- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How can I change depreciation from straight line to double declining method with half year calculation in Sched E? It defaults to SL monthly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I change depreciation from straight line to double declining method with half year calculation in Sched E? It defaults to SL monthly.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I change depreciation from straight line to double declining method with half year calculation in Sched E? It defaults to SL monthly.

what type of property

Turbotax should be selecting the best method based on what you entered for the type of asset.

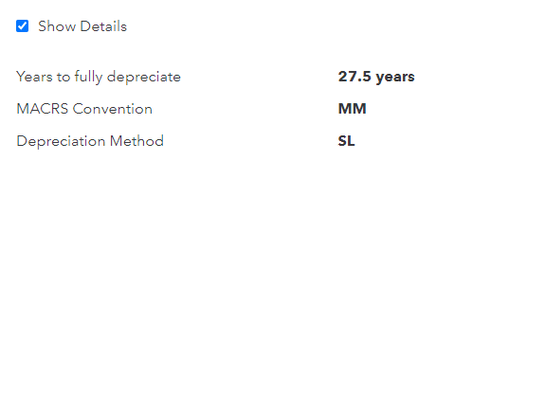

buildings are depreciated using the straight-line method and mid-month convention over 27.5 years for residential real estate and 39 years for commercial - types I and J1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I change depreciation from straight line to double declining method with half year calculation in Sched E? It defaults to SL monthly.

It is a residential rental so it should be 27.5. It accurately gets the 27.5 but then it does SL/MM. I acquired this property late in the year (October) and I'm trying to depreciate at half a year DD/HY. How can I change the method and convention?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I change depreciation from straight line to double declining method with half year calculation in Sched E? It defaults to SL monthly.

Sorry but it doesn't work that way ... a residential use building cannot use the DD/HY method ... the ONLY option is the SL/MM method that the program does correctly automatically.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I change depreciation from straight line to double declining method with half year calculation in Sched E? It defaults to SL monthly.

I agree with @Critter-3 , for what that is worth.

You cannot use an improper method and TurboTax is selecting the proper one. This can be subject to an override in the program but you would do that at your own peril.

As a side note, I do not quite understand why you might possibly believe that putting residential rental real estate in service late in the year would give you an option to select a different method of depreciation.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

_John__

Level 2

user17618569045

New Member

markorec

Level 2

dmkpatrick

New Member

scottverm

New Member