax Online:

- You should be signed in and working in TurboTax Online

- In the left-hand black menu, click on Tax Tools

- Then choose Clear and Start Over.

TurboTax defaults to the edition that you were last using.

You can also use Delete a Form to remove any Forms that have information you cannot otherwise get rid of.

- In the left-hand black menu, choose Tax Tools then Tools.

- Click on Delete a Form from the window that pops up.

- You should now see the Review Form List. Scroll down the list and click Delete on any forms that you choose.

- You may get a pop up telling you additional worksheets and forms are being deleted. Approve and click delete.

- You should come back to the Review Form List. Scroll to the bottom and click Continue with My Return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deleat a 1040/1040SR form

I followed the instructions and it says the 1040/1040SR Wks form was deleted successfully however I'm still not able to file, as the same form is stopping me saying there are errors. I try to delete again and it is still there, no matter how many times it says the form was successfully deleted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deleat a 1040/1040SR form

@Moconnor3 wrote:

I followed the instructions and it says the 1040/1040SR Wks form was deleted successfully however I'm still not able to file, as the same form is stopping me saying there are errors. I try to delete again and it is still there, no matter how many times it says the form was successfully deleted.

The Form 1040 or Form 1040-SR Worksheet cannot be deleted.

What part of this worksheet is showing an error?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deleat a 1040/1040SR form

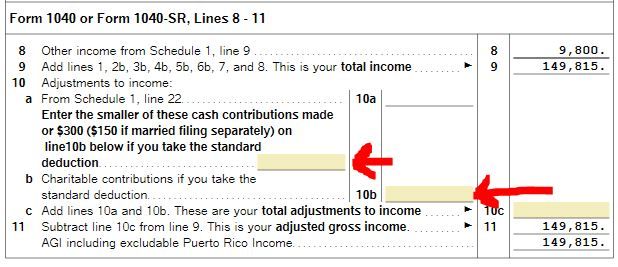

"Check this entry: 1040/1040SR Wks: Charitable contributions has an unacceptable value." Section 10b. I don't know how this form got into my return because I don't have any 1040/1040SR documents. I don't know what an acceptable value would be for this line

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deleat a 1040/1040SR form

@Moconnor3 wrote:

"Check this entry: 1040/1040SR Wks: Charitable contributions has an unacceptable value." Section 10b. I don't know how this form got into my return because I don't have any 1040/1040SR documents. I don't know what an acceptable value would be for this line

Form 1040 Line 10b is for an above the line cash donation of the $300 or less to a qualified charitable organization.

If you did not make a donation then both boxes for 10b should be blank (empty) on the Worksheet

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

pop2553

New Member

GlennRCook

New Member

l-vanwey

New Member

dmier393

New Member

Mixy1961

New Member