- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Follow these steps:

- Open your NY return

- Continue through the screens past income and credits

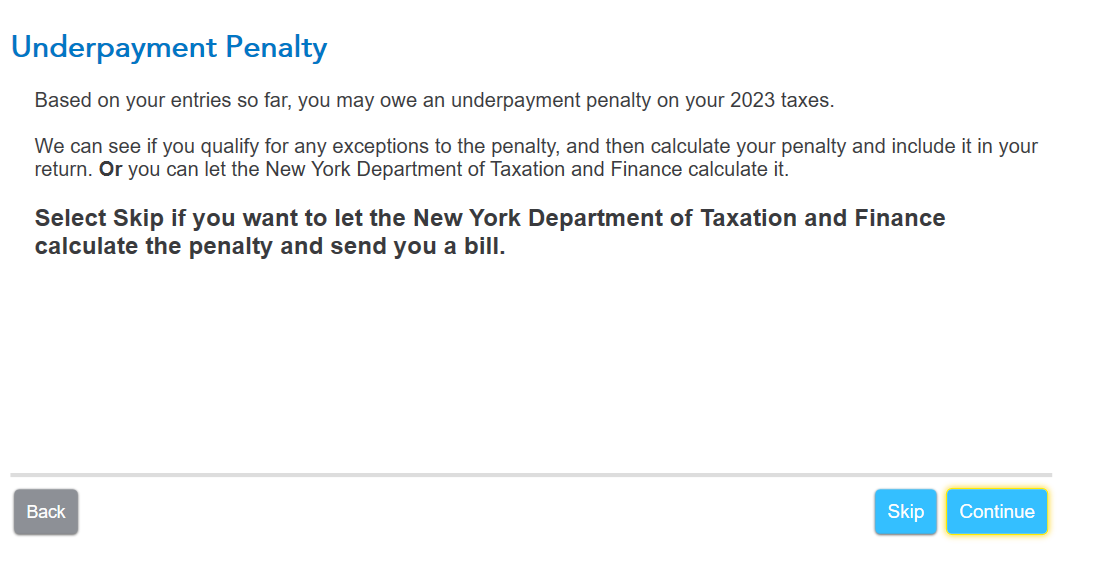

- When asked about Underpayment Penalty,, select Continue

- Answer the questions regarding 2022

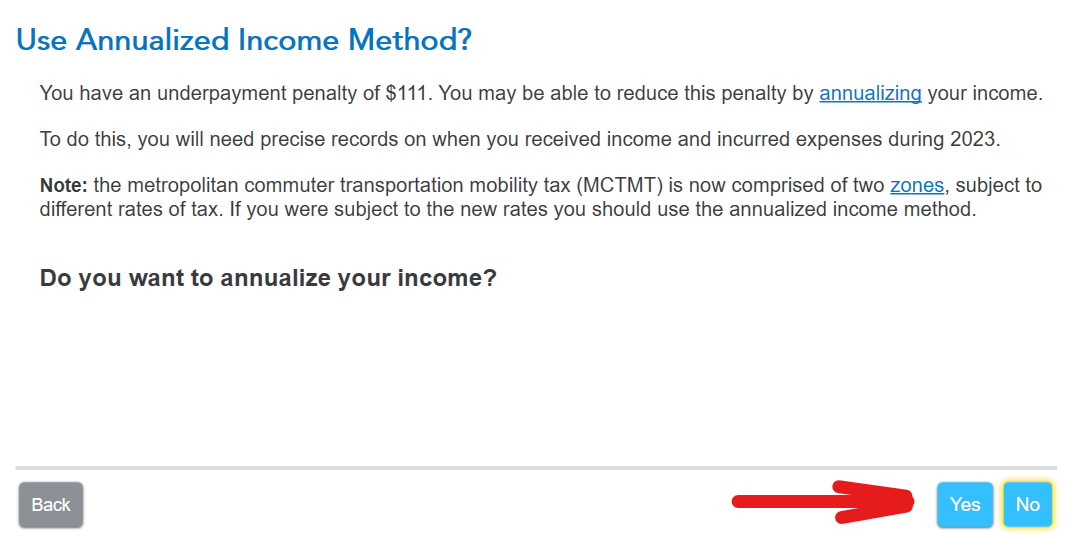

- Use Annualized Income Method? Select Yes

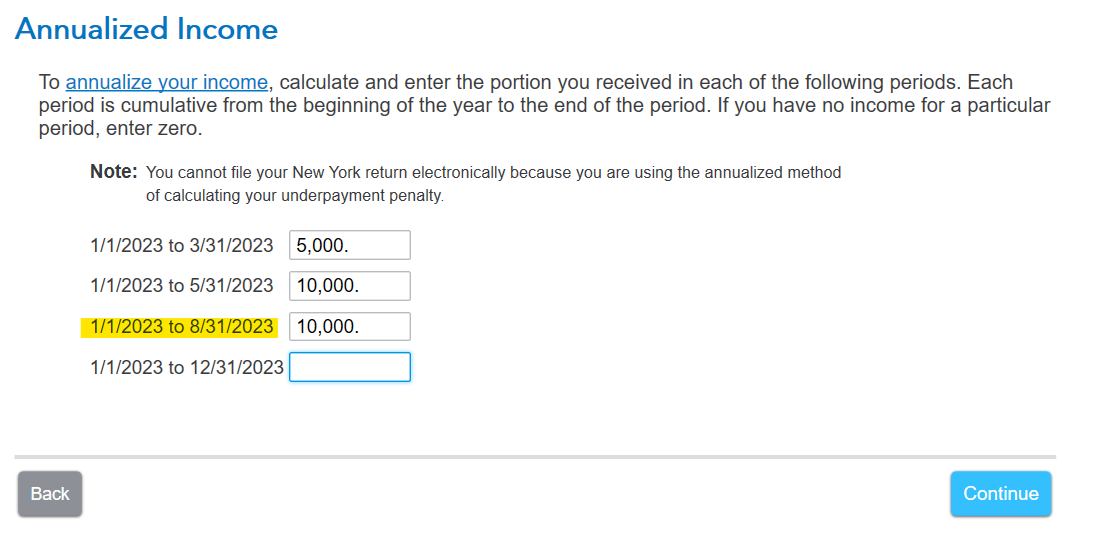

- Enter the amount paid in total the first 3 months of the year in the first box

- Enter the total paid in the first 5 months of the year in the second box

- Continue entering totals for the year for the time period.

- Select continue and do the same for any deductions or credits through the year.

- Enter the date you will pay your balance

- Continue

This example shows $5,000 paid in the first quarter and another $5,000 the second quarter with no payments the 3rd quarter.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 14, 2024

9:13 AM