- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How can I input the correct about on my 1099-B for Robinhood? I have a 1f / 1g box that includes another $ amount but there is no option to input that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I input the correct about on my 1099-B for Robinhood? I have a 1f / 1g box that includes another $ amount but there is no option to input that.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I input the correct about on my 1099-B for Robinhood? I have a 1f / 1g box that includes another $ amount but there is no option to input that.

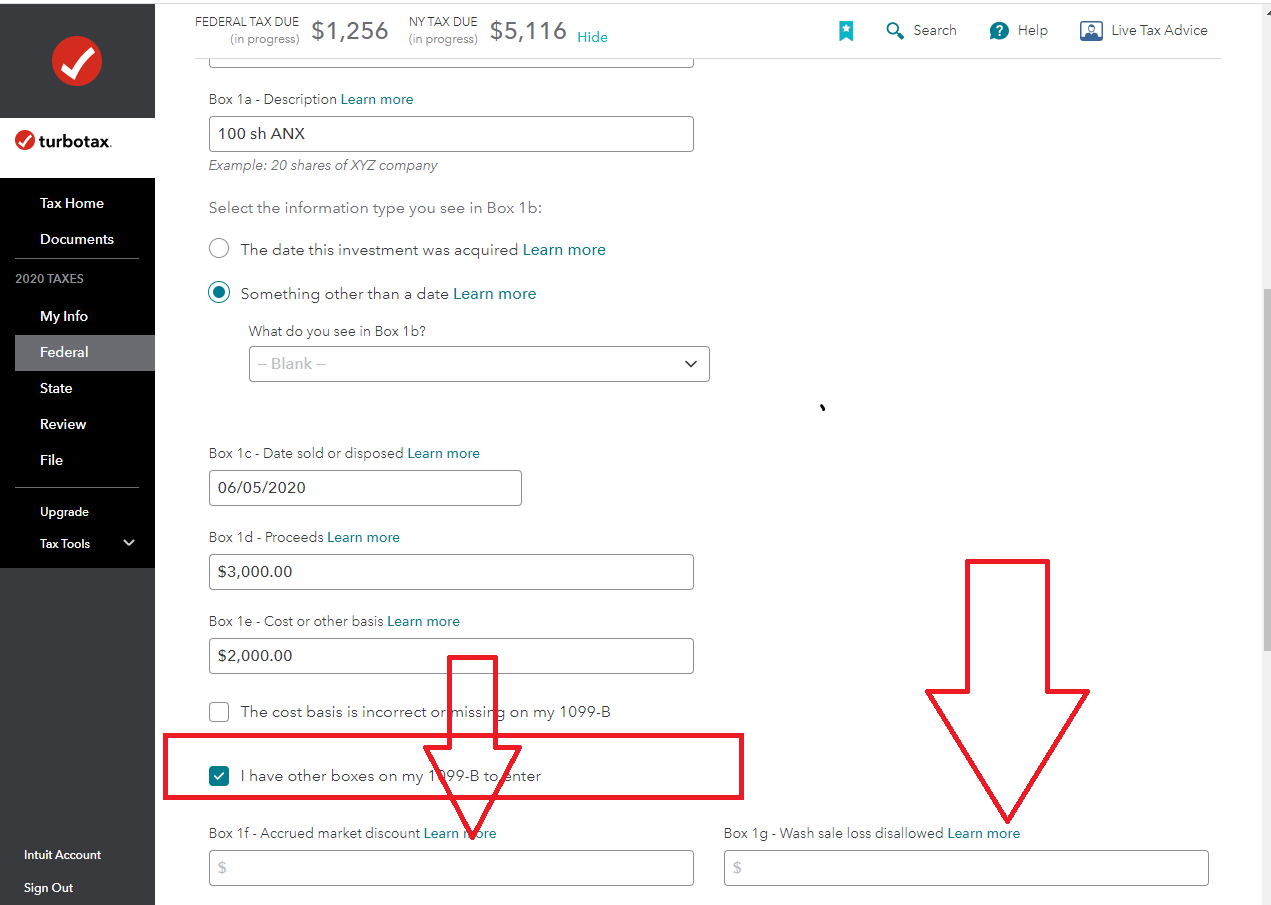

On the a1099-B entry screen, scroll down until you get to I have other boxes on my 1099-B to enter. Place a check mark in the box. Boxes 1f and 1g will appear.

The wash sale rule doesn't allow you to deduct losses when you buy replacement stocks or securities (including contracts or options within a 30-day period) either before or after you sold substantially identical securities.

The rule doesn't apply if you're a securities dealer and the trade was part of your business activity.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bruce-carr49

New Member

tonyych

New Member

Priller

Level 3

Frank nKansas

Level 3

DFS1

Level 2