- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Home Caregiver W2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Caregiver W2

Hi,

I got a W2 from the Home Aid Agency, that is paying me to take care of my inlaw.

The overall tax withholding was like 10% with no Federal withholding.

After putting this W2 in my overall tax, it dropped my refund by $1,500

Isn't there some deduction for providing family care living in the same house?

My friend who is doing the same thing, went to a cpa and was told that she doesn't need to pay tax on it.

I'm not sure what her tax situation is, maybe she has some special setup.

So I was wondering if its possible in turbotax to do the same?

My question is do I need to pay taxes on my W2 for taking care of my inlaw.

thanks,

Kevin

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Caregiver W2

If you live with the person you provide care for, the income you earn for providing care services can be excluded from your federal income taxes.

The payments you receive are Difficulty of care payments and can be excluded from taxable income, according to IRS Notice 2014-7.

If you received a form W-2 for these payments, you'll report the form on your tax return. but it will not be part of your taxable income. Here's how:

Enter that form W-2 in TurboTax just like a normal W-2.

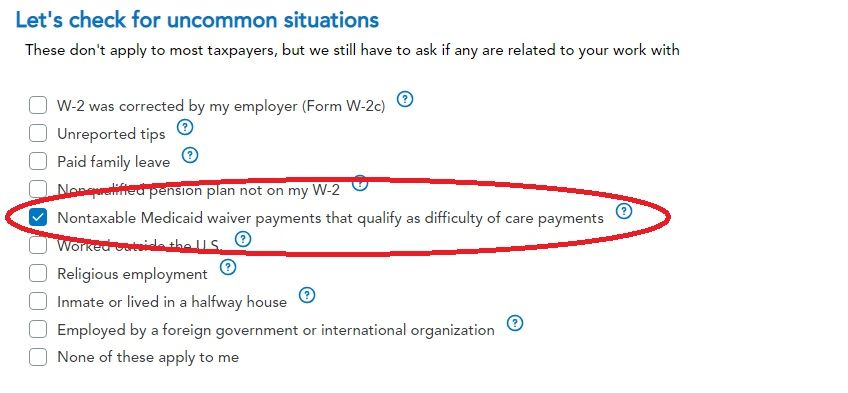

Then in the follow-up interview, when you arrive at the page titled Let's check for uncommon situations, put a checkmark on Nontaxable Medicaid waiver payments that qualify as difficulty of care payments and click Continue. On the next page you can indicate how much of the W-2 amount should be nontaxable, which in your case is All of it.

See attached screenshot.

[Edited 03/24/24 | 11:09 AM PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Caregiver W2

thank you for the information.

I did get a W2, you mentioned that I don't have to report it, isn't that the same as not entering the info?

But on the next sentence you provided the steps to report it in my 1040.

A bit confuse. thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Caregiver W2

I'm using the pc version and found the option to report this as, and it helped in giving me back the refund I had before adding it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Caregiver W2

There was a typo in my original answer. I have now edited my answer.

You found the correct way to report your form W-2 and exclude that amount from taxable income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Caregiver W2

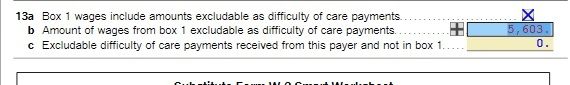

Turbotax did a final check and found this to need review.

I thought it was an issue with it being 5602.50 (but I guess rounding up is fine), and 13c to be 0, but it won't let me continue on.

Any idea on how to proceed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Caregiver W2

oh man, it looks like 13b

The review check, doesn't like it to be rounded up. The issue was that the diffcultiy of payment can not be greater then w4 line 1, which is 5602.50, but turbotax auto roundup to 5603, i edit it and put in 5602.

attaching screenshot again for reference.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Mental-Colorado

New Member

sarahwolfgram88

New Member

anntqueen

New Member

BevF

New Member

Richfl40

New Member