- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How can I validate my CPAs work?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I validate my CPAs work?

Tax beginner here...really don't know much. Its why I use a CPA.

My question: How can I validate my CPAs work? I've used the same CPA for last 7 years and he just retired and has handed the business off to his son. Ever since the transition occurred, experience has been sub-par. Not responding to my questions, lots of non-answers, delays after delays due to which I was forced to file an extension. I finally was able to get my return, but I'm having strong doubts. Without having to find another CPA, what is the best course of action here?

My general concern - in 2021, i made less, had a new born - and in talking to others, i should have received a bigger return than in 2020. Again, i know the numbers matter in the end, but curious if by looking at these, can anyone provide some guidance - does the refund for 2021 seem reasonable?

| 2021 | 2020 | |

| W2 wages | $ 150,409 | $ 184,930 |

| Cap gain/loss | $ 16,469 | $ 7,339 |

| Total income | $ 169,980 | $ 188,891 |

| AGI | $ 167,979 | $ 182,891 |

| Deduction | $ 25,100 | $ 24,800 |

| Taxable Income | $ 142,879 | $ 158,091 |

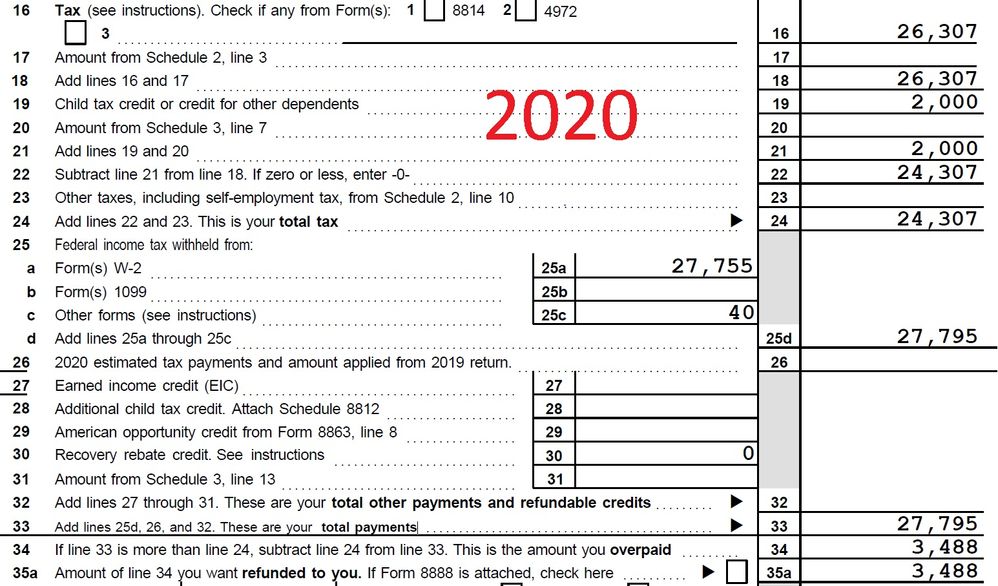

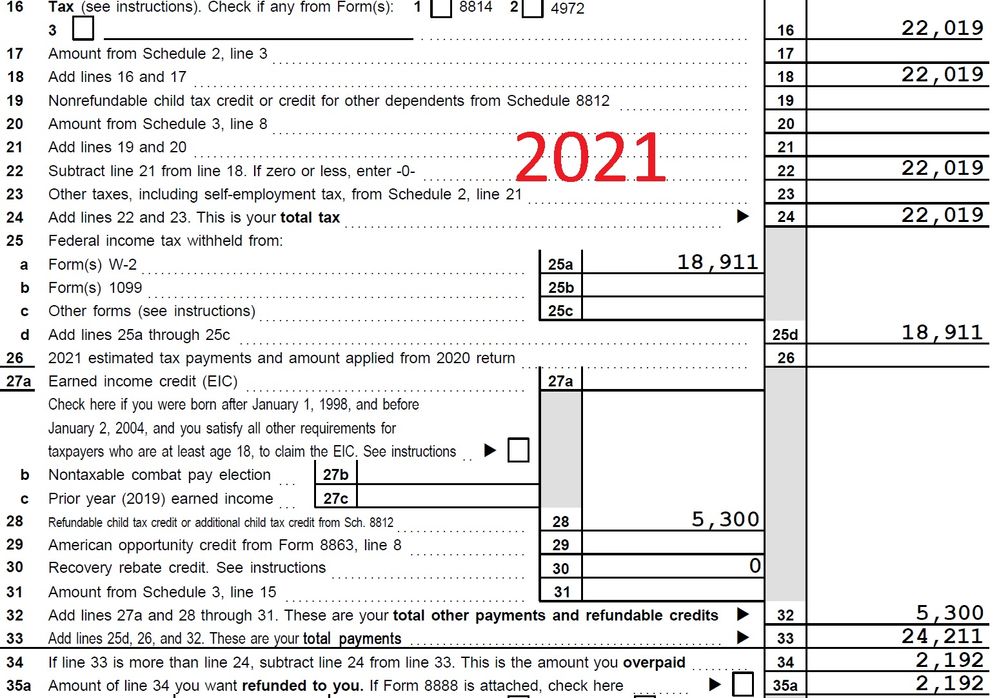

| Tax | $ 22,019 | $ 26,307 |

| Refundable CTC | $ 5,300 | $ 2,000 |

| Total payments | $ 24,211 | $ 27,795 |

| Refund | $ 2,192 | $ 3,488 |

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I validate my CPAs work?

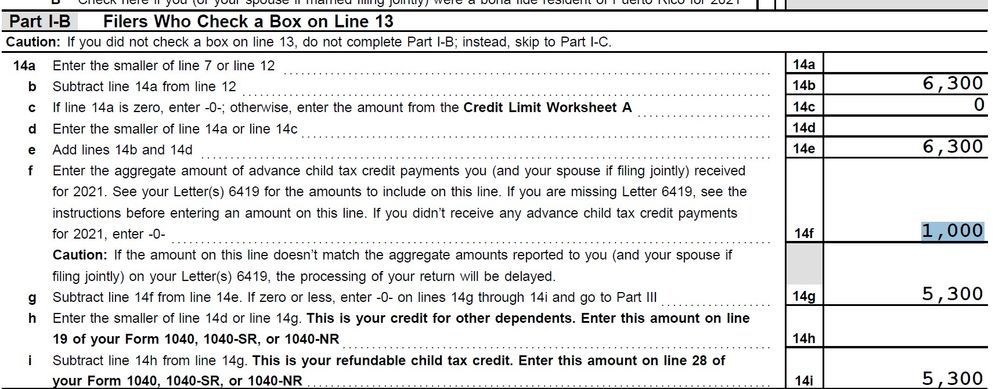

@VolvoGirl @one26528 - because AGI exceeds $150,000, the Child Tax Credit is limited, so it wouldn't be $7200 for the two children. the credit is reduced by $50 for each $1,000 over $150,000. So that is $18,000 Times 5% or $900. The credit is $7200 - $900 or $6300, so that is correct

Also, since 2020 AGI exceeded $150,000 the Advance would have been 1/2 of $2000 (and no record of the 2021 Baby since the Advance was based on 2020 tax return).

$5300 on the tax return appears to be correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I validate my CPAs work?

first, rather than using the word 'return', I think what you mean is a larger 'refund'.

can you please review what you entered in your table?

1) the tax, less the refundable CTC, less the payments should equal your refund,

for 2020, that math works

for 2021, it doesn't. the refundable CTC is missing from the refund. the refund should be $7,392 based on the table you presented.

didn't the CPA use a software package to complete the return? something doersn't make sense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I validate my CPAs work?

Thank you for the response. You are correct - its refund, not return.

Let me double check the numbers. I pulled them directly off of the prepared returns. Will post an update soon.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I validate my CPAs work?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I validate my CPAs work?

@one26528 - okay - the numbers you pulled were correct; how the IRS calculated 'payments' in 2021 was different than 2020, so the math you presented is correct (CTC was part of payments in 2021 but not in 2020)

Your withholdings in 2020 were $27,755 and in 2021 the withholdings were only $18,911, so that is driving how the refund is calculated. Yes, had the 2021 withholdings held steady at $27,755 , then the refund for 2021 would have been a lot higher.

The refund is a function of

1) tax LESS

2) CTC LESS

3) withholdings

but since you withholdings were so much lower, in effect, you received part of the refund with each paycheck during the year.

it makes sense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I validate my CPAs work?

$2192 refund would be correct because the $5300 is included in the total payments. so total payments of $24,211 exceed total taxes of $22,019 by $2,192. the numbers make sense from a math standpoint.

in 2020 the CTC reduced your tax but in 2021 the CTC was treated as a tax payment.

there could be a question about the accuracy of the $5300 if you received any advance CTC payments that were not reflected on form 8812

any advance payments should be on line 14f of the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I validate my CPAs work?

How many children and their ages? Better double check your bank account to see how much Advance Child Tax Credit you got July-Dec. And each spouse should have received IRS letter 6419 saying how much they sent you (1/2 for each spouse).

You get Child Tax Credit of 3,600 for under 6 and 3,000 for 6-17. Minus the Advance you got. So it's hard to figure how you got 5300 on line 28.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I validate my CPAs work?

thanks so much for the response! This helps a lot. Greatly appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I validate my CPAs work?

thanks for the response. see attached a screenprint of Part I-B with the advance payment amount. This is how they reached $5300.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I validate my CPAs work?

thank you for the response.

2 kids - 5 yr old and 20 month old (born in Jan 2021).

I will double check how much Advance Child Tax Credit was received July-Dec. Also will pull up the 6419 to see what is on there.

Also, don't know if it matters but my wife does not work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I validate my CPAs work?

@VolvoGirl @one26528 - because AGI exceeds $150,000, the Child Tax Credit is limited, so it wouldn't be $7200 for the two children. the credit is reduced by $50 for each $1,000 over $150,000. So that is $18,000 Times 5% or $900. The credit is $7200 - $900 or $6300, so that is correct

Also, since 2020 AGI exceeded $150,000 the Advance would have been 1/2 of $2000 (and no record of the 2021 Baby since the Advance was based on 2020 tax return).

$5300 on the tax return appears to be correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I validate my CPAs work?

@one26528 wrote:

I've used the same CPA for last 7 years and he just retired and has handed the business off to his son. Ever since the transition occurred, experience has been sub-par. Not responding to my questions, lots of non-answers, delays after delays due to which I was forced to file an extension. I finally was able to get my return, but I'm having strong doubts. Without having to find another CPA, what is the best course of action here?

It sounds like you do need to find a new CPA for next year. Even if your 2021 tax return turns out to be correct, the poor service is reason enough to look for someone else.

Or learn to do it yourself with TurboTax. Your tax return is not very complicated. You could try it out by redoing your 2021 tax return in TurboTax online. You don't have to pay unless you print or e-file. However, if you decide to use TurboTax next year, I suggest the CD/Download TurboTax software instead of TurboTax Online. The CD/Download software is a far superior product with significant additional features.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17711805556

New Member

jillverkaik

New Member

Cherryapplesun

New Member

CWP2023

Level 1

itzmom

New Member