- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How can I correct dates received in the underpayment Statement for NYS? TT spread out the withholding over the full year which results in an underpayment.

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I correct dates received in the underpayment Statement for NYS? TT spread out the withholding over the full year which results in an underpayment.

I receive income from three sources over the year. 2 provides a W-2. The third is a Fellowship grant that does not withhold taxes. I made an estimated payment for the income received from the fellowship. TT spread the amounts withheld over the year instead of 6 months resulting in an underpayment of NYS taxes. How can I fix this?

Topics:

posted

March 12, 2024

7:35 AM

last updated

March 12, 2024

7:35 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I correct dates received in the underpayment Statement for NYS? TT spread out the withholding over the full year which results in an underpayment.

Follow these steps:

- Open your NY return

- Continue through the screens past income and credits

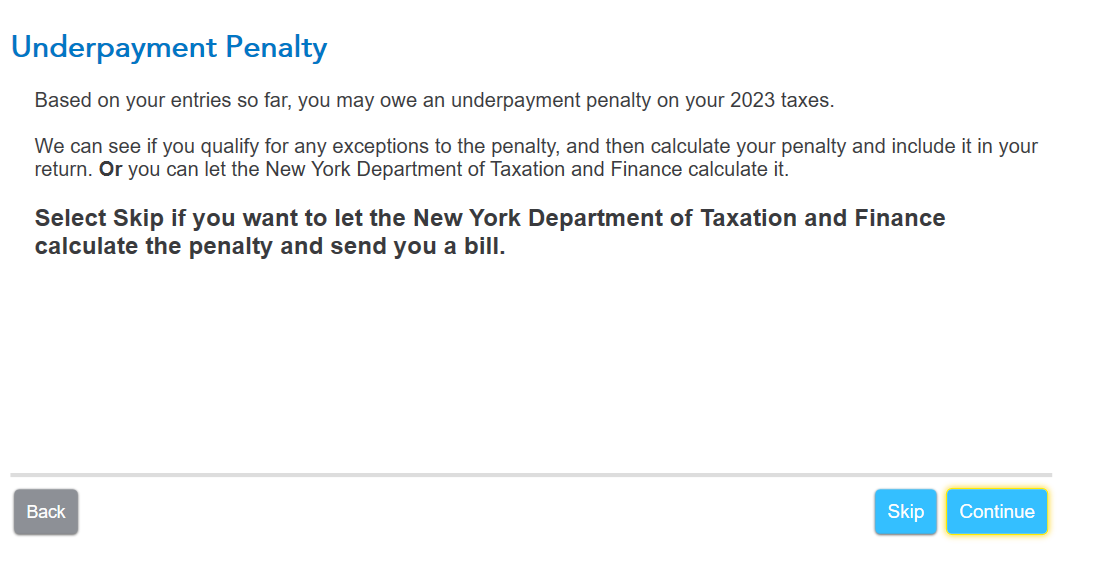

- When asked about Underpayment Penalty,, select Continue

- Answer the questions regarding 2022

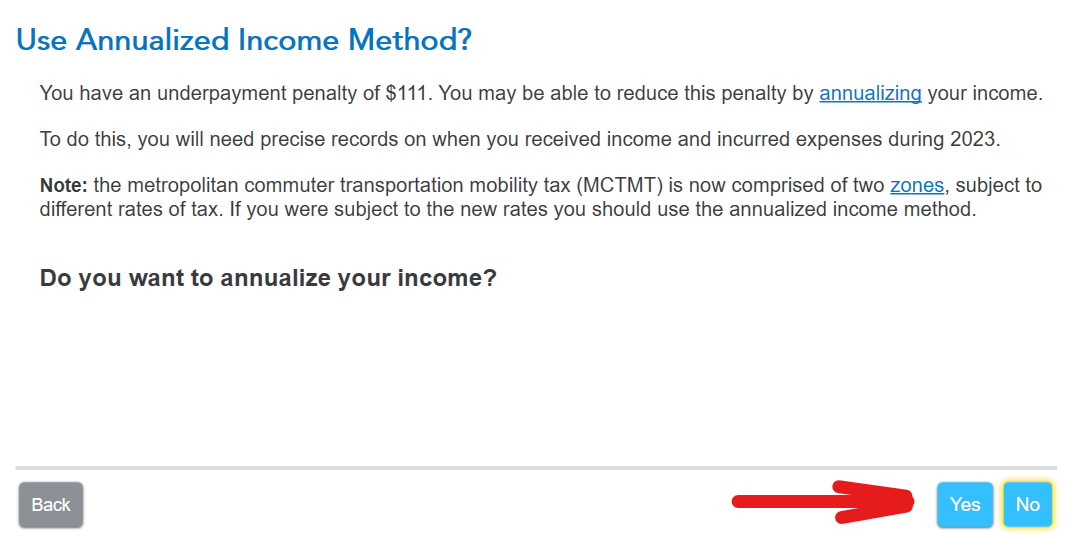

- Use Annualized Income Method? Select Yes

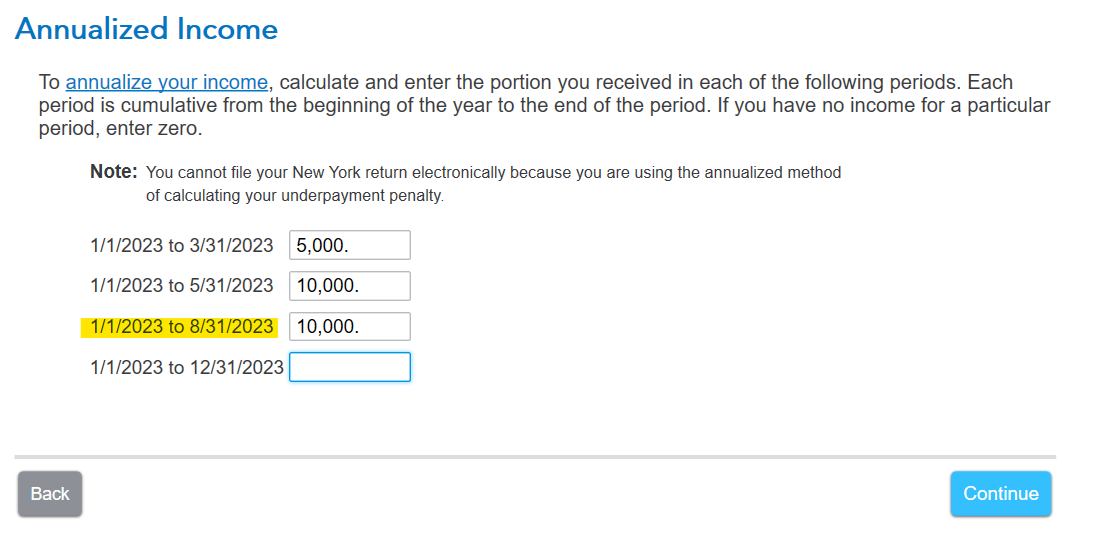

- Enter the amount paid in total the first 3 months of the year in the first box

- Enter the total paid in the first 5 months of the year in the second box

- Continue entering totals for the year for the time period.

- Select continue and do the same for any deductions or credits through the year.

- Enter the date you will pay your balance

- Continue

This example shows $5,000 paid in the first quarter and another $5,000 the second quarter with no payments the 3rd quarter.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 14, 2024

9:13 AM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

az148

Level 3

jstan78

New Member

sakilee0209

Level 2

douglasjia

Level 3

garne2t2

Level 1